This year on our ballots in Mesa we will be asked to consider half a billion dollars of new debt.

- Local control of the budget vs. spending caps from the state (Question 1)

- Raising the sales tax 14% (Question 2)

- $85 million dollars to build a police/fire joint station in northeast Mesa (Question 3)

- $111 million dollars for parks and culture. Including ASU park downtown, a permanent ice skating rink, and massive soccer fields in northeast Mesa. (Question 4)

- Modifying the City Charter to allow us to spend $100 million on a sports complex in northeast Mesa. (Question 5)

- Increase the lodging tax by 20% (Question 6)

I’m sure that not all of my positions will align with your views and that’s ok. I only wish to present the facts to those who are looking for them in the abyss of data. I should also note the opinions I express are my own. My goals are simple, they are to provide transparency to the finances of our city for the purpose of protecting the assets that belong to the residents before they are entirely depleted due to a massive spending spree with no plan to pay for anything. It’s time to get our spending under control. In addition, my hope is that we can start creating policies that favor the middle class and the poor in our community. This requires us to live within our means and get back to providing core municipal services to our residents. It is important to note that financial crisis situations do not occur overnight. They take years to evolve usually with those at the helm ignorant in what it is they’re creating.

Deceit

It is important to realize that when governments request to spend more money and voters must approve the spending they put plenty of thought in how they phrase the ballot measures as much as possible to deceive the voters into voting “yes”. To this extent, some ballot measures are outright deceitful or arguably outright lies. In our instances, I take issue with multiple items on our ballot this year.

The first issue is always invoking the words “public safety” as a scare tactic. You may recall the video last year where they tried to push the sales tax increase to pay for more public safety workers and the ASU building downtown, they showed an immigrant killing a Circle K employee to justify the tax hike. This scare tactic is a way to get voters to approve whatever you put in front of them with the belief that if they do not approve it then police and fire services will be slashed and cause massive increases in crime and response times for services. All the meanwhile money is siphoned off the books to pet projects that never make it on to the ballot. Then when they do and you vote against them alternative methods are used to finance them.

The second item I take issue with on this ballot is the calculation of the tax increases. To determine how much your taxes are increasing the formula is simple. You take the difference of the new tax rate (2%) from the existing one (1.75%). You then divide this number(.25%) by the original tax rate and multiply by 100. More details can be found on Google for calculating the percentage of increases – https://goo.gl/5RDDSE

In our example on the ballot this year, our existing sales tax rate is 1.75% the new tax rate being proposed is 2%. This is a difference of .25%. If you divide this number by the original tax rate you get .142, multiply this by 100 and you arrive at 14.2% of a sales tax increase. If someone indicates to you that the sales tax rate is only increasing by .25% one of two things is happening, they either don’t understand the math behind calculating percentages of increases or they are intentionally disguising the actual increase to deceive you. The .25% number disguises the true severity of the problem. It seems small on the surface when the real increase is significantly larger. Once you realize how massive of a tax increase this is you have to start analyzing how to fix the problems causing it rather than kicking the can down the road.

In addition to the sales tax increase is the lodging tax increase. It currently sits at 5% and is being proposed to go to 6%. I won’t show the math here, rather you can use the formula above to determine this is another massive 20% increase.

The third item that is an issue with our ballot this year is the deceit in which the increase sales tax funds can be spent. Yes, it is true that this new sales tax increase (Question 2) can only go to public safety based on the wording. However, money is fungible, meaning, this frees up the money from the general fund that can then be spent on anything without any restriction. In fact, this is exactly how items are funneled through the city that you don’t want to pay for. Taxes are raised on the items that are “polled” and that you will support which frees up other money to pay for pet projects. This is not how a government should function.

Bond rating agencies

One item to pay close attention to in order to track our financial issues facing the city are the bond rating reports which are done by Moody’s and S&P, two credit rating agencies. I’m honestly not sure why Fitch, the third credit rating agency, was excluded. There are some items of concern within these reports. These items touch on some of my concerns but not all. It is important to understand bond rating agencies are only concerned about investors and borrows defaulting on debt. Meaning they do not analyze the social issues or quality of life issues which must also be taken into consideration. They merely want to assure the lenders that they will receive their payments and principle back. Here are some excerpts from the reports.

- “Reserve levels remain somewhat below national medians”

- “Pension liabilities and costs, already elevated, will continue to grow without additional funding”

- “Economic contraction resulting in significant revenue declines and inability to bring about fiscal balance”

- “Demonstrated unwillingness to make budgetary adjustments as necessary to maintain reserves”

Running out of money

Looking at the chart below you can see the city’s unrestricted net position or unrestricted assets minus liabilities is almost negative half a billion dollars. This is the equivalent of an individual’s net worth. If this were a corporation it would be bankrupt.

The city has a few levers we can pull when we start to run out of money. They are as follows:

- Increase the sales tax

- Increase debt through sales-tax backed bonds or excise tax bonds

- Increase property tax bonds

- Amortize debt over a longer period to stop the squeeze

- Increase utility rates

- Spend money allocated for capital replacement and improvements for operating expenses (disguising the severity of the issue)

- Pray that the economy does well and we will see an increase in state shared sales tax revenue

It should be noted and of significant importance that we are doing every single one of these items outlined above. This is an indication of an unsustainable position.

Based on this if you cannot afford to pay your bills in an operating year you should not be spending on items that are discretionary in nature or unnecessary. The math is simple if you make $50k/year and your bills add up to $60k/year you should be looking for ways to cut $10k/year out of your budget. You cannot run deficits in perpetuity you will eventually run out of money when your savings are depleted. Currently, Mesa does not have a balanced budget (revenue sources minus uses). To be more specific we are only able to balance our budget because we transfer dollars from our reserve, or savings account each year. Hence the reason why we must pull all the levers outlined above.

City governments do not get to enjoy “exorbitant privilege” like the US government in their budgets deficits. This comes from our inability to print money and inflate our way out of debt. So our situation will need to be addressed sooner. In the above example, and simplified, for every year that you spend $60k while making $50k you must have future years in which you only spend $40k to make up for this deficit spending.

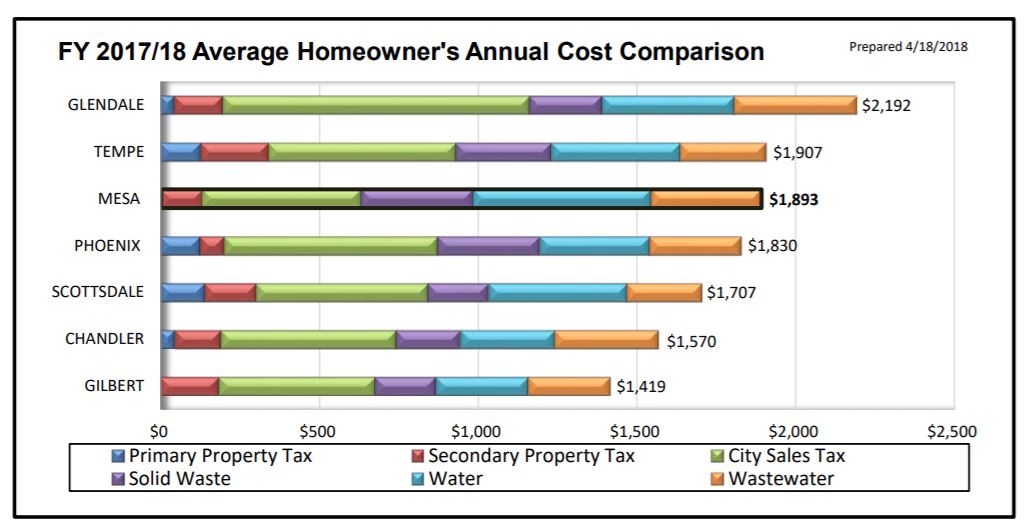

Cost of living

The spending problem we have becomes apparent when you compare our cost of living to other cities. After our utility rate increases this year and new taxes Mesa will overtake Tempe as the second most expensive city to live in. Only being outpaced by Glendale. It is important to note that when you hear bureaucrats telling you, “well we don’t have a primary property tax”. This chart takes that into consideration.

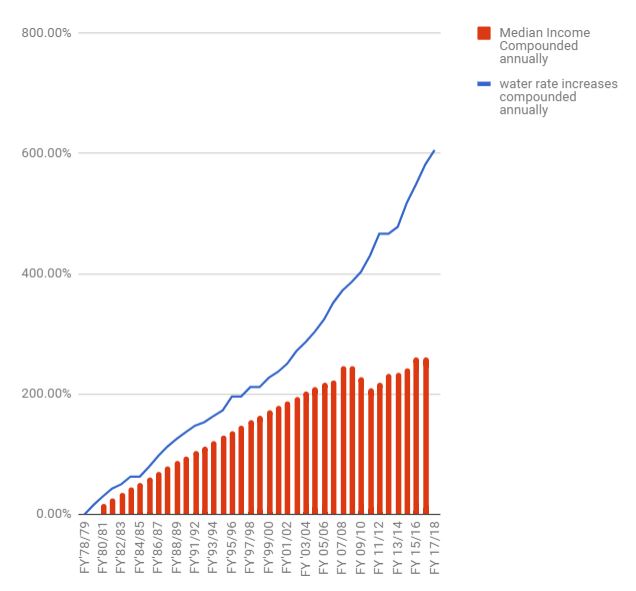

I have outlined the issue of inflation vs. median income in the past. This is one of the biggest issues I have with the spending. Our cost of living through our utilities is skyrocketing while the median income is not increasing at the same rate. What this means is that your utilities are and will continue to consume a larger part of your budget. This is fundamentally why I oppose more unnecessary spending these costs have a larger impact on the middle class and poor. As they are stretched from paycheck to paycheck our city can never improve because their discretionary spending is squeezed tighter every year. Arguably this is part of a bigger problem facing our entire country.

Lack of savings

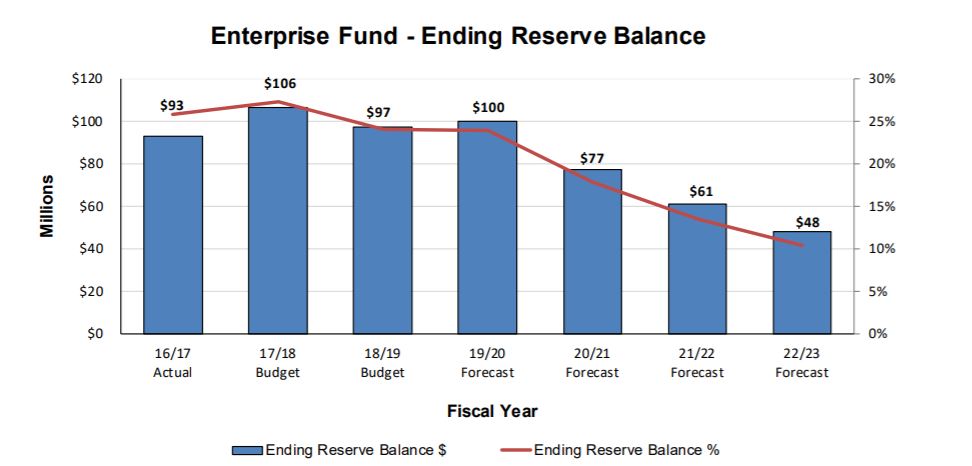

In times of economic prosperity, like what we’re going through today, organizations, corporations, and individuals should be saving for future downturns in the economy. Instead, we’ve accelerated our spending and are estimated to deplete our reserves to their lowest allowable levels 8-10% by fiscal year 22/23.

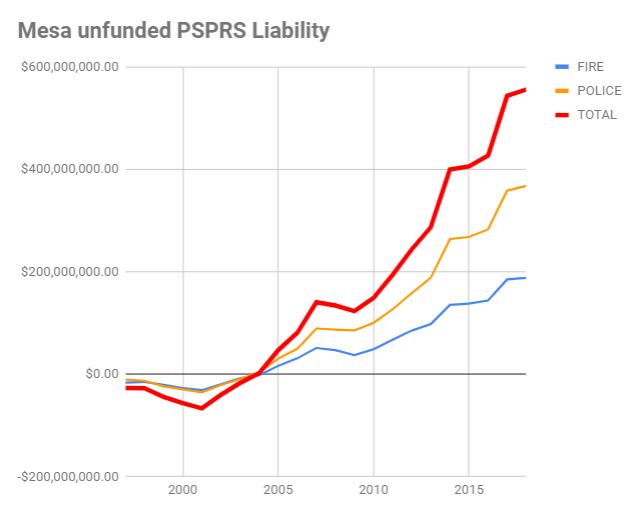

Lurking massive public safety pension problems

The single biggest issue facing our city financially is the bankrupt PSPRS fund. This is destroying our city financially. If you look at the chart below it is clear we are headed for a disaster. Even more concerning is the lack of an attempt to pay down this debt. A percentage of the revenues from Question 2 should have been allocated to addressing this problem. Instead, the Council decided to change the amortization period from 20 to 30 years, simply kicking the can down the road. These funds sit at dangerously unfunded levels that are not prepared for the next recession, 44.26% for police and 46.7% for fire personnel.

Red Mountain Soccer Complex

The reasons outlined above are why I opposed the ASU complex downtown and other discretionary spending. So is now the time to be spending more money on a bunch of new taxes, a park that includes a year-round ice skating rink downtown, and massive soccer complex which will only positively impact one of the wealthiest parts of northeast Mesa? I say no, however, I’ve outlined my arguments above and will respect your opinion if we disagree. The only question I hope you would ask before voting for all these new taxes, “How and who will pay for all of this?“.

I referenced multiple items throughout this article. Most of the data was derived from the City of Mesa’s executive budget report or the comprehensive annual financial report.

Mesa’s Executive Budget Plan – https://www.mesaaz.gov/home/showdocument?id=28835

Mesa’s Comprehensive Annual Financial Report – https://www.mesaaz.gov/home/showdocument?id=24514

PSPRS CAFR – http://www.psprs.com/uploads/sites/1/2017_CAFR_FINAL.pdf