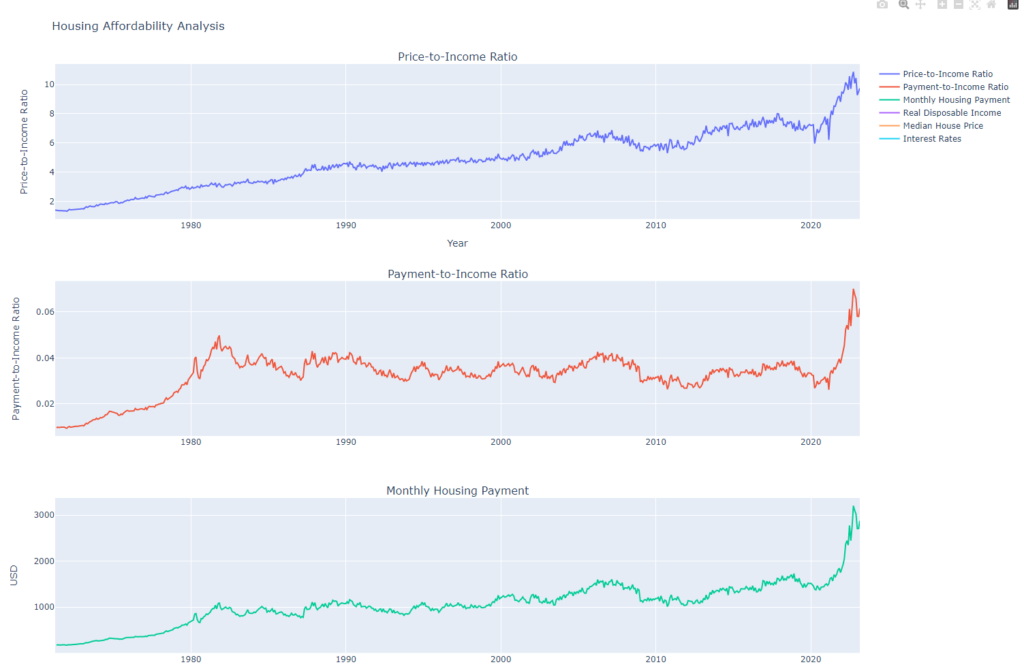

Understanding trends in housing affordability provides crucial insights into financial stability and economic conditions. A key metric to consider is the price-to-payment-to-income ratio. This ratio calculates the burden of mortgage payments on the available income. Over recent years, this ratio has been skyrocketing, indicating a growing financial burden on homeowners. The high price-to-payment-to-income ratio is a clear sign of housing unaffordability, and it suggests that the current state of housing is unsustainable.

Equally concerning is the high price-to-income ratio. This ratio measures the relative cost of housing to available income. When the price-to-income ratio is high, it means that a larger proportion of a person’s income is needed to afford housing.

Given these metrics, it’s clear that something has to give. There are three main possibilities: the Federal Reserve could lower rates, housing prices will fall, or incomes would have to rise dramatically. Each of these scenarios carries its own set of implications and potential problems.

If the Federal Reserve decides to lower rates, it could stimulate economic activity by making borrowing cheaper. However, this could also lead to inflation which the FED has clearly signaled they will fight tooth and nail. Even if rates were to drop, the price-to-income ratio would still remain high as rates have no impact on this directly.

A surge in income is a possibility. While it’s the most ideal, it’s also the least likely. Income growth has been stagnant for many years and it would take a substantial economic shift for incomes to rise dramatically enough to offset the high housing prices. Furthermore, such a change could also lead to inflation, which would, in turn, would cause the FED to continue raising rates.

The current trends suggest that a stagnation or decline in housing prices appears to be the most probable outcome. Many homeowners have secured mortgages with low interest rates, a factor that often leads to less mobility in the housing market as people are less inclined to sell or buy. As a result, we could see a period of low housing turnover stretching out for years into the future.