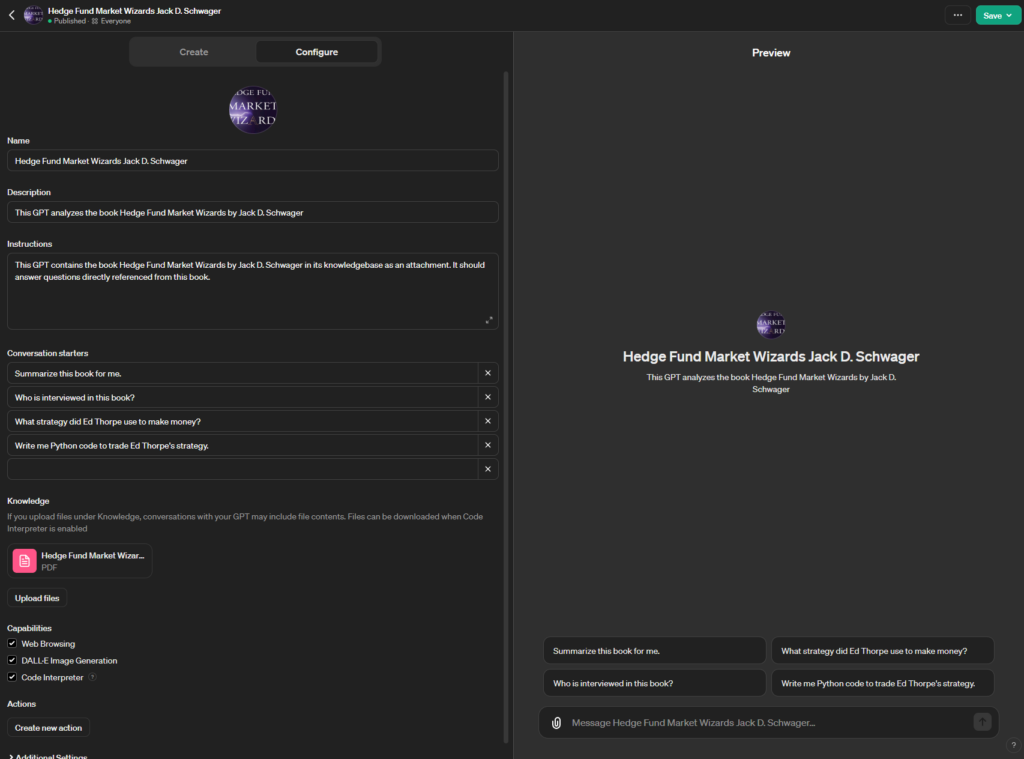

If you read a lot of technical books or want to specifically reference them in the future, then you need to check out ChatGPT’s custom GPT creator. I’m going to show an example of how I upload a PDF of Jack Schwager’s Hedge Fund Market Wizard’s book. I can then query and ask this GPT any questions about this book.

Here is a link to the GPT – Hedge Fund Market Wizards by Jack D. Schwager Custom GPT

Example prompts:

Summarize this book for me.

“Hedge Fund Market Wizards” by Jack D. Schwager features interviews with successful hedge fund managers who share their strategies, experiences, and insights into the financial markets. The book is divided into three parts: “Macro Men,” “Multistrategy Players,” and “Equity Traders.” Each chapter focuses on a different manager, covering a wide range of trading philosophies and methodologies. The book aims to shed light on the attributes and practices that have made these traders successful, offering readers valuable lessons on risk management, market analysis, and the psychological aspects of trading. Schwager’s work is not just a collection of trading stories but a comprehensive exploration of the nuanced approaches that define hedge fund success.

Who is interviewed in this book?

The interviews conducted in “Hedge Fund Market Wizards” by Jack D. Schwager include discussions with the following individuals:

- Colm O’Shea along with an addendum featuring Ray Dalio’s Big Picture View

- Ray Dalio

- Larry Benedict

- Scott Ramsey

- Jaffray Woodriff

- Edward Thorp

- Jamie Mai

- Michael Platt

- Steve Clark

- Martin Taylor

- Tom Claugus

- Joe Vidich

- Kevin Daly

- Jimmy Balodimas

- Joel Greenblatt

These individuals represent a broad spectrum of strategies within the hedge fund industry, from macro trading to equity trading and multi-strategy approaches.

List the strategies in this book that are used by all the traders.

The strategies used by all the traders interviewed in “Hedge Fund Market Wizards” by Jack D. Schwager include a wide range of philosophies, methods, and insights, reflecting the diverse nature of trading success. Here are the key strategies and lessons extracted from the book:

- No Holy Grail in Trading: Successful trading does not rely on a single, unchanging method. The diversity of approaches among the traders highlights the multitude of ways to succeed in the markets.

- Trading Method Must Fit Your Personality: It’s crucial for traders to find a methodology that aligns with their own beliefs and talents. What works for one trader may not work for another.

- Trade Within Your Comfort Zone: Managing emotional capacity and fear is essential. Oversizing positions can lead to premature exits and missed opportunities.

- Flexibility: Successful traders are willing to adapt their positions based on market feedback, even if it means reversing their stance.

- Need to Adapt: Markets change, and strategies that once worked may lose their effectiveness. Continuous adaptation is necessary.

- Good Trades vs. Winning Trades: A good trade is one that adheres to a positive-edge process, regardless of its outcome. Conversely, a trade taken as a gamble is bad, irrespective of its result.

- Focus on What Works: Traders should concentrate on strategies that have proven successful for them and avoid those without a clear edge.

- Trying Harder Won’t Help If Out of Sync: Taking a break can be more beneficial than persisting in adversity.

- Learn from Mistakes: Every mistake provides a learning opportunity that can enhance future trading success.

- Wait for High-Conviction Trades: Patience in waiting for the right opportunity significantly enhances trade outcomes.

- Trade Based on Opportunity: Trades should be executed based on perceived opportunities, not the desire to make money.

- Importance of Doing Nothing: Sometimes, the best action is inaction, especially when market conditions are not favorable.

- Implementation Is Key: The success of a trade can depend as much on how it is executed as on the trade idea itself.

- Trading Around a Position: Dynamically managing positions between entry and exit can enhance profitability and reduce risks.

- Position Size Matters: Managing position size based on the potential and risk of the trade can be more crucial than the entry price.

These strategies emphasize the importance of adaptability, self-awareness, disciplined risk management, and continuous learning in achieving trading success. Each trader has their unique approach, but these common themes provide a foundation for aspiring traders to develop their strategies.

Write me a detailed explanation of Edward Thorp’s investing strategy noting anything he mentioned in the book. I want to implement his trading strategy.

Edward Thorp’s investing strategy, as discussed in “Hedge Fund Market Wizards,” showcases a groundbreaking blend of mathematical expertise, strategic financial bets, and a commitment to identifying and exploiting inefficiencies within financial markets. His multifaceted approach is characterized by several key elements:

Foundational Achievements: Thorp’s career is marked by pioneering contributions to gambling, finance, and mathematical theories, setting the stage for his investment strategies. Notably, he co-developed the first wearable computer to predict roulette outcomes, created the first system providing a statistical edge in blackjack, and was among the first to engage in convertible bond arbitrage and statistical arbitrage. These endeavors underscore his knack for identifying and leveraging inefficiencies and mathematical edges in various systems.

Market Neutral and Quantitative Hedge Fund: Thorp was the founder of the first market-neutral fund and the first successful quant hedge fund, emphasizing strategies that were indifferent to market directions and relied on mathematical models to generate returns. His approach was deeply rooted in the belief that markets contain inefficiencies that can be systematically exploited through rigorous analysis and innovative strategies.

Convertible Arbitrage and Statistical Arbitrage: Thorp’s foray into convertible arbitrage involved taking positions in convertible securities and hedging these with offsetting stock positions, capitalizing on pricing discrepancies. Similarly, his statistical arbitrage strategy, initiated in the mid-1980s and later offered to institutional clients and other investors through his hedge fund Ridgeline Partners, sought to profit from pricing inefficiencies between related securities. Over a decade, this strategy yielded an average annual compounded return of 21 percent with a remarkably low volatility of 7 percent annually, highlighting Thorp’s skill in generating consistent returns while managing risk effectively.

Adaptation and Evolution of Strategies: Thorp’s investing ethos was characterized by constant adaptation to maintain an edge in evolving markets. For instance, his initial statistical arbitrage strategy involved balancing long positions in undervalued stocks with short positions in overvalued stocks to achieve market neutrality. As market dynamics shifted, Thorp refined his approach to include sector neutrality and, eventually, adjustments for various market factors to sustain performance despite changing market conditions.

Risk Management and Bet Sizing: A critical component of Thorp’s strategy was his sophisticated approach to risk management and bet sizing, informed by the Kelly criterion. Thorp advocated for betting sizes proportional to the perceived edge and the confidence in the outcome of a trade. This disciplined approach allowed for maximizing returns while controlling the risk of significant drawdowns. His cautionary stance on bet sizing—often utilizing a fraction of the Kelly-recommended size, especially in less certain trades—illustrates his prudent risk management philosophy.

Implementing Thorp’s trading strategy involves a deep understanding of quantitative analysis, a disciplined approach to risk management, and the flexibility to adapt strategies as market conditions change. It also necessitates capabilities in developing and testing statistical models, as well as a readiness to continually seek out and exploit market inefficiencies.

Write me a detailed explanation of Joel Greenblatt’s investing strategy noting anything he mentioned in the book. I want to implement his trading strategy.

Joel Greenblatt’s investing strategy, as detailed in “Hedge Fund Market Wizards,” is primarily based on value investing principles, combined with a systematic approach to selecting stocks. His strategy, famously known as the “Magic Formula,” aims to buy good companies at cheap prices. The formula involves ranking companies based on two key metrics: earnings yield and return on capital. Earnings yield is used to assess how cheap a company is, while return on capital evaluates how good it is. The companies are then ranked based on a combination of these metrics, and investors are advised to invest in the top-ranked companies.

Greenblatt’s strategy is grounded in the belief that over the long term, the market will recognize the value of undervalued companies, resulting in superior returns for investors who are patient. This approach necessitates a long-term investment horizon, as value stocks may underperform the market for extended periods before their true value is recognized by the market.

In practice, Greenblatt recommends buying a diversified portfolio of these top-ranked stocks and holding them for a year before re-evaluating and adjusting the portfolio based on the updated rankings. This systematic, disciplined approach aims to take emotion out of investing and capitalize on the market’s inefficiencies.

It’s important to note that while the Magic Formula is straightforward in theory, its successful implementation requires discipline, patience, and a long-term perspective. The approach is designed to exploit market inefficiencies that arise from the market’s short-term focus, providing an edge to investors who are willing to invest with a longer time horizon.

Greenblatt also emphasizes the importance of not being swayed by short-term market fluctuations or the allure of recent high performers. Instead, investors should focus on the intrinsic value of businesses and the price they are paying to become part owners of those businesses.

Implementing Greenblatt’s strategy involves:

Identifying companies with high returns on capital (a measure of profitability) and high earnings yields (indicative of undervaluation).

Ranking these companies based on these criteria and investing in a portfolio of the top-ranked companies.

Holding the investments for a predetermined period, typically one year, before repeating the process.

This approach, while rooted in fundamental analysis, incorporates a systematic and disciplined methodology, setting it apart from more speculative or momentum-driven investing strategies.

Write me a detailed explanation of Jimmy Balodimas’s investing strategy noting anything he mentioned in the book. I want to implement his trading strategy.

Jimmy Balodimas’s investing strategy, as described in “Hedge Fund Market Wizards,” revolves around a reversion-to-the-mean philosophy, combined with detailed analysis of sectors and specific stock fundamentals. He uses standard deviation bands based on historical data to define extreme readings for market indices, adjusting his portfolio’s net exposure accordingly. At extreme low valuations, he positions heavily in longs, and at high valuations, he shifts towards shorts, always considering the long-term secular uptrend in stock prices.

Balodimas emphasizes the importance of sector analysis, identifying sectors that are either undervalued or overpriced, and then further delving into specific fundamentals of stocks within these sectors. He spends a significant amount of time understanding why a stock or sector is valued the way it is and what could potentially change that valuation.

His strategy also involves looking for anomalies, especially during quarterly earnings seasons, identifying companies with substantial earnings surprises as potential investment opportunities. He illustrates this approach with an example of how consolidation and lack of capacity expansion in the paper industry led to a situation where the pricing power shifted to suppliers, prompting him to invest in Rock Tenn.

Balodimas adheres to specific risk management principles, aiming to prevent significant losses rather than just having a plan for when things go wrong. His portfolio experiences high turnover, reflecting an active trading approach, particularly on the short side. He underscores the importance of discretion in risk management, being particularly wary of leverage as a major risk factor.

Despite his systematic approach, Balodimas acknowledges the challenges of market timing, especially during bubble periods like the tech bubble of the late 1990s, highlighting the importance of flexibility and the willingness to adjust exposure in response to rapid market changes.

Overall, Balodimas’s strategy is characterized by a mix of quantitative analysis for market positioning and qualitative analysis for stock selection, with a strong emphasis on risk management and the avoidance of leverage.

Write me a detailed explanation of Kevin Daly’s investing strategy noting anything he mentioned in the book. I want to implement his trading strategy.

I was unable to find specific information about Kevin Daly’s investing strategy in “Hedge Fund Market Wizards” by Jack D. Schwager within the provided document. It appears that the information may not be detailed or directly outlined in the accessible sections of the book. For implementing Kevin Daly’s trading strategy, I recommend looking for sections specifically dedicated to his interview for direct quotes and insights on his approach to investing. If you have a specific area or topic in mind that you believe might contain details on Daly’s strategy, please let me know, and I can search for that specifically.

Write me a detailed explanation of Joe Vidich‘s investing strategy noting anything he mentioned in the book. I want to implement his trading strategy.

Joe Vidich’s investing strategy, as outlined in “Hedge Fund Market Wizards,” is a unique blend of long-term thematic investing complemented by short-term trading to provide supplemental returns. Here are the key components of his strategy, based on insights shared in the book:

Big Picture Analysis: Vidich begins with a macroeconomic analysis to develop a big picture view of the economy and the stock market. This step is crucial for identifying overarching themes that could influence market movements.

Thematic Approach: Following the macro analysis, he looks for themes that could drive market sectors or subsectors. These themes form the basis of his investment focus, narrowing down the areas where he believes the most significant opportunities lie.

Fundamental Analysis and Trading Activity: With sectors and themes in mind, Vidich conducts fundamental analysis on individual stocks within those areas. He combines this with observations of trading activity to select stocks he believes are best positioned for gains. His entry and exit timings for these positions are influenced significantly by market sentiment, which he assesses through price action in relation to current events.

Market Sentiment Analysis: Vidich places a high emphasis on market sentiment, listening to around 300 conference calls each quarter to gauge the market’s reaction to company announcements. For instance, if a company reports positive news but its stock price falls, he views this as a bearish signal.

Active Trading with a Focus on Short Positions: Despite his long-term investment themes, Vidich is an extremely active trader, especially on the short side. This is attributed to his background as a market maker and proprietary trader, where he developed a nuanced skill for short trading. His fund’s turnover is about 20X, with approximately 15X of that on the short side.

Flexible Net Exposure: Vidich’s strategy involves varying the net exposure of his portfolio significantly, ranging from 80 percent net long to 37 percent net short, depending on his market outlook.

Implementing Joe Vidich’s strategy would require a robust understanding of macroeconomic trends, the ability to conduct detailed fundamental analysis, and the skills to assess market sentiment accurately. Additionally, it calls for a high level of trading activity and the flexibility to shift between long and short positions as market conditions change.

Write me a detailed explanation of Tom Claugus‘s investing strategy noting anything he mentioned in the book. I want to implement his trading strategy.

Tom Claugus’s investing strategy, as detailed in “Hedge Fund Market Wizards” by Jack D. Schwager, is deeply influenced by his background in risk arbitrage and his appreciation for the value investing principles of Benjamin Graham. Here’s a comprehensive overview of his approach and how you might implement it:

Early Influences and Philosophical Foundations

- Benjamin Graham’s Influence: Claugus was significantly influenced by Benjamin Graham’s value investing philosophy, particularly the concept of investing in stocks trading below their intrinsic or liquidation value. This influence shaped his early investing activities, including a fund he started based on Graham’s principles.

- Risk Arbitrage Background: His initial experience in risk arbitrage, where he focused on mergers and acquisitions, hostile takeovers, and other corporate restructuring events, honed his skills in evaluating complex financial situations. This experience contributed to a preference for investing in situations with asymmetric return profiles—high upside potential relative to downside risk.

Investing Strategy Core Components

- Value Investing with a Twist: Claugus integrates the core principles of value investing—buying undervalued securities with a margin of safety—with a keen interest in special situations. These situations include spin-offs, recapitalizations, tender offers, and other corporate events that can create price inefficiencies.

- Focus on Special Situations: He is attracted to complex situations that most investors would overlook or find too cumbersome to analyze. These include distressed companies or those undergoing significant corporate changes. Claugus believes that thorough analysis of such situations can uncover mispriced securities offering significant upside potential.

- Comprehensive Analysis: His strategy involves an exhaustive evaluation of a company’s financial statements, market position, and the specific details of the corporate event or situation it is involved in. This rigorous analysis aims to identify opportunities where the market has mispriced a security relative to its potential value post-event or restructuring.

- Use of Options for Leverage and Hedging: Claugus’s background in options trading is evident in his use of derivatives to leverage positions or hedge against potential losses. This approach allows him to manage risk while exploiting the asymmetric return profiles of his investments.

- Long-Term Perspective: Despite his focus on events and situations that might suggest a shorter-term horizon, Claugus emphasizes the importance of patience and a long-term outlook. He acknowledges that it might take time for the market to recognize and correct mispricings.

Implementation Tips

- Thorough Research: Start with exhaustive research into potential investment targets, focusing on undervalued companies undergoing significant corporate events. Utilize all available information, including financial statements, regulatory filings, and market analysis.

- Complex Situation Analysis: Develop a proficiency in analyzing complex corporate situations, understanding the nuances of different types of special events, and evaluating their potential impact on a company’s value.

- Risk Management: Use options strategically to manage risk, whether to leverage positions in companies with high upside potential or to hedge against downside risks in uncertain situations.

- Patience and Discipline: Maintain a long-term perspective, recognizing that significant returns from special situations and value investments may take time to materialize. Discipline in sticking to your investment thesis and patience in waiting for the market to recognize value are crucial.

Claugus’s success highlights the effectiveness of blending traditional value investing principles with a focus on special situations and a sophisticated approach to risk management. Implementing his strategy requires a solid foundation in financial analysis, a willingness to delve into complex situations, and the discipline to maintain a long-term perspective amidst market volatility.

Write me a detailed explanation of Martin Taylor‘s investing strategy noting anything he mentioned in the book. I want to implement his trading strategy.

Martin Taylor’s investing strategy, as detailed in “Hedge Fund Market Wizards” by Jack D. Schwager, is centered around a thorough analysis of macroeconomic trends, company-specific fundamentals, and the effective management of risk and portfolio exposure. Here’s a detailed breakdown of his approach:

- Macro Analysis: Taylor places a significant emphasis on understanding the broader macroeconomic environment and its potential impact on investment opportunities. His deep dive into Russia’s economic situation ahead of the 1998 crisis exemplifies his meticulous approach to macroeconomic analysis. Taylor noticed discrepancies in Russia’s balance of payments data that were not aligned with the prevailing optimistic sentiment in the market. This led him to predict the impending crisis and adjust his portfolio accordingly, demonstrating a keen sense of how macroeconomic factors can drive market movements.

- Emphasis on Cash and Risk Management: Taylor’s strategy includes holding a significant portion of his portfolio in cash, especially when market conditions appear overvalued or when there are clear signs of economic distress. This approach helped him navigate through turbulent times, such as the Russian financial crisis, by allowing him flexibility to adjust his exposure and take advantage of buying opportunities post-crisis. His decision to move 40 percent of his fund to cash ahead of the 1998 Russian crisis underscores the importance he places on liquidity and risk management.

- Stock Selection Based on Fundamental Analysis: Taylor believes in the importance of individual stock selection, focusing on companies with strong fundamentals and growth prospects. He prefers high-beta stocks, which tend to be more volatile but offer greater potential for returns, balanced by cash or shorts to manage the overall risk in the portfolio. His strategy involves identifying companies with solid management teams, favorable macro conditions, and participation in secular trends, such as the increasing mobile phone penetration in Russia during the late 1990s and early 2000s.

- Flexibility and Adaptability: Taylor’s ability to change his investment stance quickly based on new information or market conditions is a key component of his strategy. This agility helped him to capitalize on opportunities and mitigate losses, as illustrated by his rapid response to market signals preceding the Russian crisis.

- Leverage of Personal Insights and Direct Company Engagement: Taylor values direct engagement with company management as part of his due diligence process. By meeting with companies regularly, he builds a comprehensive understanding of their business models, competitive advantages, and growth potential, which informs his investment decisions.

- Avoidance of Large Asset Overhang: Taylor’s decision to significantly reduce the size of his fund underscores his belief that managing a smaller asset base can lead to better performance. He observed that excessive fund size could hinder the ability to execute on investment ideas effectively and limit flexibility, leading to his decision to cap the assets of his new fund at a fraction of his previous fund’s size.

Implementing Taylor’s strategy involves a blend of rigorous macroeconomic analysis, detailed company research, disciplined risk management, and the flexibility to adjust positions based on evolving market conditions. It requires a deep understanding of both the macroeconomic environment and the specific fundamentals of potential investment targets, as well as a commitment to maintaining liquidity and managing portfolio exposure to align with risk tolerance levels.

Write me a detailed explanation of Steve Clark‘s investing strategy noting anything he mentioned in the book. I want to implement his trading strategy.

Steve Clark’s investing strategy, as described in “Hedge Fund Market Wizards,” emphasizes several key principles critical for traders aiming to replicate his approach. Clark’s strategy is deeply rooted in his understanding of market dynamics, psychological resilience, and disciplined risk management. Here are the primary components of his trading strategy:

1. Emotional Capacity and Trade Size

Clark advises traders to operate within their emotional capacity by keeping trading sizes manageable to prevent fear from overriding judgment. This approach involves adjusting position sizes based on confidence in the trade and potential relative to risk, suggesting that when conditions are highly favorable, a larger-than-normal size might be warranted. Conversely, in times of increased market volatility or during a losing streak, reducing exposure or even stepping away from trading temporarily can help regain objectivity.

2. Flexibility and Open-mindedness

A core aspect of Clark’s philosophy is the importance of flexibility in trading. He emphasizes the need for traders to be willing to change their market views instantly if the price action contradicts their initial hypothesis. This agility enables traders to adapt to market conditions swiftly and avoid being stuck in losing positions due to an attachment to a specific idea.

3. Risk Management

Clark’s approach to risk management is nuanced and does not rely on conventional quantitative models, which he believes can give a false sense of security. Instead, he advocates for common-sense risk control, evaluating each trade based on a comprehensive set of criteria including company fundamentals, cash flow generation, management trustworthiness, confidence in projections, and a favorable macro outlook. Position sizing is then determined by the perceived risk level, allowing for significant allocations to high-confidence, lower-risk positions.

4. Avoiding Euphoria and Market Hysteria

He warns against the dangers of euphoria and market hysteria, illustrating with an example where he recognized his own irrational behavior in the market as a signal to switch from buying to selling. This awareness of one’s emotional state and its influence on trading decisions is a crucial element of his strategy.

5. Strategic Diversification and Focus

Clark underscores the value of understanding where one excels and focusing efforts on those areas rather than diversifying into unfamiliar territory. This principle extends to the types of trades made; if certain trades consistently yield profits while others result in losses, the strategy should be adjusted to focus on the former. This approach requires thorough analysis of past trades to identify profitable patterns.

Implementing Steve Clark’s strategy necessitates a deep understanding of one’s own psychological makeup, a disciplined approach to risk management, and a willingness to continually learn from the market and adapt strategies accordingly. His success underlines the importance of psychological resilience, adaptability, and a nuanced approach to risk, rather than relying solely on technical analysis or quantitative models.

Write me a detailed explanation of Michael Platt‘s investing strategy noting anything he mentioned in the book. I want to implement his trading strategy.

Michael Platt’s investing strategy, as detailed in “Hedge Fund Market Wizards,” primarily revolves around a disciplined and comprehensive approach to trading that emphasizes risk control, market understanding, and the pragmatic adjustment of trades based on ongoing market analysis. Here are key elements of Platt’s investing philosophy and practice based on the insights shared in the book:

- Macro Assessment and Flexible Net Exposure: Platt’s strategy involves a thorough macroeconomic assessment to determine the fund’s net exposure. He adapts his strategy based on global economic conditions, shifting the portfolio’s net exposure to align with the prevailing economic environment. For example, during periods of negative global macro fundamentals, he would significantly lower the fund’s net exposure, reflecting a cautious stance.

- Secular Trends and Company Fundamentals: Platt pays close attention to secular trends that could affect trade outcomes. He seeks situations where a strong, fundamentally based secular trend supports the trade, alongside companies that have attractive growth prospects and are priced reasonably relative to their future earnings potential. This dual focus allows him to identify long positions in sectors or countries with positive fundamentals and to navigate around “boring” companies, regardless of their apparent value.

- Position Sizing Based on Confidence and Risk: The size of the positions Platt takes in the portfolio is carefully calibrated based on his assessment of company and country risk, as well as his confidence in the trade’s success. He employs a pragmatic approach to sizing, which can range significantly based on the perceived risk and potential return of the investment.

- Utilization of Technical Analysis as a Supplemental Tool: While Platt’s strategy is fundamentally driven, he does not ignore the insights provided by technical analysis. Charts and technical indicators play a role in timing his entries and exits for stocks, serving as a supplementary tool to his primarily fundamental analysis. He looks at charts to avoid buying stocks that are overbought or to gain confidence in adding to positions where the chart supports the fundamental view.

- Gut Feel and Market Sentiment: Platt acknowledges the importance of gut feel in trading decisions. He is attuned to the market’s sentiment and is cautious of positions that do not act as expected, indicating a need to revisit the fundamentals. This sensitivity to market behavior and sentiment helps him avoid potential pitfalls that might not be evident from purely quantitative analysis.

- Risk Control and Avoidance of Quantitative Models: Uniquely, Platt’s approach to risk management eschews quantitative models, which he views as backward-looking and potentially misleading. Instead, he emphasizes common-sense assessments of trades, including a multi-faceted review of a company’s attractiveness and the macroeconomic environment. His philosophy is to avoid being in a position where he is forced to make significant changes based on adverse movements, preferring instead to maintain control and flexibility in his trading approach.

Implementing Platt’s strategy would involve a disciplined adherence to risk management, a thorough analysis of macroeconomic conditions, and a selective approach to stock selection based on secular trends and fundamental analysis. It would also require flexibility in adjusting portfolio exposure based on evolving market conditions and an openness to incorporating technical analysis as a means of refining trade execution.

Write me a detailed explanation of Jamie Mai’s investing strategy noting anything he mentioned in the book. I want to implement his trading strategy.

Jamie Mai’s investing strategy, as detailed in “Hedge Fund Market Wizards,” is centered around identifying and capitalizing on asymmetric risk-reward opportunities, primarily through the use of options and special situations that involve mispriced securities. Mai, a principal at Cornwall Capital, focuses on trades where the potential upside significantly outweighs the downside risk. This approach is rooted in the search for market inefficiencies and the belief that markets do not always price securities correctly, especially regarding their future changes in value.

The foundation of Mai’s strategy involves a blend of bottom-up fundamental analysis and expertise in capital markets, derivatives, and fixed income trading. Cornwall’s investment approach is characterized by seeking highly asymmetric trades with positive skew, meaning they aim for investments where the possibility of gains far exceeds the potential losses. For instance, one of Cornwall’s notable bets was a short position on subprime mortgages, which ultimately yielded an approximately 80-fold return on the initial premium paid for subprime default protection.

Mai’s strategy includes looking for special situations and using options to exploit identified price dislocations caused by the market assigning an undue risk premium to a perceived idiosyncratic risk. He looks for cases where the market’s reaction to news or events creates an overblown sense of risk, resulting in securities being undervalued. A critical aspect of his methodology is the rigorous analysis to challenge the market’s assumptions, often resulting in trades that bet against the prevailing market sentiment.

For example, in one scenario, Mai capitalized on the market’s overreaction to rating agency downgrades of Altria due to litigation risks. Mai’s analysis suggested the market had overly discounted Altria’s stock, presenting an opportunity for a bullish outcome through out-of-the-money calls, which were undervalued given the situation’s bimodal potential outcomes. This trade, along with others like it, exemplifies Mai’s approach to finding value in situations where the market has mispriced the actual risk involved.

Moreover, Mai’s strategy extends to exploiting inconsistencies in option pricing, particularly around events or situations that result in non-normal distributions of returns. His trades often involve long-dated options or scenarios where the implicit assumptions in option pricing models do not align with market realities, such as the historical volatility being a poor predictor of future volatility or the breakdown of forward option-pricing models in certain market conditions.

Implementing Mai’s strategy involves a deep dive into fundamental analysis, a keen understanding of options and market dynamics, and a willingness to take contrarian positions based on rigorous research. It’s about recognizing when the market has overreacted or failed to accurately assess the probability of various outcomes and positioning oneself to profit from the eventual correction in perceptions. While this approach has led to significant returns for Cornwall Capital, it requires a high level of diligence, expertise, and risk management to execute successfully.

Write me a detailed explanation of Jaffray Woodriff’s investing strategy noting anything he mentioned in the book. I want to implement his trading strategy.

Jaffray Woodriff’s investing strategy, as detailed in “Hedge Fund Market Wizards,” revolves around a quantitative approach that leverages statistical models and algorithms to make investment decisions. Woodriff emphasizes the importance of managing exposure based on market opportunities, using sophisticated models to predict market movements and identify the optimal times to increase or decrease net exposure. His strategy involves a rigorous assessment of probabilities and outcomes, rather than basing decisions solely on the results of trades. This mindset allows for a more nuanced understanding of market dynamics and the inherent randomness of outcomes.

One of the key aspects of Woodriff’s approach is his focus on “free optionality,” where he seeks investment opportunities that the market has undervalued or overlooked. This could involve companies with untapped potential due to new technologies, unexplored markets, or other factors that could lead to future revenue growth not currently reflected in their stock prices. He cites examples such as companies with innovative solutions or potential for significant exploration success that are not priced into their current valuation.

Woodriff’s strategy also involves a keen understanding of market sentiment and its impact on stock prices. He emphasizes the distinction between public sentiment, as influenced by media and popular opinion, and market sentiment, which is reflected in the actual movement of stock prices. By focusing on how stocks respond to news and events, he aims to capture opportunities based on discrepancies between public expectations and market realities.

In terms of risk management, Woodriff advocates for flexibility in adjusting exposure based on the prevailing market conditions. This includes being willing to take both long and short positions and to shift the portfolio’s net exposure in response to changes in the market’s price band. He stresses the importance of not being overly attached to a particular direction or outcome, recognizing that successful trading involves navigating uncertainty and adapting to new information.

Implementing Woodriff’s strategy requires a strong foundation in quantitative analysis, access to comprehensive market data, and the ability to develop and refine predictive models. It also necessitates a disciplined approach to risk management and an openness to reevaluating positions in light of new evidence. While the specific quantitative models and algorithms Woodriff uses are proprietary, the underlying principles of his approach can be adapted by investors with the requisite skills and resources.

Write me a detailed explanation of Scott Ramsey‘s investing strategy noting anything he mentioned in the book. I want to implement his trading strategy.

Scott Ramsey, as discussed in “Hedge Fund Market Wizards,” is a low-risk futures trader who employs a distinctive combination of discretionary trading and fundamental analysis within the highly liquid futures and foreign exchange (FX) markets. Unlike the majority of Commodity Trading Advisors (CTAs) who rely on systematic approaches, Ramsey’s methodology is notably discretionary, integrating fundamental analysis into his decision-making process.

Ramsey’s strategy begins with establishing a broad fundamental macro view to determine his directional bias in each market. Based on this bias, he opts to go short in the weakest market within a sector if his outlook is bearish, or long in the strongest market if his outlook is bullish. Technical analysis plays a crucial role in timing both trade entry and position adjustments.

One of the key strengths of Ramsey’s approach is his stringent risk control measures. He typically risks a mere 0.1 percent of capital on each trade from the point of entry, ensuring that losses remain relatively small. This disciplined risk management has allowed Ramsey to maintain an impressive track record, including never having a down year, and to achieve substantial returns with low volatility and moderate drawdowns.

Ramsey also pays close attention to price movements in related markets, utilizing discrepancies as signals of inherent strength or weakness. This nuanced understanding of market dynamics, combined with a rigorous approach to risk control, forms the cornerstone of his strategy. Furthermore, his success underscores the importance of dedication to trading, as he monitors positions continuously, even while on vacation, reflecting a level of commitment that has been critical to his performance.

Implementing Ramsey’s strategy requires a thorough understanding of fundamental macroeconomic factors, skill in technical analysis for precise entry and exit points, and a rigorous approach to risk management. Investors looking to adopt his approach should be prepared for the dedication and continuous market monitoring that his method entails.

Write me a detailed explanation of Larry Benedict’s investing strategy noting anything he mentioned in the book. I want to implement his trading strategy.

Larry Benedict’s investing strategy, as outlined in “Hedge Fund Market Wizards,” revolves around a few core principles:

- Mean Reversion Trading: Benedict primarily operates as a mean reversion trader. He sells into short-term upswings and buys into short-term declines, focusing on the S&P 500 while also engaging with foreign equity indexes (such as the DAX, Hang Seng, and Nikkei), interest rate markets, major currencies, and key commodities like crude oil and gold.

- Risk Management: A central tenet of Benedict’s approach is rigorous risk management. He is highly cautious, liquidating his entire portfolio and starting fresh if his losses in any month approach 2.5%. Typically, after experiencing a 2.0% to 2.5% decline, he reduces his position size significantly, trading at a smaller scale until he regains profitability. This strategy has prevented him from ever incurring a large monthly loss.

- Market Correlation and Discretionary Trading: Benedict does not fit neatly into the categories of either fundamental or technical traders. Instead, he has a keen sense for when to buy and sell based on his extensive experience and observation of market correlations. He trades without looking at charts, relying on his understanding of price actions and market correlations, making him a unique type of discretionary technical trader.

- Short-Term Trading and Tape Reading: Benedict is a very active short-term trader, with trade durations ranging from a few seconds to a couple of days. He does not use charts during the trading day but has a sort of “mental chart,” focusing instead on tape reading and price movements in relation to other markets.

- No Use of Fundamentals in Short Duration Trading: While Benedict understands market fundamentals, they do not play a role in his short-duration trading strategies.

- High Activity Level: Benedict averages about 100 to 200 trades a day, reflecting his high-frequency trading approach and short-term focus. This level of activity is a critical component of his strategy to “grind out” returns, avoiding reliance on a few significant up days.

- Extreme Risk Management and Portfolio Risk Limitation: Benedict emphasizes extreme risk management, limiting portfolio risk to a small, fixed amount before taking actions to mitigate further losses. He believes in reducing exposure when trading is not going well, underscoring his philosophy that trading is fundamentally about managing risk.

To implement Larry Benedict’s trading strategy, one would need to focus on mean reversion trading, maintain rigorous risk management, observe and utilize market correlations without relying on traditional chart analysis, engage in high-frequency, short-term trades, and prioritize the management of risk over seeking profit. His approach requires an exceptional level of discipline, an ability to process market information without the aid of visual charts, and a commitment to controlling risk at all times.

Write me a detailed explanation of Ray Dalio’s investing strategy noting anything he mentioned in the book. I want to implement his trading strategy.

I’ve gathered information on several hedge fund managers from “Hedge Fund Market Wizards” by Jack D. Schwager, but I encountered a limitation in accessing specific details about Ray Dalio’s investing strategy directly from the book within the given time.

From general knowledge, Ray Dalio is known for his unique approach to investing, which includes the concept of risk parity, diversification, and the economic machine. Dalio’s Bridgewater Associates implements a global macro strategy, focusing on economic trends such as changes in exchange rates, inflation, and GDP growth. He advocates for a well-diversified portfolio that balances various asset classes to achieve steady returns while managing risk, irrespective of market environments. His famous “All Weather” portfolio is designed to perform well in various economic scenarios, including growth, inflation, deflation, and recession.

Dalio emphasizes understanding the “economic machine,” which involves recognizing the long-term debt cycle, short-term debt cycle, and productivity growth. He suggests that by understanding these fundamental drivers, investors can better anticipate market movements and position their portfolios accordingly.

For a detailed exploration of Dalio’s strategies, I recommend examining his public writings and interviews, where he discusses his principles for investing and managing risk.

If you have further or more specific questions, please let me know, and I’ll do my best to assist you.

Write me a detailed explanation of Colm O’Shea‘s investing strategy noting anything he mentioned in the book. I want to implement his trading strategy.

Colm O’Shea’s investing strategy, as detailed in “Hedge Fund Market Wizards” by Jack D. Schwager, is rooted in a global macro approach, focusing on leveraging directional trends across a broad spectrum of markets including currency, interest rates, equity, and commodities. O’Shea treats his trading ideas as hypotheses, where a market moving contrary to his expectations serves as evidence that his hypothesis for that particular trade was incorrect, prompting him to exit the position promptly. This disciplined approach allows him to limit losses to a small percentage of assets, emphasizing the importance of risk management over pursuing outsized gains.

O’Shea’s path to trading was influenced by his early interest in politics and economics, leading him to self-educate in these areas. His initial exposure to the financial markets came through an unexpected opportunity to work as an economist before university, where he learned the limitations and herding behavior prevalent in economic consulting. This experience cemented his disdain for the field and steered him towards trading, where he believed he could have a more direct impact.

Upon joining Citigroup and later managing a portfolio for Soros’s Quantum Fund, O’Shea consistently delivered profitable years, demonstrating a keen understanding of the interplay between economics, politics, and market dynamics. His strategy emphasizes the importance of acknowledging and adapting to the realities of the market, rather than being guided by theoretical models or the latest market trends.

O’Shea’s approach to trading during periods of market uncertainty, such as the 2006-2007 financial bubble, showcases his pragmatic and opportunistic stance. He participated in the bubble cautiously, ensuring positions were highly liquid to allow for quick exits and using options to manage risk effectively. His strategy also involves waiting for the right time to act, recognizing that fundamental factors need to align with market sentiment for a trade to be successful. This patient and strategic positioning allows him to capitalize on market inefficiencies while maintaining a strong risk management discipline.

Implementing O’Shea’s strategy requires a deep understanding of global macroeconomic trends, the ability to formulate and test trading hypotheses, and the discipline to adhere to predetermined risk parameters. His approach underscores the significance of both fundamental analysis and technical indicators, advocating for a balanced view of the market that considers underlying economic conditions as well as market behavior.

How to Create a Custom GPT

Here is a screenshot of my custom GPT. You give it a little direction and upload the PDF that you want to reference.