I find myself listening to videos on YouTube quite frequently where it would be nice to dump them into an MP3 and take them on the road. This script will do exactly that. I also added transcription for analysis. Just put in your link and it will generate the MP3 and TXT file.

Category Archives: Uncategorized

Analyzing Any Polymarket User’s Trades Using Polygon

Polymarket.com, a prediction market platform, operates on the Ethereum blockchain through the Polygon network, making it possible to analyze user transactions directly from the blockchain. By accessing a user’s wallet address, we can examine their trades in detail, track profit/loss, and monitor position changes over time. In this post, I’ll show how you can leverage the Polygon blockchain data to analyze trades on Polymarket using wallet IDs and some helpful Python code.

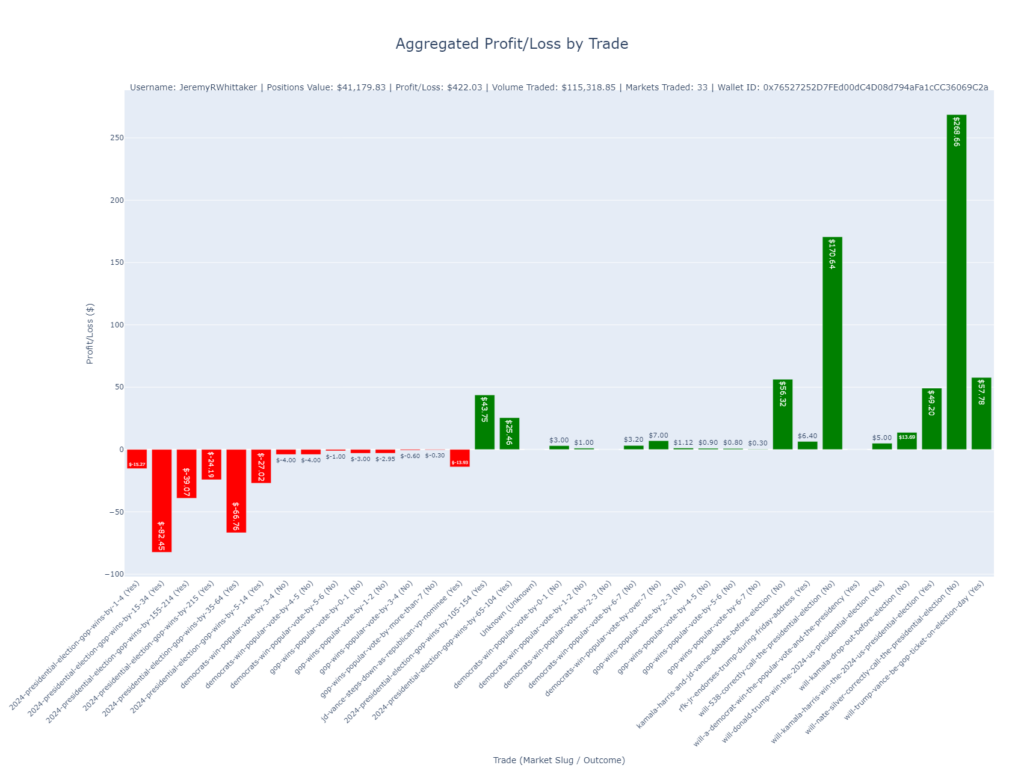

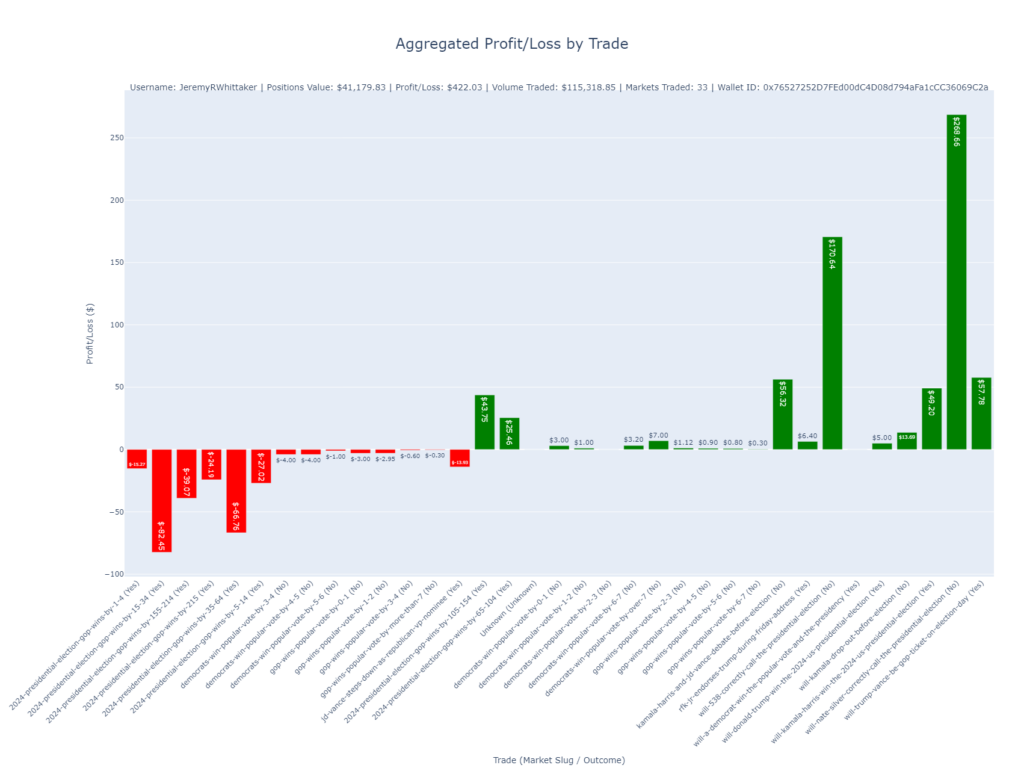

Below are examples of the kinds of charts the script generates and their significance.

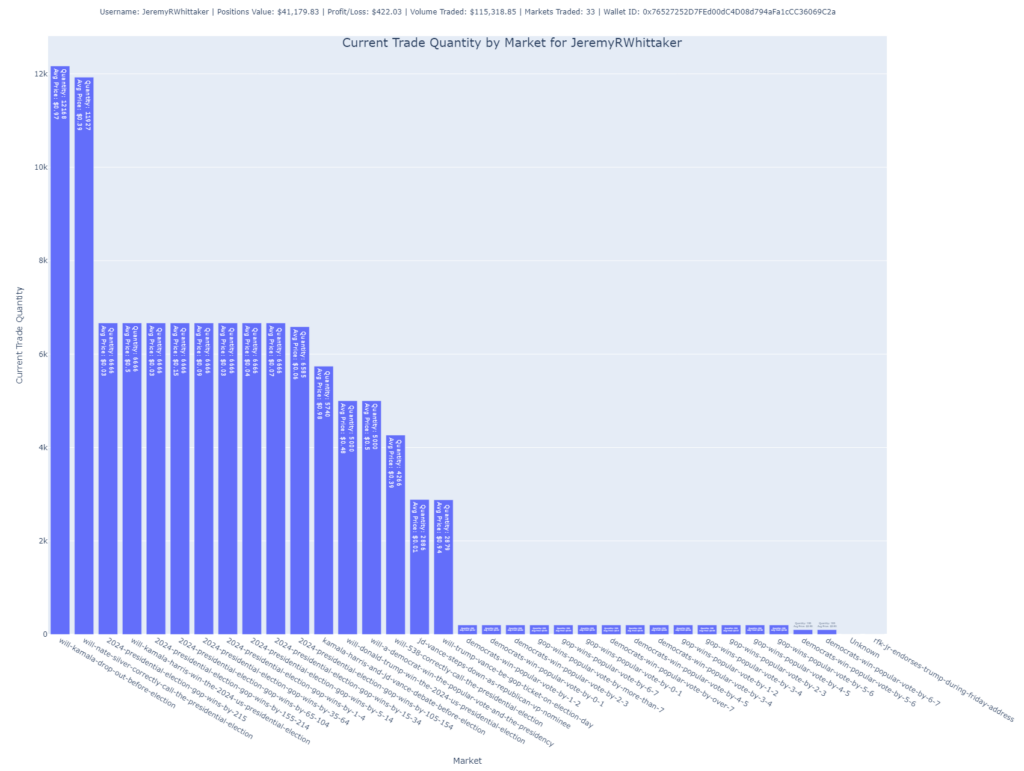

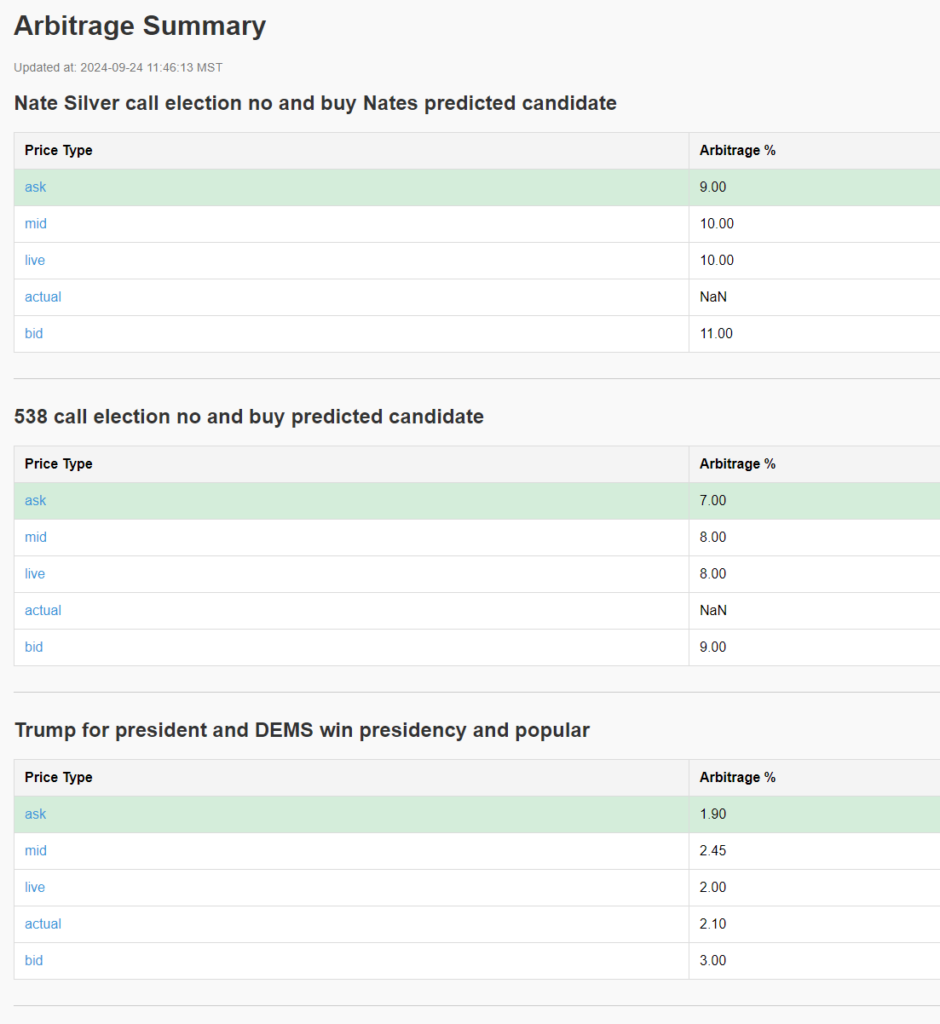

Shares by Market

This chart focuses on the number of shares the user holds across different markets. It’s another way to visualize their exposure to various outcomes but focuses on the number of shares rather than their total purchase value.

Insight: Larger bars suggest higher exposure to specific markets. The average price paid per share is also annotated, providing further context.

Purpose: Useful for understanding the user’s position size in each market.

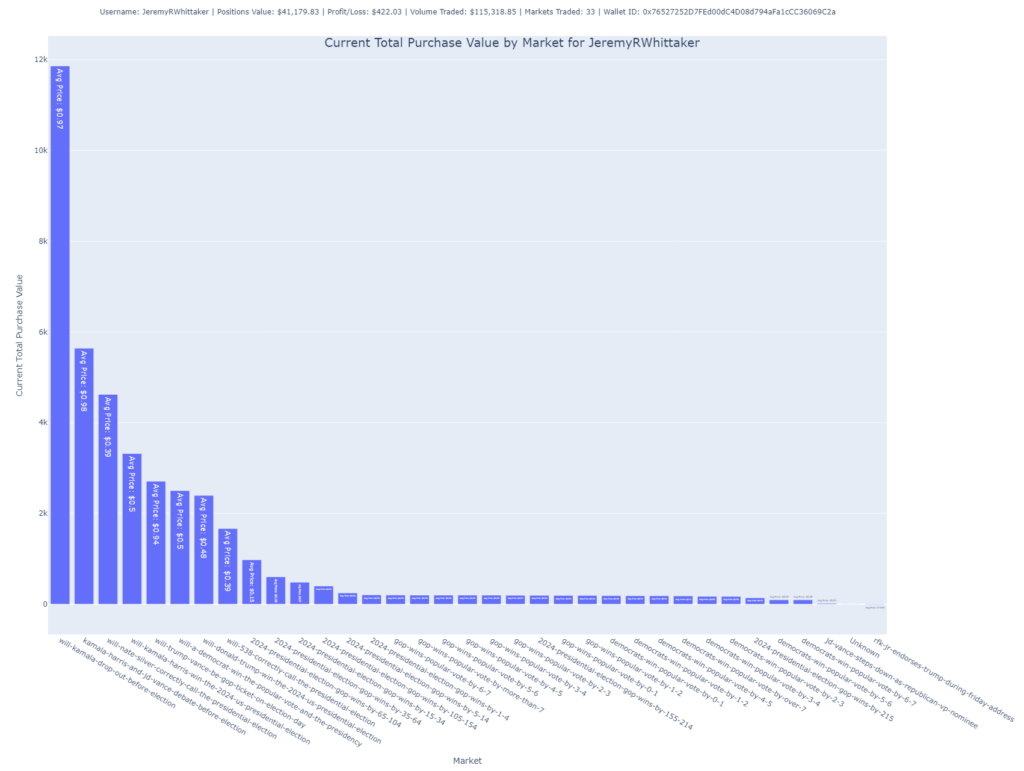

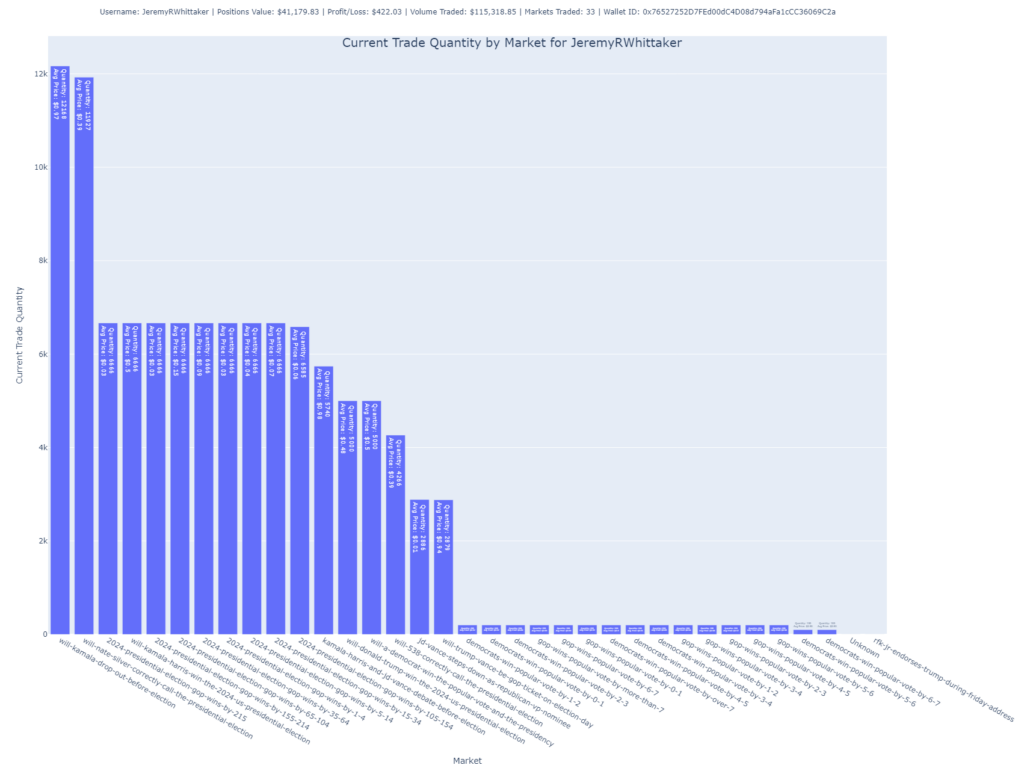

Total Purchase Value by Market

In this bar chart, the user’s total purchase value is broken down by market. The height of each bar indicates how much the user has invested in each specific market.

- Purpose: It allows for a clear visualization of where the user is concentrating their funds, showing which markets hold the largest portion of their portfolio.

- Insight: The accompanying labels provide information about the average price paid per share in each market, helping understand whether the user is buying low or high within a market.

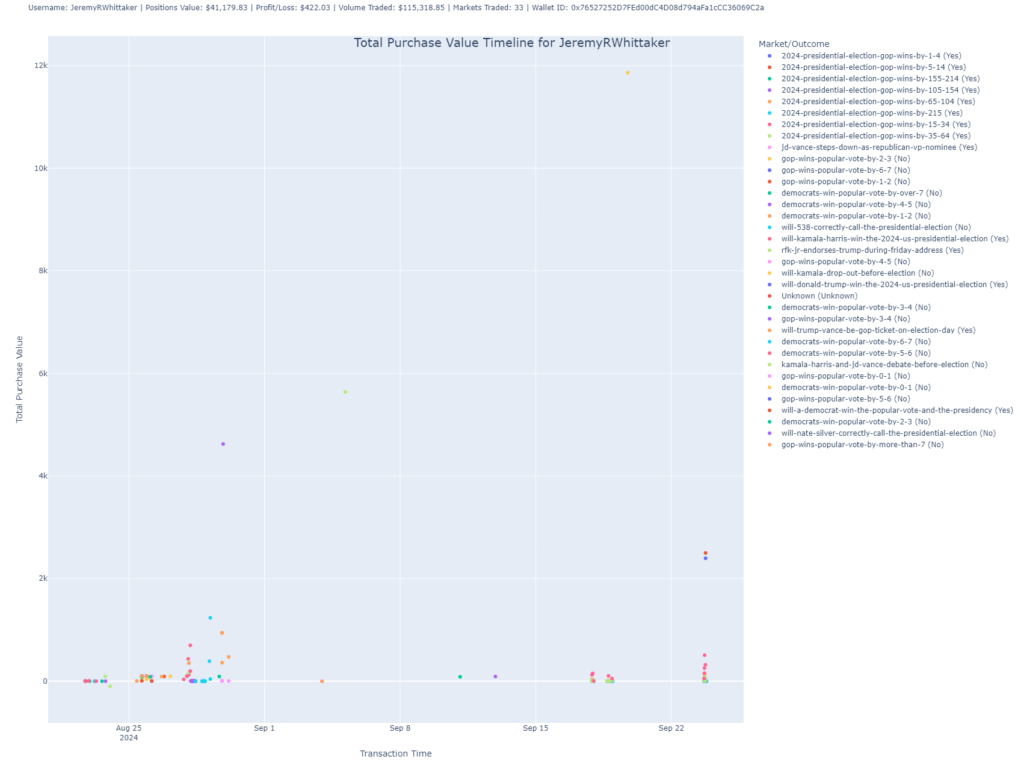

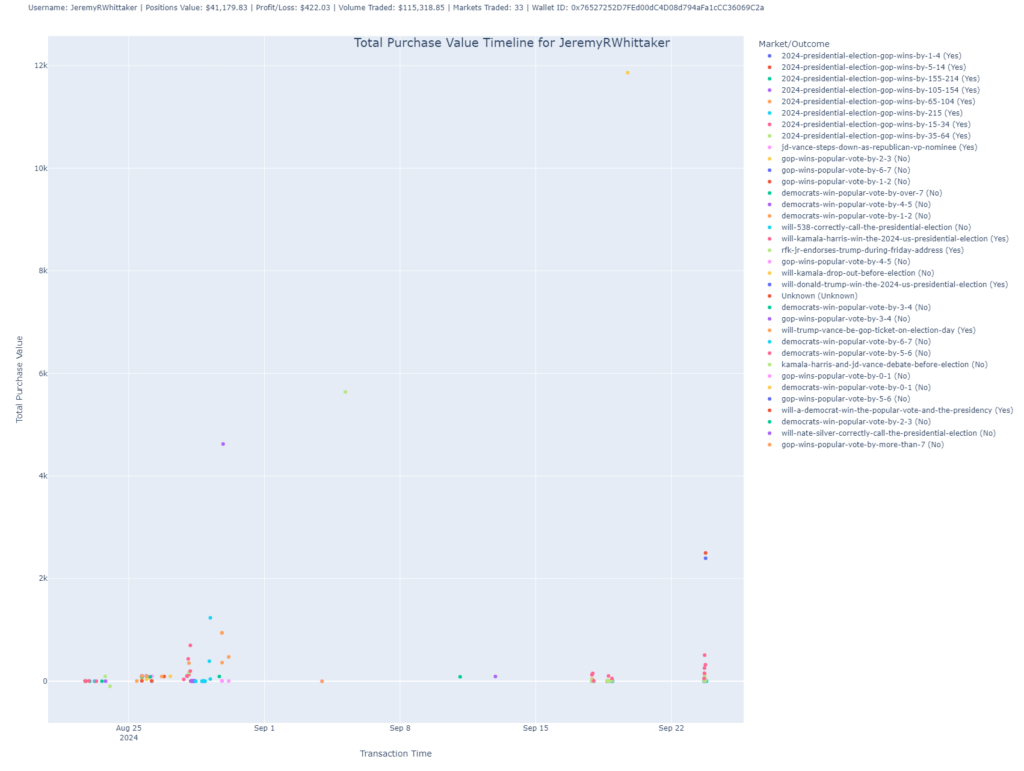

Total Purchase Value Timeline

This scatter plot shows the timeline of the user’s trades by plotting the total purchase value of trades over time.

- Purpose: This chart reveals when the user made their largest investments, showing the fluctuations in purchase value across trades.

- Insight: Each dot represents a trade, with its position on the Y-axis showing the value and on the X-axis showing the timestamp of the transaction. You can use this chart to understand when the user made big moves in the market.

Holdings by Market and Outcome (Treemap)

The treemap provides a more detailed look at the user’s holdings, breaking down their positions by both market and outcome. Each rectangle represents the shares held in a particular market-outcome pair, with the size of the rectangle proportional to the user’s investment.

- Purpose: Ideal for visually assessing how much the user has allocated to each market and outcome combination.

- Insight: It highlights not just which markets the user has invested in but also how they’ve distributed their bets across different outcomes within those markets.

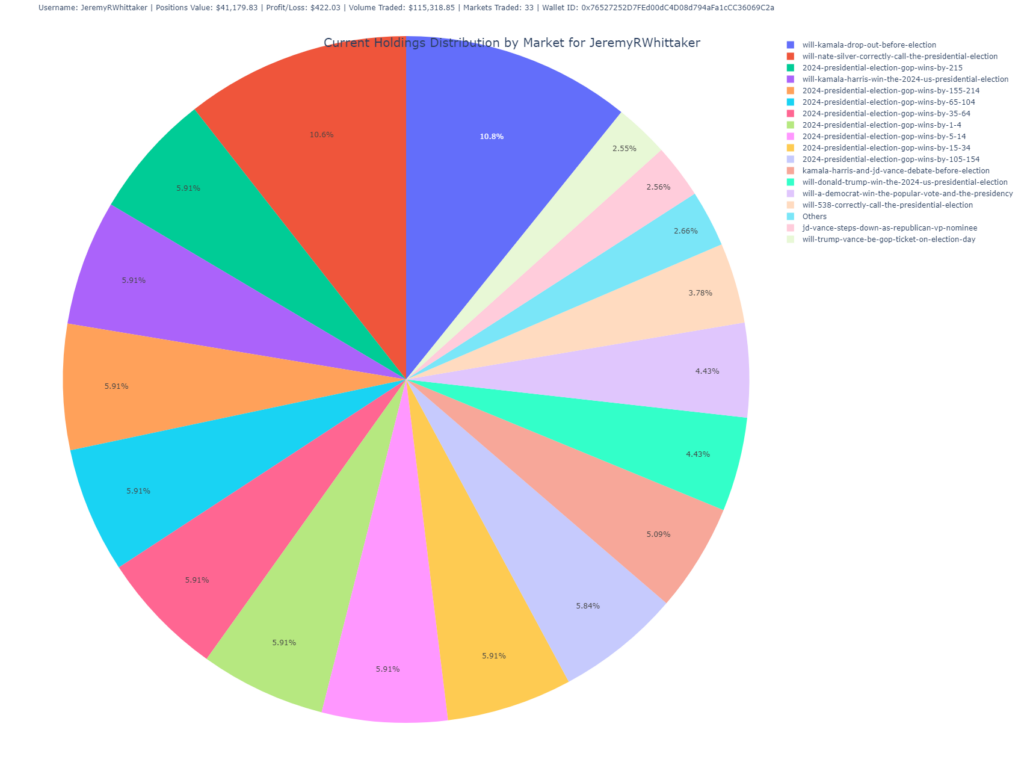

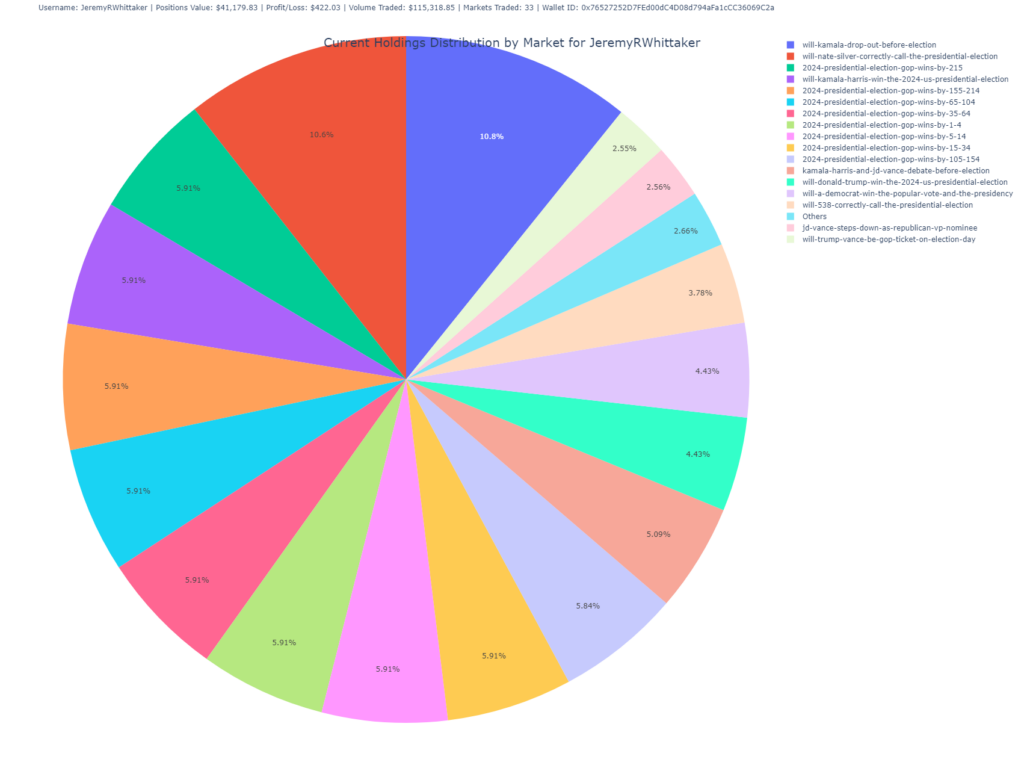

Holdings Distribution by Market (Pie Chart)

This pie chart visualizes the user’s current holdings, showing the percentage distribution of shares across different markets.

- Purpose: Offers a high-level overview of the user’s portfolio diversification across different markets.

- Insight: Larger slices indicate heavier investments in specific markets, allowing you to quickly see where the user has concentrated their bets.

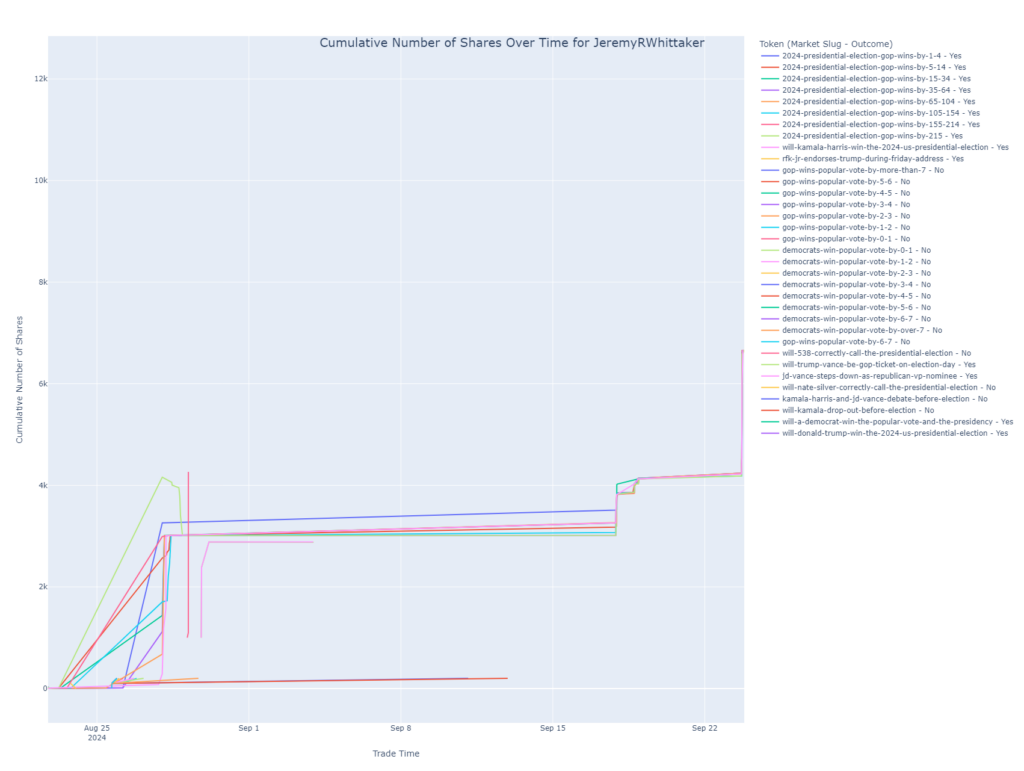

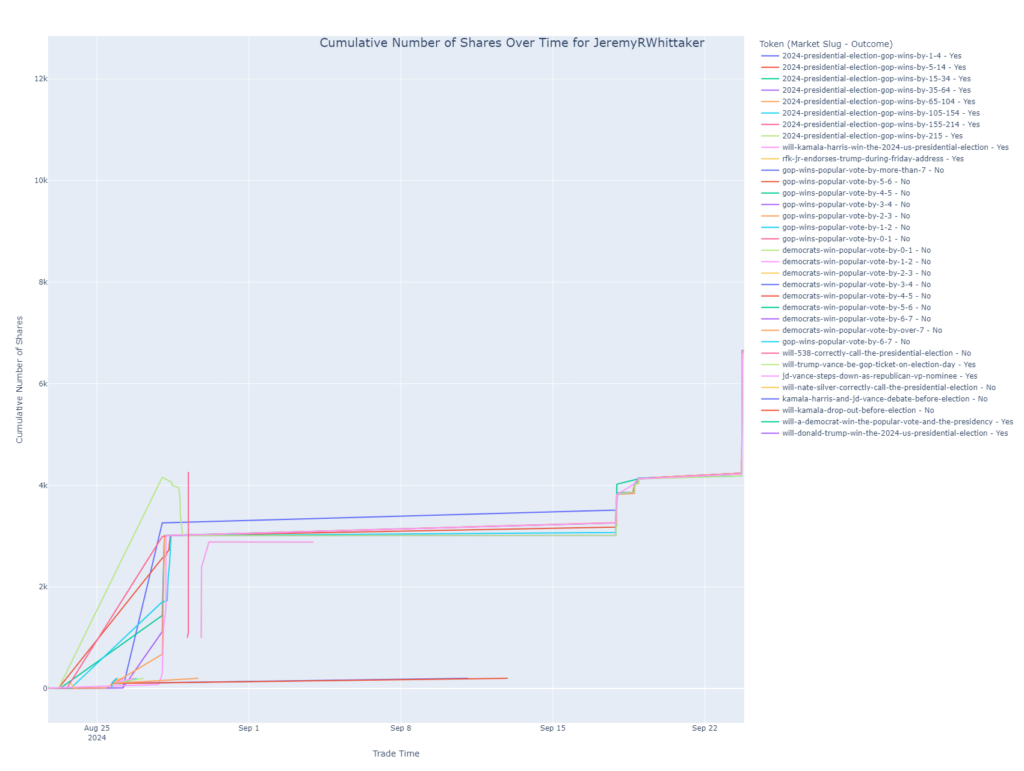

Cumulative Shares Over Time

This line chart tracks the cumulative number of shares held by the user in various markets over time. It helps visualize when the user bought or sold shares and how their position has evolved in each market.

- Purpose: This chart is essential for understanding the user’s trading strategy over time, revealing periods of heavy buying or selling.

- Insight: Each line represents a different market and outcome combination. Peaks in the lines indicate increased positions, while dips show reductions or sales.

The Code

The code behind these charts fetches data from Polygon’s blockchain and processes the transactions associated with a given wallet ID. It retrieves ERC-1155 and ERC-20 token transaction data, enriches it with market information, and generates visual insights based on trading activity. You can use this code to analyze any Polymarket user’s trades simply by knowing their wallet address.

Here’s a breakdown of the main functions:

fetch_user_transactions(wallet_address, api_key): Fetches all ERC-1155 and ERC-20 transactions for a given wallet from Polygon.add_financial_columns(): Processes transactions to calculate key financial metrics like profit/loss, total purchase value, and shares held.plot_profit_loss_by_trade(): Generates a bar plot showing profit or loss for each trade.plot_shares_over_time(): Creates a line plot showing cumulative shares over time.create_and_save_pie_chart(): Generates a pie chart that breaks down holdings by market.create_and_save_treemap(): Produces a treemap for holdings based on market and outcome.plot_total_purchase_value(): Generates a scatter plot showing total purchase value over time.

This tool offers deep insights into any user’s trading behavior and performance on Polymarket.

import os

import requests

import logging

import pandas as pd

import subprocess

import json

import time

from dotenv import load_dotenv

import plotly.express as px

import re

from bs4 import BeautifulSoup

from importlib import reload

import numpy as np

import argparse

import os

import subprocess

import json

import logging

import pandas as pd

from dotenv import load_dotenv

logging.basicConfig(level=logging.DEBUG, format='%(asctime)s - %(levelname)s - %(message)s')

logger = logging.getLogger(__name__)

# Load environment variables

load_dotenv("keys.env")

price_cache = {}

# EXCHANGES

CTF_EXCHANGE = '0x2791Bca1f2de4661ED88A30C99A7a9449Aa84174'

NEG_RISK_CTF_EXCHANGE = '0x4d97dcd97ec945f40cf65f87097ace5ea0476045'

# SPENDERS FOR EXCHANGES

NEG_RISK_CTF_EXCHANGE_SPENDER = '0xC5d563A36AE78145C45a50134d48A1215220f80a'

NEG_RISK_ADAPTER = '0xd91E80cF2E7be2e162c6513ceD06f1dD0dA35296'

CTF_EXCHANGE_SPENDER = '0x4bFb41d5B3570DeFd03C39a9A4D8dE6Bd8B8982E'

CACHE_EXPIRATION_TIME = 60 * 30 # Cache expiration time in seconds (5 minutes)

PRICE_CACHE_FILE = './data/live_price_cache.json'

# Dictionary to cache live prices

live_price_cache = {}

def load_price_cache():

"""Load the live price cache from a JSON file."""

if os.path.exists(PRICE_CACHE_FILE):

try:

with open(PRICE_CACHE_FILE, 'r') as file:

return json.load(file)

except json.JSONDecodeError as e:

logger.error(f"Error loading price cache: {e}")

return {}

return {}

def save_price_cache(cache):

"""Save the live price cache to a JSON file."""

with open(PRICE_CACHE_FILE, 'w') as file:

json.dump(cache, file)

def is_cache_valid(cache_entry, expiration_time=CACHE_EXPIRATION_TIME):

"""

Check if the cache entry is still valid based on the current time and expiration time.

"""

if not cache_entry:

return False

cached_time = cache_entry.get('timestamp', 0)

return (time.time() - cached_time) < expiration_time

def call_get_live_price(token_id, expiration_time=CACHE_EXPIRATION_TIME):

"""

Get live price from cache or update it if expired.

"""

logger.info(f'Getting live price for token {token_id}')

# Load existing cache

price_cache = load_price_cache()

cache_key = f"{token_id}"

# Check if cache is valid

if cache_key in price_cache and is_cache_valid(price_cache[cache_key], expiration_time):

logger.info(f'Returning cached price for {cache_key}')

return price_cache[cache_key]['price']

# If cache is expired or doesn't exist, fetch live price

try:

result = subprocess.run(

['python3', 'get_live_price.py', token_id],

stdout=subprocess.PIPE,

stderr=subprocess.PIPE,

text=True,

check=True

)

# Parse the live price from the subprocess output

output_lines = result.stdout.strip().split("\n")

live_price_line = next((line for line in output_lines if "Live price for token" in line), None)

if live_price_line:

live_price = float(live_price_line.strip().split(":")[-1].strip())

else:

logger.error("Live price not found in subprocess output.")

return None

logger.debug(f"Subprocess get_live_price output: {result.stdout}")

# Update cache with the new price and timestamp

price_cache[cache_key] = {'price': live_price, 'timestamp': time.time()}

save_price_cache(price_cache)

return live_price

except subprocess.CalledProcessError as e:

logger.error(f"Subprocess get_live_price error: {e.stderr}")

return None

except Exception as e:

logger.error(f"Error fetching live price: {str(e)}")

return None

def update_live_price_and_pl(merged_df, contract_token_id, market_slug=None, outcome=None):

"""

Calculate the live price and profit/loss (pl) for each trade in the DataFrame.

"""

# Ensure tokenID in merged_df is string

merged_df['tokenID'] = merged_df['tokenID'].astype(str)

contract_token_id = str(contract_token_id)

# Check for NaN or empty token IDs

if not contract_token_id or contract_token_id == 'nan':

logger.warning("Encountered NaN or empty contract_token_id. Skipping.")

return merged_df

# Add live_price and pl columns if they don't exist

if 'live_price' not in merged_df.columns:

merged_df['live_price'] = np.nan

if 'pl' not in merged_df.columns:

merged_df['pl'] = np.nan

# Filter rows with the same contract_token_id and outcome

merged_df['outcome'] = merged_df['outcome'].astype(str)

matching_rows = merged_df[(merged_df['tokenID'] == contract_token_id) &

(merged_df['outcome'].str.lower() == outcome.lower())]

if not matching_rows.empty:

logger.info(f'Fetching live price for token {contract_token_id}')

live_price = call_get_live_price(contract_token_id)

logger.info(f'Live price for token {contract_token_id}: {live_price}')

if live_price is not None:

try:

# Calculate profit/loss based on the live price

price_paid_per_token = matching_rows['price_paid_per_token']

total_purchase_value = matching_rows['total_purchase_value']

pl = ((live_price - price_paid_per_token) / price_paid_per_token) * total_purchase_value

# Update the DataFrame with live price and pl

merged_df.loc[matching_rows.index, 'live_price'] = live_price

merged_df.loc[matching_rows.index, 'pl'] = pl

except Exception as e:

logger.error(f"Error calculating live price and profit/loss: {e}")

else:

logger.warning(f"Live price not found for tokenID {contract_token_id}")

merged_df.loc[matching_rows.index, 'pl'] = np.nan

return merged_df

def find_token_id(market_slug, outcome, market_lookup):

"""Find the token_id based on market_slug and outcome."""

for market in market_lookup.values():

if market['market_slug'] == market_slug:

for token in market['tokens']:

if token['outcome'].lower() == outcome.lower():

return token['token_id']

return None

def fetch_data(url):

"""Fetch data from a given URL and return the JSON response."""

try:

response = requests.get(url, timeout=10) # You can specify a timeout

response.raise_for_status() # Raise an error for bad responses (4xx, 5xx)

return response.json()

except requests.exceptions.RequestException as e:

logger.error(f"Error fetching data from URL: {url}. Exception: {e}")

return None

def fetch_all_pages(api_key, token_ids, market_slug_outcome_map, csv_output_dir='./data/polymarket_trades/'):

page = 1

offset = 100

retry_attempts = 0

all_data = [] # Store all data here

while True:

url = f"https://api.polygonscan.com/api?module=account&action=token1155tx&contractaddress={NEG_RISK_CTF_EXCHANGE}&page={page}&offset={offset}&startblock=0&endblock=99999999&sort=desc&apikey={api_key}"

logger.info(f"Fetching transaction data for tokens {token_ids}, page: {page}")

data = fetch_data(url)

if data and data['status'] == '1':

df = pd.DataFrame(data['result'])

if df.empty:

logger.info("No more transactions found, ending pagination.")

break # Exit if there are no more transactions

all_data.append(df)

page += 1 # Go to the next page

else:

logger.error(f"API response error or no data found for page {page}")

if retry_attempts < 5:

retry_attempts += 1

time.sleep(retry_attempts)

else:

break

if all_data:

final_df = pd.concat(all_data, ignore_index=True) # Combine all pages

logger.info(f"Fetched {len(final_df)} transactions across all pages.")

return final_df

return None

def validate_market_lookup(token_ids, market_lookup):

valid_token_ids = []

invalid_token_ids = []

for token_id in token_ids:

market_slug, outcome = find_market_info(token_id, market_lookup)

if market_slug and outcome:

valid_token_ids.append(token_id)

else:

invalid_token_ids.append(token_id)

logger.info(f"Valid token IDs: {valid_token_ids}")

if invalid_token_ids:

logger.warning(f"Invalid or missing market info for token IDs: {invalid_token_ids}")

return valid_token_ids

def sanitize_filename(filename):

"""

Sanitize the filename by removing or replacing invalid characters.

"""

# Replace invalid characters with an underscore

return re.sub(r'[\\/*?:"<>|]', '_', filename)

def sanitize_directory(directory):

"""

Sanitize the directory name by removing or replacing invalid characters.

"""

# Replace invalid characters with an underscore

return re.sub(r'[\\/*?:"<>|]', '_', directory)

def extract_wallet_ids(leaderboard_url):

"""Scrape the Polymarket leaderboard to extract wallet IDs."""

logging.info(f"Fetching leaderboard page: {leaderboard_url}")

response = requests.get(leaderboard_url)

if response.status_code != 200:

logging.error(f"Failed to load page {leaderboard_url}, status code: {response.status_code}")

return []

logging.debug(f"Page loaded successfully, status code: {response.status_code}")

soup = BeautifulSoup(response.content, 'html.parser')

logging.debug("Page content parsed with BeautifulSoup")

wallet_ids = []

# Debug: Check if <a> tags are being found correctly

a_tags = soup.find_all('a', href=True)

logging.debug(f"Found {len(a_tags)} <a> tags in the page.")

for a_tag in a_tags:

href = a_tag['href']

logging.debug(f"Processing href: {href}")

if href.startswith('/profile/'):

wallet_id = href.split('/')[-1]

wallet_ids.append(wallet_id)

logging.info(f"Extracted wallet ID: {wallet_id}")

else:

logging.debug(f"Skipped href: {href}")

return wallet_ids

def load_market_lookup(json_path):

"""Load market lookup data from a JSON file."""

with open(json_path, 'r') as json_file:

return json.load(json_file)

def find_market_info(token_id, market_lookup):

"""Find market_slug and outcome based on tokenID."""

token_id = str(token_id) # Ensure token_id is a string

if not token_id or token_id == 'nan':

logger.warning("Token ID is NaN or empty. Skipping lookup.")

return None, None

logger.debug(f"Looking up market info for tokenID: {token_id}")

for market in market_lookup.values():

for token in market['tokens']:

if str(token['token_id']) == token_id:

logger.debug(

f"Found market info for tokenID {token_id}: market_slug = {market['market_slug']}, outcome = {token['outcome']}")

return market['market_slug'], token['outcome']

logger.warning(f"No market info found for tokenID: {token_id}")

return None, None

def fetch_data(url):

"""Fetch data from a given URL and return the JSON response."""

response = requests.get(url)

return response.json()

def save_to_csv(filename, data, headers, output_dir):

"""Save data to a CSV file in the specified output directory."""

filepath = os.path.join(output_dir, filename)

with open(filepath, 'w', newline='') as file:

writer = csv.DictWriter(file, fieldnames=headers)

writer.writeheader()

for entry in data:

writer.writerow(entry)

logger.info(f"Saved data to {filepath}")

def add_timestamps(erc1155_df, erc20_df):

"""

Rename timestamp columns and convert them from UNIX to datetime.

"""

# Rename the timestamp columns to avoid conflicts during merge

erc1155_df.rename(columns={'timeStamp': 'timeStamp_erc1155'}, inplace=True)

erc20_df.rename(columns={'timeStamp': 'timeStamp_erc20'}, inplace=True)

# Convert UNIX timestamps to datetime format

erc1155_df['timeStamp_erc1155'] = pd.to_numeric(erc1155_df['timeStamp_erc1155'], errors='coerce')

erc20_df['timeStamp_erc20'] = pd.to_numeric(erc20_df['timeStamp_erc20'], errors='coerce')

erc1155_df['timeStamp_erc1155'] = pd.to_datetime(erc1155_df['timeStamp_erc1155'], unit='s', errors='coerce')

erc20_df['timeStamp_erc20'] = pd.to_datetime(erc20_df['timeStamp_erc20'], unit='s', errors='coerce')

return erc1155_df, erc20_df

def enrich_erc1155_data(erc1155_df, market_lookup):

"""

Enrich the ERC-1155 DataFrame with market_slug and outcome based on market lookup.

"""

def get_market_info(token_id):

if pd.isna(token_id) or str(token_id) == 'nan':

return 'Unknown', 'Unknown'

for market in market_lookup.values():

for token in market['tokens']:

if str(token['token_id']) == str(token_id):

return market['market_slug'], token['outcome']

return 'Unknown', 'Unknown'

erc1155_df['market_slug'], erc1155_df['outcome'] = zip(

*erc1155_df['tokenID'].apply(lambda x: get_market_info(x))

)

return erc1155_df

def get_transaction_details_by_hash(transaction_hash, api_key, output_dir='./data/polymarket_trades/'):

"""

Fetch the transaction details by hash from Polygonscan, parse the logs, and save the flattened data as a CSV.

Args:

- transaction_hash (str): The hash of the transaction.

- api_key (str): The Polygonscan API key.

- output_dir (str): The directory to save the CSV file.

Returns:

- None: Saves the transaction details to a CSV.

"""

# Ensure output directory exists

os.makedirs(output_dir, exist_ok=True)

# Construct the API URL for fetching transaction receipt details by hash

url = f"https://api.polygonscan.com/api?module=proxy&action=eth_getTransactionReceipt&txhash={transaction_hash}&apikey={api_key}"

logger.info(f"Fetching transaction details for hash: {transaction_hash}")

logger.debug(f"Request URL: {url}")

try:

# Fetch transaction details

response = requests.get(url)

logger.debug(f"Polygonscan API response status: {response.status_code}")

if response.status_code != 200:

logger.error(f"Non-200 status code received: {response.status_code}")

return None

# Parse the JSON response

data = response.json()

logger.debug(f"Response JSON: {data}")

# Check if the status is successful

if data.get('result') is None:

logger.error(f"Error in API response: {data.get('message', 'Unknown error')}")

return None

# Extract the logs

logs = data['result']['logs']

logs_df = pd.json_normalize(logs)

# Save the logs to a CSV file for easier review

csv_filename = os.path.join(output_dir, f"transaction_logs_{transaction_hash}.csv")

logs_df.to_csv(csv_filename, index=False)

logger.info(f"Parsed logs saved to {csv_filename}")

return logs_df

except Exception as e:

logger.error(f"Exception occurred while fetching transaction details for hash {transaction_hash}: {e}")

return None

def add_financial_columns(erc1155_df, erc20_df, wallet_id, market_lookup):

"""

Merge the ERC-1155 and ERC-20 dataframes, calculate financial columns,

including whether a trade was won or lost, and fetch the latest price for each contract and tokenID.

"""

# Merge the two dataframes on the 'hash' column

merged_df = pd.merge(erc1155_df, erc20_df, how='outer', on='hash', suffixes=('_erc1155', '_erc20'))

# Convert wallet ID and columns to lowercase for case-insensitive comparison

wallet_id = wallet_id.lower()

merged_df['to_erc1155'] = merged_df['to_erc1155'].astype(str).str.lower()

merged_df['from_erc1155'] = merged_df['from_erc1155'].astype(str).str.lower()

# Remove rows where 'tokenID' is NaN or 'nan'

merged_df['tokenID'] = merged_df['tokenID'].astype(str)

merged_df = merged_df[~merged_df['tokenID'].isnull() & (merged_df['tokenID'] != 'nan')]

# Set transaction type based on wallet address

merged_df['transaction_type'] = 'other'

merged_df.loc[merged_df['to_erc1155'] == wallet_id, 'transaction_type'] = 'buy'

merged_df.loc[merged_df['from_erc1155'] == wallet_id, 'transaction_type'] = 'sell'

# Calculate the purchase price per token and total dollar value

if 'value' in merged_df.columns and 'tokenValue' in merged_df.columns:

merged_df['price_paid_per_token'] = merged_df['value'].astype(float) / merged_df['tokenValue'].astype(float)

merged_df['total_purchase_value'] = merged_df['value'].astype(float) / 10**6 # USDC has 6 decimal places

merged_df['shares'] = merged_df['total_purchase_value'] / merged_df['price_paid_per_token']

else:

logger.error("The necessary columns for calculating purchase price are missing.")

return merged_df

# Create the 'lost' and 'won' columns

merged_df['lost'] = (

(merged_df['to_erc1155'] == '0x0000000000000000000000000000000000000000') &

(merged_df['transaction_type'] == 'sell') &

(merged_df['price_paid_per_token'].isna() | (merged_df['price_paid_per_token'] == 0))

).astype(int)

merged_df['won'] = (

(merged_df['transaction_type'] == 'sell') &

(merged_df['price_paid_per_token'] == 1)

).astype(int)

merged_df.loc[merged_df['lost'] == 1, 'shares'] = 0

merged_df.loc[merged_df['lost'] == 1, 'total_purchase_value'] = 0

# Fetch live prices and calculate profit/loss (pl)

merged_df['tokenID'] = merged_df['tokenID'].astype(str)

merged_df = update_latest_prices(merged_df, market_lookup)

return merged_df

def plot_profit_loss_by_trade(df, user_info):

"""

Create a bar plot to visualize aggregated Profit/Loss (PL) by trade, with values rounded to two decimal places and formatted as currency.

Args:

df (DataFrame): DataFrame containing trade data, including 'market_slug', 'outcome', and 'pl'.

user_info (dict): Dictionary containing user information, such as username, wallet address, and other relevant details.

"""

if 'pl' not in df.columns or df['pl'].isnull().all():

logger.warning("No PL data available for plotting. Skipping plot.")

return

username = user_info.get("username", "Unknown User")

wallet_id = user_info.get("wallet_address", "N/A")

positions_value = user_info.get("positions_value", "N/A")

profit_loss = user_info.get("profit_loss", "N/A")

volume_traded = user_info.get("volume_traded", "N/A")

markets_traded = user_info.get("markets_traded", "N/A")

# Combine market_slug and outcome to create a trade identifier

df['trade'] = df['market_slug'] + ' (' + df['outcome'] + ')'

# Aggregate the Profit/Loss (pl) for each unique trade

aggregated_df = df.groupby('trade', as_index=False).agg({'pl': 'sum'})

# Round PL values to two decimal places

aggregated_df['pl'] = aggregated_df['pl'].round(2)

# Format the PL values with a dollar sign for display

aggregated_df['pl_display'] = aggregated_df['pl'].apply(lambda x: f"${x:,.2f}")

# Define a color mapping based on Profit/Loss sign

aggregated_df['color'] = aggregated_df['pl'].apply(lambda x: 'green' if x >= 0 else 'red')

# Create the plot without using the color axis

fig = px.bar(

aggregated_df,

x='trade',

y='pl',

title='',

labels={'pl': 'Profit/Loss ($)', 'trade': 'Trade (Market Slug / Outcome)'},

text='pl_display',

color='color', # Use the color column

color_discrete_map={'green': 'green', 'red': 'red'},

)

# Remove the legend if you don't want it

fig.update_layout(showlegend=False)

# Rotate x-axis labels for better readability and set the main title

fig.update_layout(

title={

'text': 'Aggregated Profit/Loss by Trade',

'y': 0.95,

'x': 0.5,

'xanchor': 'center',

'yanchor': 'top',

'font': {'size': 24}

},

xaxis_tickangle=-45,

margin=dict(t=150, l=50, r=50, b=100)

)

# Prepare the subtitle text with user information

subtitle_text = (

f"Username: {username} | Positions Value: {positions_value} | "

f"Profit/Loss: {profit_loss} | Volume Traded: {volume_traded} | "

f"Markets Traded: {markets_traded} | Wallet ID: {wallet_id}"

)

# Add the subtitle as an annotation

fig.add_annotation(

text=subtitle_text,

xref="paper",

yref="paper",

x=0.5,

y=1.02,

xanchor='center',

yanchor='top',

showarrow=False,

font=dict(size=14)

)

# Save the plot

plot_dir = "./plots/user_trades"

os.makedirs(plot_dir, exist_ok=True)

sanitized_username = sanitize_filename(username)

plot_file = os.path.join(plot_dir, f"{sanitized_username}_aggregated_profit_loss_by_trade.html")

fig.write_html(plot_file)

logger.info(f"Aggregated Profit/Loss by trade plot saved to {plot_file}")

def plot_shares_over_time(df, user_info):

"""

Create a line plot to visualize the cumulative number of shares for each token over time.

Buy orders add to the position, and sell orders subtract from it.

Args:

df (DataFrame): DataFrame containing trade data, including 'timeStamp_erc1155', 'shares', 'market_slug', 'outcome', and 'transaction_type' ('buy' or 'sell').

user_info (dict): Dictionary containing user information, such as username, wallet address, and other relevant details.

"""

if 'shares' not in df.columns or df['shares'].isnull().all():

logger.warning("No 'shares' data available for plotting. Skipping plot.")

return

username = user_info.get("username", "Unknown User")

# Ensure 'timeStamp_erc1155' is a datetime type, just in case it needs to be converted

if df['timeStamp_erc1155'].dtype != 'datetime64[ns]':

df['timeStamp_erc1155'] = pd.to_datetime(df['timeStamp_erc1155'], errors='coerce')

# Drop rows with NaN values in 'timeStamp_erc1155', 'shares', 'market_slug', 'outcome', or 'transaction_type'

df = df.dropna(subset=['timeStamp_erc1155', 'shares', 'market_slug', 'outcome', 'transaction_type'])

# Sort the dataframe by time to ensure the line chart shows the data in chronological order

df = df.sort_values(by='timeStamp_erc1155')

# Combine 'market_slug' and 'outcome' to create a unique label for each token

df['token_label'] = df['market_slug'] + " - " + df['outcome']

# Create a column for 'position_change' which adds shares for buys and subtracts shares for sells based on 'transaction_type'

df['position_change'] = df.apply(lambda row: row['shares'] if row['transaction_type'] == 'buy' else -row['shares'], axis=1)

# Group by 'token_label' and calculate the cumulative position

df['cumulative_position'] = df.groupby('token_label')['position_change'].cumsum()

# Forward fill the cumulative position to maintain it between trades

df['cumulative_position'] = df.groupby('token_label')['cumulative_position'].ffill()

# Create the line plot, grouping by 'token_label' for separate lines per token ID

fig = px.line(

df,

x='timeStamp_erc1155',

y='cumulative_position',

color='token_label', # This ensures each token ID (market_slug + outcome) gets its own line

title=f'Cumulative Shares Over Time for {username}',

labels={'timeStamp_erc1155': 'Trade Time', 'cumulative_position': 'Cumulative Position', 'token_label': 'Token (Market Slug - Outcome)'},

line_shape='linear'

)

# Update layout for better aesthetics

fig.update_layout(

title={

'text': f"Cumulative Number of Shares Over Time for {username}",

'y': 0.95,

'x': 0.5,

'xanchor': 'center',

'yanchor': 'top',

'font': {'size': 20}

},

margin=dict(t=60),

xaxis_title="Trade Time",

yaxis_title="Cumulative Number of Shares",

legend_title="Token (Market Slug - Outcome)"

)

# Save the plot

plot_dir = "./plots/user_trades"

os.makedirs(plot_dir, exist_ok=True)

sanitized_username = sanitize_filename(username)

plot_file = os.path.join(plot_dir, f"{sanitized_username}_shares_over_time.html")

fig.write_html(plot_file)

logger.info(f"Cumulative shares over time plot saved to {plot_file}")

def plot_user_trades(df, user_info):

"""Plot user trades and save plots, adjusting for trades that were lost."""

username = user_info["username"]

wallet_id = user_info["wallet_address"]

# Sanitize only the filename, not the directory

sanitized_username = sanitize_filename(username)

info_text = (

f"Username: {username} | Positions Value: {user_info['positions_value']} | "

f"Profit/Loss: {user_info['profit_loss']} | Volume Traded: {user_info['volume_traded']} | "

f"Markets Traded: {user_info['markets_traded']} | Wallet ID: {wallet_id}"

)

# Ensure the directory exists

os.makedirs("./plots/user_trades", exist_ok=True)

plot_dir = "./plots/user_trades"

# Flag loss trades where to_erc1155 is zero address, transaction_type is sell, and price_paid_per_token is NaN

df['is_loss'] = df.apply(

lambda row: (row['to_erc1155'] == '0x0000000000000000000000000000000000000000')

and (row['transaction_type'] == 'sell')

and pd.isna(row['price_paid_per_token']), axis=1)

# Set shares and total purchase value to zero for loss trades

df.loc[df['is_loss'], 'shares'] = 0

df.loc[df['is_loss'], 'total_purchase_value'] = 0

### Modify for Total Purchase Value by Market (Current holdings)

df['total_purchase_value_adjusted'] = df.apply(

lambda row: row['total_purchase_value'] if row['transaction_type'] == 'buy' else -row['total_purchase_value'],

axis=1

)

grouped_df_value = df.groupby(['market_slug']).agg({

'total_purchase_value_adjusted': 'sum',

'shares': 'sum',

}).reset_index()

# Calculate the weighted average price_paid_per_token

grouped_df_value['weighted_price_paid_per_token'] = (

grouped_df_value['total_purchase_value_adjusted'] / grouped_df_value['shares']

)

# Sort by total_purchase_value in descending order (ignoring outcome)

grouped_df_value = grouped_df_value.sort_values(by='total_purchase_value_adjusted', ascending=False)

# Format the label for the bars (removing outcome)

grouped_df_value['bar_label'] = (

"Avg Price: $" + grouped_df_value['weighted_price_paid_per_token'].round(2).astype(str)

)

fig = px.bar(

grouped_df_value,

x='market_slug',

y='total_purchase_value_adjusted',

barmode='group',

title=f"Current Total Purchase Value by Market for {username}",

labels={'total_purchase_value_adjusted': 'Current Total Purchase Value', 'market_slug': 'Market'},

text=grouped_df_value['bar_label'],

hover_data={'weighted_price_paid_per_token': ':.2f'},

)

fig.update_layout(

title={

'text': f"Current Total Purchase Value by Market for {username}",

'y': 0.95,

'x': 0.5,

'xanchor': 'center',

'yanchor': 'top',

'font': {'size': 20}

},

margin=dict(t=60),

showlegend=False # Remove the legend as you requested

)

fig.add_annotation(

text=info_text,

xref="paper", yref="paper", showarrow=False, x=0.5, y=1.05, font=dict(size=12)

)

# Save the bar plot as an HTML file

plot_file = os.path.join(plot_dir, f"{sanitized_username}_current_market_purchase_value.html")

fig.write_html(plot_file)

logger.info(f"Current market purchase value plot saved to {plot_file}")

### Modify for Trade Quantity by Market (Current holdings)

df['shares_adjusted'] = df.apply(

lambda row: row['shares'] if row['transaction_type'] == 'buy' else -row['shares'], axis=1)

grouped_df_quantity = df.groupby(['market_slug']).agg({

'shares_adjusted': 'sum',

'total_purchase_value': 'sum',

}).reset_index()

# Calculate the weighted average price_paid_per_token

grouped_df_quantity['weighted_price_paid_per_token'] = (

grouped_df_quantity['total_purchase_value'] / grouped_df_quantity['shares_adjusted']

)

grouped_df_quantity = grouped_df_quantity.sort_values(by='shares_adjusted', ascending=False)

grouped_df_quantity['bar_label'] = (

"Quantity: " + grouped_df_quantity['shares_adjusted'].round().astype(int).astype(str) + "<br>" +

"Avg Price: $" + grouped_df_quantity['weighted_price_paid_per_token'].round(2).astype(str)

)

fig = px.bar(

grouped_df_quantity,

x='market_slug',

y='shares_adjusted',

barmode='group',

title=f"Current Trade Quantity by Market for {username}",

labels={'shares_adjusted': 'Current Trade Quantity', 'market_slug': 'Market'},

text=grouped_df_quantity['bar_label'],

)

fig.update_layout(

title={

'text': f"Current Trade Quantity by Market for {username}",

'y': 0.95,

'x': 0.5,

'xanchor': 'center',

'yanchor': 'top',

'font': {'size': 20}

},

margin=dict(t=60),

showlegend=False # Remove the legend as you requested

)

fig.add_annotation(

text=info_text,

xref="paper", yref="paper", showarrow=False, x=0.5, y=1.05, font=dict(size=12)

)

# Save the trade quantity plot as an HTML file

plot_file = os.path.join(plot_dir, f"{sanitized_username}_current_market_trade_quantity.html")

fig.write_html(plot_file)

logger.info(f"Current market trade quantity plot saved to {plot_file}")

### Modify for Total Purchase Value Timeline

df['total_purchase_value_timeline_adjusted'] = df.apply(

lambda row: row['total_purchase_value'] if row['transaction_type'] == 'buy' else -row['total_purchase_value'],

axis=1

)

# Combine 'market_slug' and 'outcome' into a unique label

df['market_outcome_label'] = df['market_slug'] + ' (' + df['outcome'] + ')'

# Create the scatter plot, now coloring by 'market_outcome_label'

fig = px.scatter(

df,

x='timeStamp_erc1155',

y='total_purchase_value_timeline_adjusted',

color='market_outcome_label', # Use the combined label for market and outcome

title=f"Total Purchase Value Timeline for {username}",

labels={

'total_purchase_value_timeline_adjusted': 'Total Purchase Value',

'timeStamp_erc1155': 'Transaction Time',

'market_outcome_label': 'Market/Outcome'

},

hover_data=['market_slug', 'price_paid_per_token', 'outcome', 'hash'],

)

fig.update_layout(

title={

'text': f"Total Purchase Value Timeline for {username}",

'y': 0.95,

'x': 0.5,

'xanchor': 'center',

'yanchor': 'top',

'font': {'size': 20}

},

margin=dict(t=60)

)

fig.add_annotation(

text=info_text,

xref="paper", yref="paper", showarrow=False, x=0.5, y=1.05, font=dict(size=12)

)

# Save the updated plot

plot_file = os.path.join(plot_dir, f"{sanitized_username}_total_purchase_value_timeline_adjusted.html")

fig.write_html(plot_file)

logger.info(f"Total purchase value timeline plot saved to {plot_file}")

def plot_total_purchase_value(df, user_info):

"""Create and save a scatter plot for total purchase value, accounting for buy and sell transactions."""

# Ensure the directory exists

os.makedirs("./plots/user_trades", exist_ok=True)

plot_dir = "./plots/user_trades"

username = user_info["username"]

wallet_id = user_info["wallet_address"]

# Sanitize only the filename, not the directory

sanitized_username = sanitize_filename(username)

info_text = (

f"Username: {username} | Positions Value: {user_info['positions_value']} | "

f"Profit/Loss: {user_info['profit_loss']} | Volume Traded: {user_info['volume_traded']} | "

f"Markets Traded: {user_info['markets_traded']} | Wallet ID: {wallet_id}"

)

# Flag loss trades where to_erc1155 is zero address, transaction_type is sell, and price_paid_per_token is NaN

df['is_loss'] = df.apply(

lambda row: (row['to_erc1155'] == '0x0000000000000000000000000000000000000000')

and (row['transaction_type'] == 'sell')

and pd.isna(row['price_paid_per_token']), axis=1)

# Set shares and total purchase value to zero for loss trades

df.loc[df['is_loss'], 'shares'] = 0

df.loc[df['is_loss'], 'total_purchase_value'] = 0

# Adjust the total purchase value based on the transaction type

df['total_purchase_value_adjusted'] = df.apply(

lambda row: row['total_purchase_value'] if row['transaction_type'] == 'buy' else -row['total_purchase_value'],

axis=1

)

# Create the scatter plot for total purchase value over time

fig = px.scatter(

df,

x='timeStamp_erc1155', # Assuming this is the correct timestamp field

y='total_purchase_value_adjusted', # Adjusted values for buys and sells

color='market_slug', # Use market_slug with outcome as the color

title=f"Current Purchase Value Timeline for {username}", # Update title to reflect "current"

labels={'total_purchase_value_adjusted': 'Adjusted Purchase Value ($)', 'timeStamp_erc1155': 'Transaction Time'},

hover_data=['market_slug', 'price_paid_per_token', 'outcome', 'hash'],

)

# Adjust title positioning and font size

fig.update_layout(

title={

'text': f"Current Purchase Value Timeline for {username}", # Update to "Current"

'y': 0.95,

'x': 0.5,

'xanchor': 'center',

'yanchor': 'top',

'font': {'size': 20}

},

margin=dict(t=60)

)

fig.add_annotation(

text=info_text,

xref="paper", yref="paper", showarrow=False, x=0.5, y=1.05, font=dict(size=12)

)

# Save the scatter plot as an HTML file

plot_file = os.path.join(plot_dir, f"{sanitized_username}_current_purchase_value_timeline.html")

fig.write_html(plot_file)

logger.info(f"Current purchase value timeline plot saved to {plot_file}")

def create_and_save_pie_chart(df, user_info):

"""Create and save a pie chart for user's current holdings."""

# Ensure the directory exists

os.makedirs("./plots/user_trades", exist_ok=True)

plot_dir = "./plots/user_trades"

username = user_info["username"]

wallet_id = user_info["wallet_address"]

sanitized_username = sanitize_filename(username)

info_text = (

f"Username: {username} | Positions Value: {user_info['positions_value']} | "

f"Profit/Loss: {user_info['profit_loss']} | Volume Traded: {user_info['volume_traded']} | "

f"Markets Traded: {user_info['markets_traded']} | Wallet ID: {wallet_id}"

)

# Flag loss trades where to_erc1155 is zero address, transaction_type is sell, and price_paid_per_token is NaN

df['is_loss'] = df.apply(

lambda row: (row['to_erc1155'] == '0x0000000000000000000000000000000000000000')

and (row['transaction_type'] == 'sell')

and pd.isna(row['price_paid_per_token']), axis=1)

# Set shares and total purchase value to zero for loss trades

df.loc[df['is_loss'], 'shares'] = 0

df['shares_adjusted'] = df.apply(

lambda row: row['shares'] if row['transaction_type'] == 'buy' else -row['shares'], axis=1)

holdings = df.groupby('market_slug').agg({'shares_adjusted': 'sum'}).reset_index()

holdings = holdings.sort_values('shares_adjusted', ascending=False)

threshold = 0.02

large_slices = holdings[holdings['shares_adjusted'] > holdings['shares_adjusted'].sum() * threshold]

small_slices = holdings[holdings['shares_adjusted'] <= holdings['shares_adjusted'].sum() * threshold]

if not small_slices.empty:

other_sum = small_slices['shares_adjusted'].sum()

others_df = pd.DataFrame([{'market_slug': 'Others', 'shares_adjusted': other_sum}])

large_slices = pd.concat([large_slices, others_df], ignore_index=True)

fig = px.pie(

large_slices,

names='market_slug',

values='shares_adjusted',

title=f"Current Holdings Distribution by Market for {username}",

)

fig.update_layout(

title={

'text': f"Current Holdings Distribution by Market for {username}",

'y': 0.95,

'x': 0.5,

'xanchor': 'center',

'yanchor': 'top',

'font': {'size': 20}

},

margin=dict(t=60)

)

fig.add_annotation(

text=info_text,

xref="paper", yref="paper", showarrow=False, x=0.5, y=1.05, font=dict(size=12)

)

# Save the pie chart as an HTML file

plot_file = os.path.join(plot_dir, f"{sanitized_username}_current_holdings_pie_chart.html")

fig.write_html(plot_file)

logger.info(f"Current holdings pie chart saved to {plot_file}")

def create_and_save_treemap(df, user_info):

"""Create and save a treemap for user's current holdings."""

plot_dir = './plots/user_trades'

username = user_info["username"]

wallet_id = user_info["wallet_address"]

sanitized_username = sanitize_filename(username)

info_text = (

f"Username: {username} | Positions Value: {user_info['positions_value']} | "

f"Profit/Loss: {user_info['profit_loss']} | Volume Traded: {user_info['volume_traded']} | "

f"Markets Traded: {user_info['markets_traded']} | Wallet ID: {wallet_id}"

)

# Flag loss trades where to_erc1155 is zero address, transaction_type is sell, and price_paid_per_token is NaN

df['is_loss'] = df.apply(

lambda row: (row['to_erc1155'] == '0x0000000000000000000000000000000000000000')

and (row['transaction_type'] == 'sell')

and pd.isna(row['price_paid_per_token']), axis=1)

# Set shares and total purchase value to zero for loss trades

df.loc[df['is_loss'], 'shares'] = 0

# Adjust shares based on transaction type (buy vs sell)

df['shares_adjusted'] = df.apply(

lambda row: row['shares'] if row['transaction_type'] == 'buy' else -row['shares'], axis=1)

# Group by market_slug and outcome for treemap

holdings = df.groupby(['market_slug', 'outcome']).agg({'shares_adjusted': 'sum'}).reset_index()

# Create the treemap

fig = px.treemap(

holdings,

path=['market_slug', 'outcome'],

values='shares_adjusted',

title=f"Current Holdings Distribution by Market and Outcome for {username}",

)

# Adjust title positioning and font size

fig.update_layout(

title={

'text': f"Current Holdings Distribution by Market and Outcome for {username}",

'y': 0.95,

'x': 0.5,

'xanchor': 'center',

'yanchor': 'top',

'font': {'size': 20}

},

margin=dict(t=60)

)

fig.add_annotation(

text=info_text,

xref="paper", yref="paper", showarrow=False, x=0.5, y=1.05, font=dict(size=12)

)

# Save the treemap as an HTML file

plot_file = os.path.join(plot_dir, f"{sanitized_username}_current_holdings_treemap.html")

fig.write_html(plot_file)

logger.info(f"Current holdings treemap saved to {plot_file}")

def update_latest_prices(merged_df, market_lookup):

"""

Fetch and update the latest prices for each contract and tokenID pair in the merged_df,

and calculate profit/loss (pl) based on the live price.

"""

# Ensure 'pl' column exists in the DataFrame

if 'pl' not in merged_df.columns:

merged_df['pl'] = np.nan # Import numpy as np at the top of your script

# Ensure tokenID is a string and filter out NaN tokenIDs

merged_df['tokenID'] = merged_df['tokenID'].astype(str)

merged_df = merged_df[~merged_df['tokenID'].isnull() & (merged_df['tokenID'] != 'nan')]

unique_contract_token_pairs = merged_df[['contractAddress_erc1155', 'tokenID']].drop_duplicates()

for contract_address, token_id in unique_contract_token_pairs.itertuples(index=False):

# Ensure token_id is a string

token_id_str = str(token_id)

if not token_id_str or token_id_str == 'nan':

logger.warning("Encountered NaN or empty token_id. Skipping.")

continue

# Find market_slug and outcome using the market_lookup

market_slug, outcome = find_market_info(token_id_str, market_lookup)

if market_slug and outcome:

# Update live price and pl in the DataFrame

merged_df = update_live_price_and_pl(merged_df, token_id_str, market_slug=market_slug, outcome=outcome)

else:

logger.warning(f"Market info not found for token ID: {token_id_str}. Skipping PL calculation for these rows.")

# Optionally, set 'pl' to 0 or np.nan for these rows

merged_df.loc[merged_df['tokenID'] == token_id_str, 'pl'] = np.nan

return merged_df

def call_get_user_profile(wallet_id):

"""

Call subprocess to get user profile data by wallet_id.

"""

if not wallet_id:

logger.error("No wallet ID provided.")

return None

try:

logger.info(f"Calling subprocess to fetch user profile for wallet ID: {wallet_id}")

# Execute get_user_profile.py using subprocess and pass wallet_id

result = subprocess.run(

['python3', 'get_user_profile.py', wallet_id], # Make sure wallet_id is passed as an argument

stdout=subprocess.PIPE,

stderr=subprocess.PIPE,

check=True,

text=True,

timeout=30 # Set a timeout for the subprocess

)

logger.debug(f"Subprocess stdout: {result.stdout}")

logger.debug(f"Subprocess stderr: {result.stderr}")

# Parse the JSON response from stdout

user_data = json.loads(result.stdout)

return user_data

except subprocess.TimeoutExpired:

logger.error(f"Subprocess timed out when fetching user profile for wallet ID: {wallet_id}")

return None

except subprocess.CalledProcessError as e:

logger.error(f"Subprocess error when fetching user profile for wallet ID {wallet_id}: {e.stderr}")

return None

except json.JSONDecodeError as e:

logger.error(f"Failed to parse JSON from subprocess for wallet ID {wallet_id}: {e}")

return None

def replace_hex_values(df, columns):

"""

Replace specific hex values in the given columns with their corresponding names.

Args:

- df (pd.DataFrame): The DataFrame containing the transaction data.

- columns (list): List of column names where the hex values should be replaced.

Returns:

- pd.DataFrame: The DataFrame with the replaced values.

"""

# Mapping of hex values to their corresponding names

replacement_dict = {

'0x2791Bca1f2de4661ED88A30C99A7a9449Aa84174': 'CTF_EXCHANGE',

'0x4d97dcd97ec945f40cf65f87097ace5ea0476045': 'NEG_RISK_CTF_EXCHANGE',

'0xC5d563A36AE78145C45a50134d48A1215220f80a': 'NEG_RISK_CTF_EXCHANGE_SPENDER',

'0xd91E80cF2E7be2e162c6513ceD06f1dD0dA35296': 'NEG_RISK_ADAPTER',

'0x4bFb41d5B3570DeFd03C39a9A4D8dE6Bd8B8982E': 'CTF_EXCHANGE_SPENDER',

}

for column in columns:

if column in df.columns:

df[column] = df[column].replace(replacement_dict)

return df

def process_wallet_data(wallet_addresses, api_key, plot=True, latest_price_mode=False):

"""

Processes user wallet data to generate user transaction information. If `latest_price_mode` is set to True,

the function will only retrieve the latest prices for tokens without generating user reports.

Args:

- wallet_addresses (list): List of wallet addresses to process.

- api_key (str): The Polygonscan API key.

- plot (bool): Whether to generate plots for the user data.

- latest_price_mode (bool): If True, only retrieve the latest transaction prices for the given wallets.

"""

# Load environment variables

load_dotenv("keys.env")

# Ensure the output directory exists

output_dir = './data/user_trades/'

os.makedirs(output_dir, exist_ok=True)

# Load the market lookup JSON data

market_lookup_path = './data/market_lookup.json'

market_lookup = load_market_lookup(market_lookup_path)

for wallet_address in wallet_addresses:

# Fetch user info (username) based on wallet ID

user_info = call_get_user_profile(wallet_address) # Pass wallet_address to the function

username = user_info['username'] if user_info else "Unknown"

# Sanitize the username to create a valid filename

sanitized_username = sanitize_filename(username)

logger.info(f"Processing wallet for user: {username}")

# API URLs for ERC-20 and ERC-1155 transactions

erc20_url = f"https://api.polygonscan.com/api?module=account&action=tokentx&address={wallet_address}&startblock=0&endblock=99999999&sort=asc&apikey={api_key}"

erc1155_url = f"https://api.polygonscan.com/api?module=account&action=token1155tx&address={wallet_address}&startblock=0&endblock=99999999&sort=asc&apikey={api_key}"

# Fetch ERC-20 and ERC-1155 transactions

erc20_response = fetch_data(erc20_url)

erc1155_response = fetch_data(erc1155_url)

if erc20_response['status'] == '1' and erc1155_response['status'] == '1':

erc20_data = erc20_response['result']

erc1155_data = erc1155_response['result']

# Convert data to DataFrames

erc20_df = pd.DataFrame(erc20_data)

erc1155_df = pd.DataFrame(erc1155_data)

# Enrich ERC-1155 data with market_slug and outcome

erc1155_df = enrich_erc1155_data(erc1155_df, market_lookup)

# Add timestamps

erc1155_df, erc20_df = add_timestamps(erc1155_df, erc20_df)

# Merge and add financial columns

merged_df = add_financial_columns(erc1155_df, erc20_df, wallet_address, market_lookup)

if 'pl' in merged_df.columns:

logger.info(f"'pl' column exists with {merged_df['pl'].count()} non-null values.")

else:

logger.error("'pl' column does not exist in merged_df after update_latest_prices.")

# Replace hex values with the corresponding names

columns_to_replace = ['contractAddress_erc1155', 'from_erc1155', 'to_erc1155']

merged_df = replace_hex_values(merged_df, columns_to_replace)

# Save the merged and enriched data

output_file = f'{output_dir}{sanitized_username}_enriched_transactions.csv'

merged_df.to_csv(output_file, index=False)

logger.info(f"Enriched data saved to {output_file}")

# Check if 'pl' column exists and has non-null values

if 'pl' in merged_df.columns and merged_df['pl'].notnull().any():

logger.info(f"'pl' column exists with {merged_df['pl'].count()} non-null values.")

if not latest_price_mode:

# Generate and save the Profit/Loss by trade plot

plot_profit_loss_by_trade(merged_df, user_info)

else:

logger.warning(f"'pl' column is missing or empty for user {username}. Skipping PL plot.")

logger.info("Data processing completed.")

def call_scrape_wallet_ids(top_volume=True, top_profit=True):

"""

Scrape leaderboard and return wallet IDs based on top volume or top profit.

Args:

- top_volume (bool): Whether to fetch top volume users.

- top_profit (bool): Whether to fetch top profit users.

Returns:

- List of wallet IDs.

"""

wallet_ids = []

# Construct the command to call get_leaderboard_wallet_ids.py with appropriate flags

command = ['python3', 'get_leaderboard_wallet_ids.py']

if top_volume:

command.append('--top-volume')

if top_profit:

command.append('--top-profit')

try:

# Run the script with the constructed command

result = subprocess.run(

command,

stdout=subprocess.PIPE,

stderr=subprocess.PIPE,

check=True,

text=True

)

logger.debug(f"Leaderboard wallet script stdout: {result.stdout}")

# Parse the output as JSON and extend the wallet_ids list

wallet_ids.extend(json.loads(result.stdout))

except subprocess.CalledProcessError as e:

logger.error(f"Error running get_leaderboard_wallet_ids.py: {e.stderr}")

except json.JSONDecodeError as json_err:

logger.error(f"Failed to parse JSON from get_leaderboard_wallet_ids.py: {json_err}")

# Log the combined wallet IDs

logger.info(f"Fetched {len(wallet_ids)} wallet IDs based on volume/profit flags.")

return wallet_ids

def process_and_plot_user_data(wallet_addresses, api_key, plot=True, latest_price_mode=False):

"""

Process wallet data for each user, calculate financial data, and optionally generate plots.

Args:

wallet_addresses (list): List of wallet addresses.

api_key (str): Polygonscan API key.

plot (bool): Whether to generate plots for the user data.

latest_price_mode (bool): If True, only retrieve the latest prices, no plotting.

"""

# Load market lookup data

market_lookup_path = './data/market_lookup.json'

market_lookup = load_market_lookup(market_lookup_path)

# Define the columns to keep

columns_to_keep = [

'timeStamp_erc1155', 'tokenID', 'tokenValue', 'market_slug', 'outcome',

'value', 'tokenDecimal', 'transaction_type', 'price_paid_per_token',

'total_purchase_value', 'shares', 'lost', 'won', 'pl', 'live_price'

]

for wallet_address in wallet_addresses:

# Fetch user info (username) based on wallet ID

user_info = call_get_user_profile(wallet_address)

username = user_info.get('username', "Unknown")

logger.info(f"Processing wallet for user: {username} ({wallet_address})")

# Fetch ERC-20 and ERC-1155 transactions

erc20_df, erc1155_df = fetch_user_transactions(wallet_address, api_key)

if erc20_df is not None and erc1155_df is not None:

# Enrich ERC-1155 data with market_slug and outcome

erc1155_df = enrich_erc1155_data(erc1155_df, market_lookup)

# Add timestamps

erc1155_df, erc20_df = add_timestamps(erc1155_df, erc20_df)

# Merge and add financial columns

merged_df = add_financial_columns(erc1155_df, erc20_df, wallet_address, market_lookup)

# Check for Profit/Loss data

if 'pl' in merged_df.columns and merged_df['pl'].notnull().any():

if not latest_price_mode and plot:

# Generate all plots for the user

generate_all_user_plots(merged_df, user_info)

# Save the merged and enriched data

sanitized_username = sanitize_filename(username)

output_dir = './data/user_trades/'

os.makedirs(output_dir, exist_ok=True)

# Save to Parquet (default format)

output_file_parquet = f'{output_dir}{sanitized_username}_enriched_transactions.parquet'

merged_df.to_parquet(output_file_parquet, index=False)

logger.info(f"Enriched data saved to {output_file_parquet}")

# Save to CSV

# Keep only the specified columns and sort by timeStamp_erc1155

merged_df = merged_df[columns_to_keep].sort_values(by='timeStamp_erc1155', ascending=True)

output_file_csv = f'{output_dir}{sanitized_username}_enriched_transactions.csv'

merged_df.to_csv(output_file_csv, index=False)

logger.info(f"Enriched data saved to {output_file_csv}")

else:

logger.warning(f"Profit/Loss column missing or empty for user: {username}")

else:

logger.error(f"Failed to fetch transaction data for wallet: {wallet_address}")

def generate_all_user_plots(merged_df, user_info):

"""

Generate all necessary plots for a user.

Args:

merged_df (DataFrame): The merged DataFrame with user transactions and financial info.

user_info (dict): Dictionary containing user information.

"""

# Generate Profit/Loss by Trade plot

plot_profit_loss_by_trade(merged_df, user_info)

# Generate Shares Over Time plot

plot_shares_over_time(merged_df, user_info)

# Generate Total Purchase Value by Market plot

plot_user_trades(merged_df, user_info)

# Generate Pie Chart for Holdings

create_and_save_pie_chart(merged_df, user_info)

# Generate Treemap for Holdings

create_and_save_treemap(merged_df, user_info)

logger.info(f"All plots generated for user: {user_info['username']}")

def fetch_user_transactions(wallet_address, api_key):

"""

Fetch ERC-20 and ERC-1155 transaction data for a user with pagination.

Args:

wallet_address (str): Wallet address to fetch transactions for.

api_key (str): Polygonscan API key.

Returns:

(DataFrame, DataFrame): DataFrames for ERC-20 and ERC-1155 transactions.

"""

def fetch_paginated_data(url):

"""

Fetch paginated data from the provided URL.

Args:

url (str): Base URL for the API request.

Returns:

DataFrame: DataFrame with all paginated results.

"""

page = 1

offset = 1000 # Set the offset/page size based on the API's limits (e.g., 1000)

all_data = []

while True:

paginated_url = f"{url}&page={page}&offset={offset}"

data = fetch_data(paginated_url)

if data and data['status'] == '1' and len(data['result']) > 0:

all_data.extend(data['result'])

page += 1

else:

break # Stop if no more data is returned

return pd.DataFrame(all_data)

# Fetch ERC-20 transactions with pagination

erc20_url = (f"https://api.polygonscan.com/api"

f"?module=account"

f"&action=tokentx"

f"&address={wallet_address}"

f"&startblock=0"

f"&endblock=99999999"

f"&sort=desc"

f"&apikey={api_key}")

erc20_df = fetch_paginated_data(erc20_url)

# Fetch ERC-1155 transactions with pagination

erc1155_url = (f"https://api.polygonscan.com/api"

f"?module=account"

f"&action=token1155tx"

f"&address={wallet_address}"

f"&startblock=0"

f"&endblock=99999999"

f"&sort=desc"

f"&apikey={api_key}")

erc1155_df = fetch_paginated_data(erc1155_url)

if not erc20_df.empty and not erc1155_df.empty:

return erc20_df, erc1155_df

else:

return None, None

def fetch_wallet_addresses(skip_leaderboard, top_volume, top_profit):

"""

Fetch wallet addresses based on leaderboard data or manual input.

Args:

skip_leaderboard (bool): Whether to skip leaderboard fetching.

top_volume (bool): Fetch top volume users.

top_profit (bool): Fetch top profit users.

Returns:

list: A list of wallet addresses to process.

"""

# Manually specified wallet addresses

manual_wallet_ids = [

'0x76527252D7FEd00dC4D08d794aFa1cCC36069C2a',

# Add more wallet IDs as needed

]

if not skip_leaderboard:

leaderboard_wallet_ids = call_scrape_wallet_ids(top_volume=top_volume, top_profit=top_profit)

wallet_addresses = list(set(manual_wallet_ids + leaderboard_wallet_ids)) # Remove duplicates

else:

wallet_addresses = manual_wallet_ids

return wallet_addresses

def main(wallet_addresses=None, skip_leaderboard=False, top_volume=False, top_profit=False, plot=True, latest_price_mode=False):

"""

Main function to process wallet data and generate plots.

Args:

wallet_addresses (list): A list of wallet addresses to process (if provided).

skip_leaderboard (bool): Whether to skip fetching leaderboard data.

top_volume (bool): Whether to fetch top volume users.

top_profit (bool): Whether to fetch top profit users.

plot (bool): Whether to generate plots for the user data.

latest_price_mode (bool): If True, only retrieve the latest prices, no plotting.

"""

# Load environment variables

load_dotenv("keys.env")

api_key = os.getenv('POLYGONSCAN_API_KEY')

if not wallet_addresses:

# Fetch wallet addresses if not provided

wallet_addresses = fetch_wallet_addresses(skip_leaderboard, top_volume, top_profit)

# Process wallet data and optionally generate plots

process_and_plot_user_data(wallet_addresses, api_key, plot=plot, latest_price_mode=latest_price_mode)

if __name__ == "__main__":

# Use argparse to accept command-line arguments

parser = argparse.ArgumentParser(description='Process wallet data for specific wallet addresses.')

parser.add_argument(

'--wallets',

nargs='+', # This will accept multiple wallet IDs

help='List of wallet addresses to process.'

)

parser.add_argument('--skip-leaderboard', action='store_true', help='Skip leaderboard fetching.')

parser.add_argument('--top-volume', action='store_true', help='Fetch top volume users.')

parser.add_argument('--top-profit', action='store_true', help='Fetch top profit users.')

parser.add_argument('--no-plot', action='store_true', help='Disable plot generation.')

parser.add_argument('--latest-price-mode', action='store_true',

help='Only retrieve the latest prices, no plotting.')

args = parser.parse_args()

# Call the main function with the parsed arguments

main(

wallet_addresses=args.wallets,

skip_leaderboard=args.skip_leaderboard,

top_volume=args.top_volume,

top_profit=args.top_profit,

plot=not args.no_plot,

latest_price_mode=args.latest_price_mode

)

Arbitrage in Polymarket.com

About a month ago, I noticed some arbitrage opportunities on Polymarket.com. However, the liquidity on the platform isn’t significant enough for me to pursue this further. I’m planning to return to stock trading. That said, I still have around $60,000 actively invested in various markets on Polymarket. Most of these trades will expire after the election, so I’ll close them out then. Below, I’ll walk you through these trades and offer some free code for anyone interested in exploring this market.

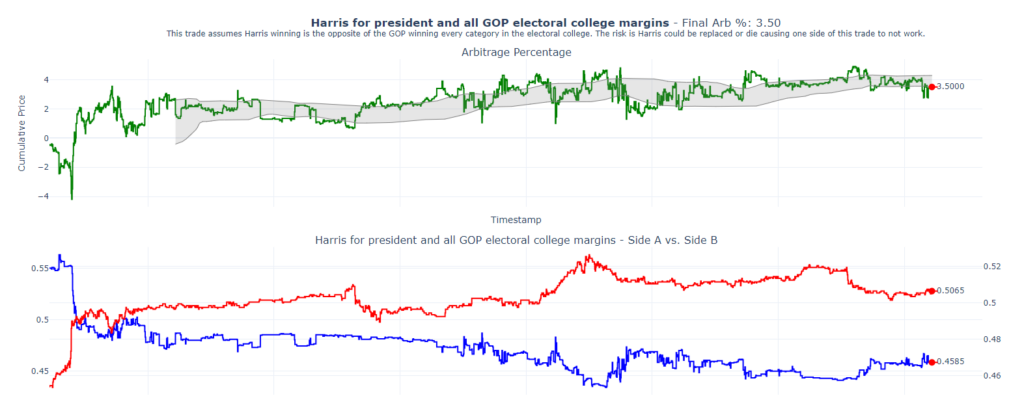

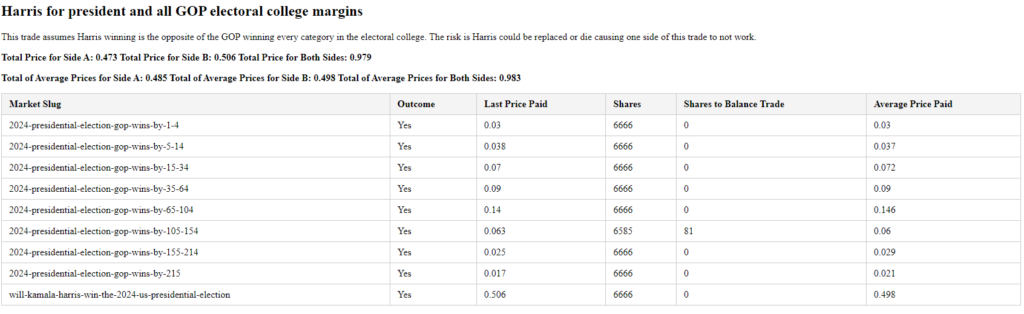

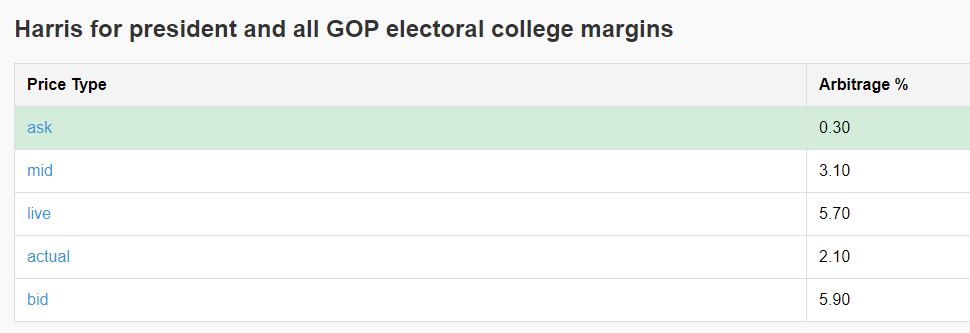

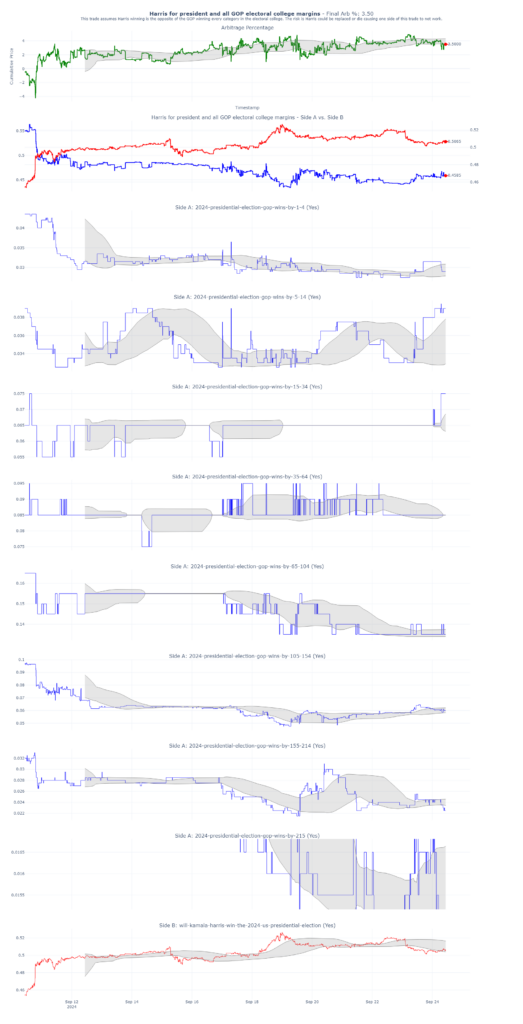

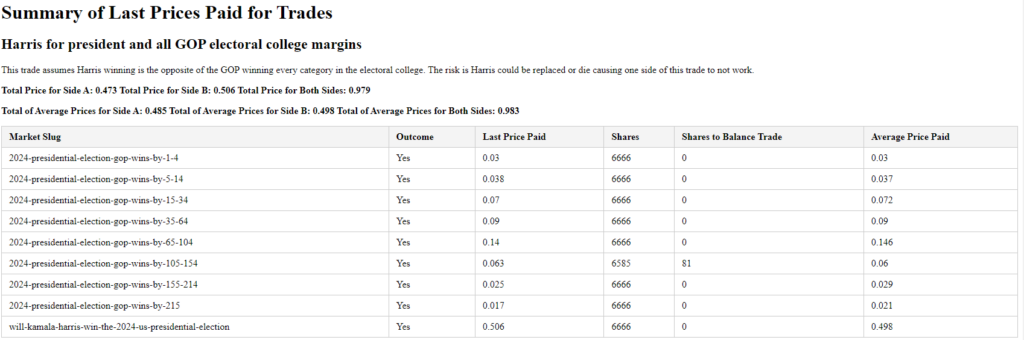

Arb 1: Harris for President and buy all GOP Electoral College Margins

The strategy here is straightforward: We’re betting that Kamala Harris will win the presidency, while simultaneously buying all the GOP Electoral College margins. Essentially, these two positions are opposites. If the total of both bets is less than 1, that difference represents the percentage of guaranteed profit—our arbitrage. As of today, this trade is yielding a 3.5% arbitrage with 41 days remaining until the election. That translates to a ~41% annualized return.

Below, you’ll find a plot that shows how I’ve structured my trades. You can see I’ve bought nearly equal amounts of shares in all possible outcomes.

Here are my trades on Polymarket.com. You can see I’ve essentially bought the same number of shares of each of possible outcomes.

Here’s a summary of my trades placed live on Polymarket. The average cost of these positions is 0.983, meaning my expected return is 1 – 0.983, or 1.7%. My last trade had a cost basis of 0.979, yielding a 2.1% return.

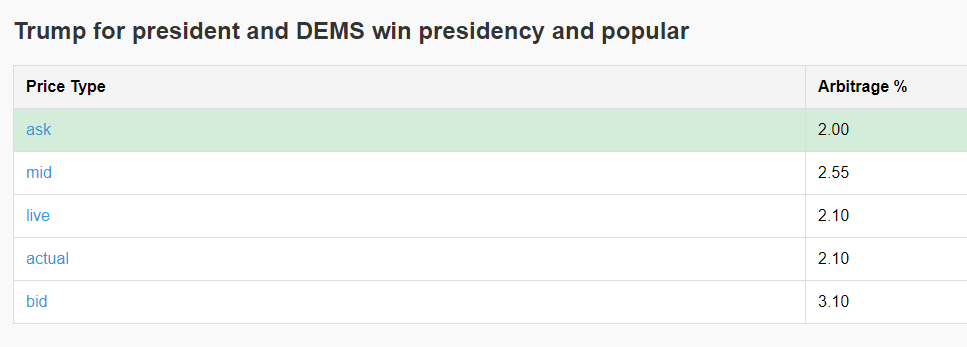

Arb 2: Trump for President hedged with DEMS to win the popular vote and presidency

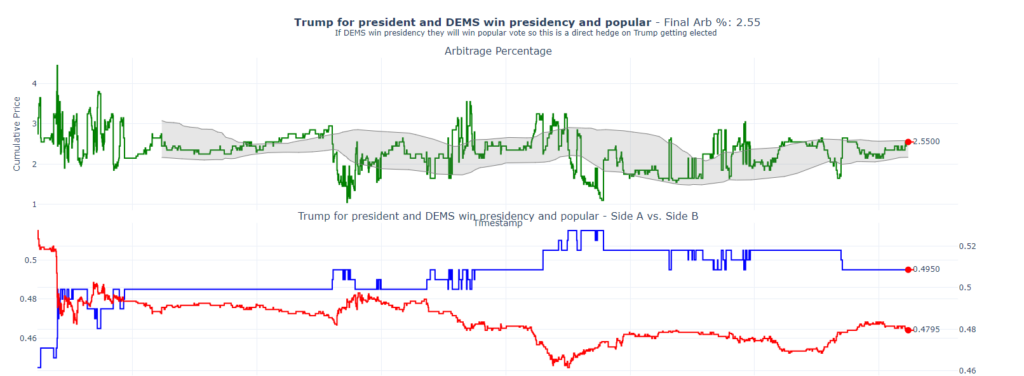

This strategy is showing a 2.55% arbitrage. In this scenario, we’re betting on Trump to win, while hedging by betting that the Democrats will win both the popular vote and the presidency. While this is not a perfect hedge (since it’s possible for the Democrats to win the presidency without the popular vote), based on my modeling, this scenario is highly unlikely. Therefore, I consider this hedge to be sound.

Below are my actual trades, demonstrating that I have an equal number of shares for each side of the bet.

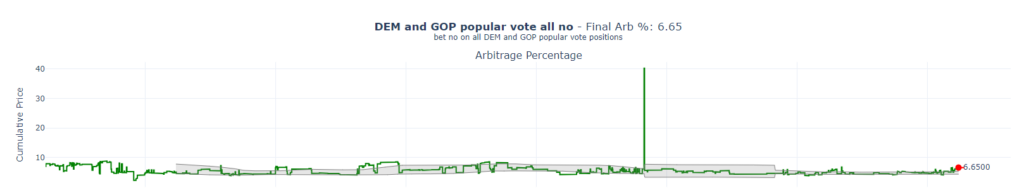

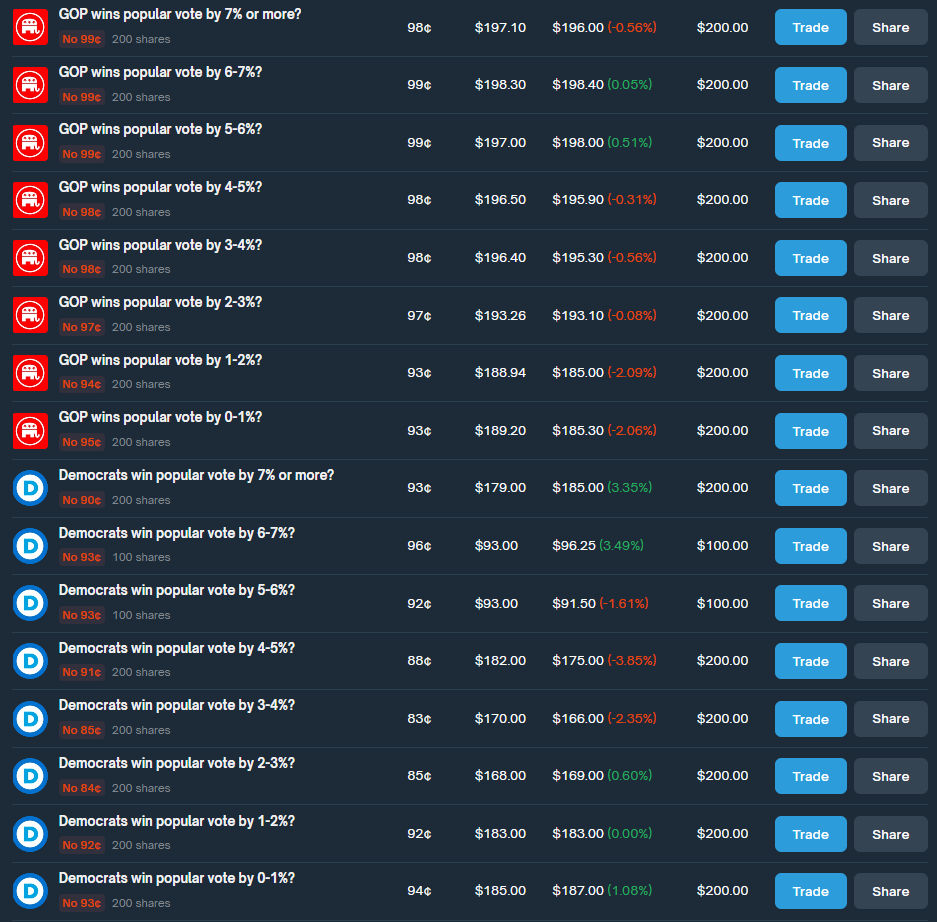

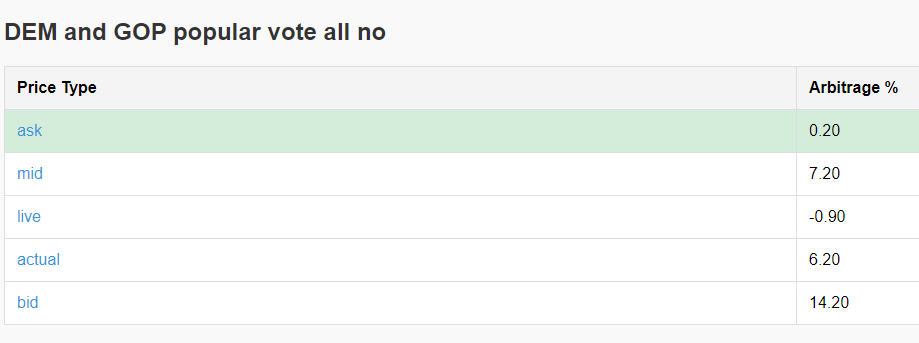

Arb 3: Buy all the no outcomes for DEM and GOP popular vote

For this trade, I’ve bought the “No” outcome on every possible bet for the popular vote. This currently presents a 6.65% arbitrage opportunity.

Here are the actual trades. As you can see, all but one of these bets will win on election day. The total profit from the winning trades, minus the loss from the single losing trade, results in the overall return.

Here are my actual trades. All of these except 1 will win on election day. So the winning side of all these trades less 1 needs to be greater than the amount lost on the losing trade.

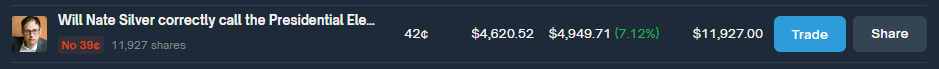

Last arb:

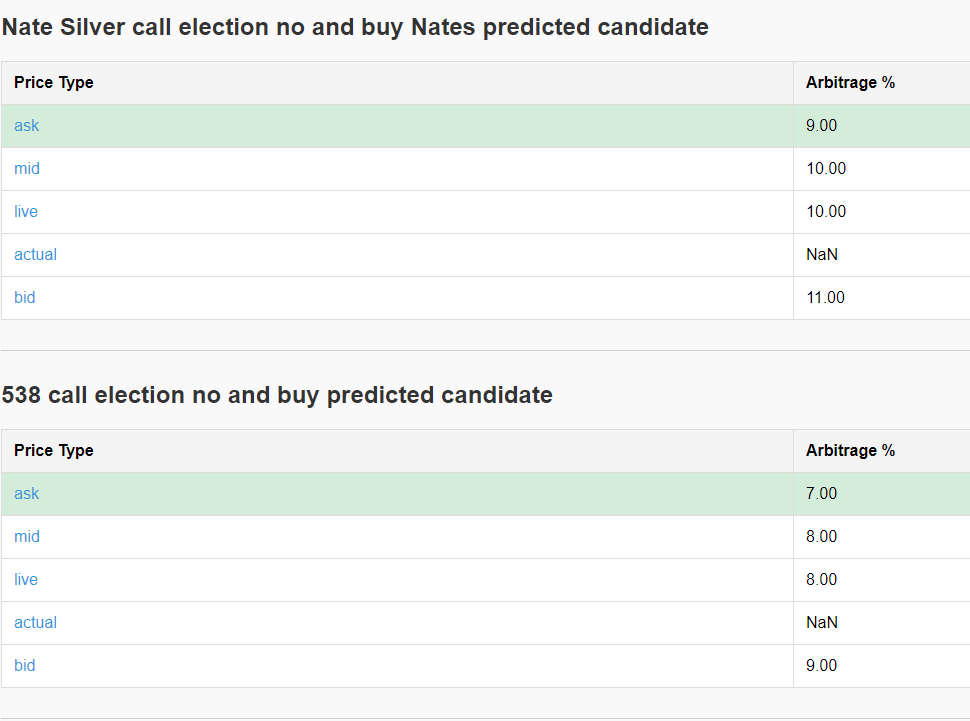

I wrote extensively about betting against Nate Silver and 538 predictions in an older blog post here. This goes in-depth on how I will trade these two markets.

I’ve written in-depth about my strategy of betting against Nate Silver and the predictions from FiveThirtyEight in a previous blog post, which you can find here. That post details how I plan to trade these two markets.

Read the Rules Carefully

One important tip: Always read the rules of each trade carefully. Some positions may seem like arbitrage opportunities, but they can carry hidden risks. For example, if a candidate were to be assassinated, you could lose all your money, despite thinking you had a safe arbitrage position.

Spread Matters

One of the biggest challenges I’ve encountered is market impact. When I place a trade, I often move the entire market in my direction due to the low liquidity. This creates discrepancies between the bid, ask, mid, live, and actual trade prices. Below are examples of this from the trades I shared earlier.

The Code:

I spent a tremendous amount of time writing code to break down Polymarkets data.

strategies.py

This file contains all of the hedge opportunities that I’m monitoring.

trades = [

{

"trade_name": "Harris for president and all GOP electoral college margins",

"subtitle": "This trade assumes Harris winning is the opposite of the GOP winning every category "

"in the electoral college. The risk is Harris could be replaced or die causing one "

"side of this trade to not work.",

"side_a_trades": [

("2024-presidential-election-gop-wins-by-1-4", "Yes"),

("2024-presidential-election-gop-wins-by-5-14", "Yes"),

("2024-presidential-election-gop-wins-by-15-34", "Yes"),

("2024-presidential-election-gop-wins-by-35-64", "Yes"),

("2024-presidential-election-gop-wins-by-65-104", "Yes"),

("2024-presidential-election-gop-wins-by-105-154", "Yes"),

("2024-presidential-election-gop-wins-by-155-214", "Yes"),

("2024-presidential-election-gop-wins-by-215", "Yes"),

],

"side_b_trades": [

("will-kamala-harris-win-the-2024-us-presidential-election", "Yes"),

],

"method": "balanced"

},

{

"trade_name": "DEM and REP electoral college all no",

"subtitle": "bet no on all DEM and REP electoral college positions",

"positions": [

("2024-presidential-election-gop-wins-by-215", "No"),

("2024-presidential-election-gop-wins-by-155-214", "No"),

("2024-presidential-election-gop-wins-by-65-104", "No"),

("2024-presidential-election-gop-wins-by-35-64", "No"),

("2024-presidential-election-gop-wins-by-15-34", "No"),

("2024-presidential-election-gop-wins-by-1-4", "No"),

("2024-presidential-election-gop-wins-by-5-14", "No"),

("2024-presidential-election-gop-wins-by-105-154", "No"),

("2024-presidential-election-democrats-win-by-0-4", "No"),

("2024-presidential-election-democrats-win-by-5-14", "No"),

("2024-presidential-election-democrats-win-by-15-34", "No"),

("2024-presidential-election-democrats-win-by-35-64", "No"),

("2024-presidential-election-democrats-win-by-65-104", "No"),

("2024-presidential-election-democrats-win-by-105-154", "No"),

("2024-presidential-election-democrats-win-by-155-214", "No"),

("2024-presidential-election-democrats-win-by-215", "No"),

],

"method": "all_no"

},

{

"trade_name": "DEM and GOP popular vote all no",

"subtitle": "bet no on all DEM and GOP popular vote positions",

"positions": [

("gop-wins-popular-vote-by-more-than-7", "No"),

("gop-wins-popular-vote-by-6-7", "No"),

("gop-wins-popular-vote-by-5-6", "No"),

("gop-wins-popular-vote-by-4-5", "No"),

("gop-wins-popular-vote-by-3-4", "No"),

("gop-wins-popular-vote-by-2-3", "No"),

("gop-wins-popular-vote-by-1-2", "No"),

("gop-wins-popular-vote-by-0-1", "No"),

("democrats-win-popular-vote-by-over-7", "No"),

("democrats-win-popular-vote-by-6-7", "No"),

("democrats-win-popular-vote-by-5-6", "No"),

("democrats-win-popular-vote-by-4-5", "No"),

("democrats-win-popular-vote-by-3-4", "No"),

("democrats-win-popular-vote-by-2-3", "No"),

("democrats-win-popular-vote-by-1-2", "No"),

("democrats-win-popular-vote-by-0-1", "No"),

],

"method": "all_no"

},

{

"trade_name": ""

"Trump for president and DEMS win presidency and popular",

"subtitle": "If DEMS win presidency they will win popular vote so this is a direct hedge "

"on Trump getting elected ",

"side_a_trades": [

("will-a-democrat-win-the-popular-vote-and-the-presidency", "Yes"),

],

"side_b_trades": [

("will-donald-trump-win-the-2024-us-presidential-election", "Yes"),

],

"method": "balanced"

},

{

"trade_name": ""

"DEM win presidency hedged on Trump",

"subtitle": "REP win presidency hedged on Kamala winning",

"side_a_trades": [

("which-party-will-win-the-2024-united-states-presidential-election", "Democratic"),

],

"side_b_trades": [

("will-donald-trump-win-the-2024-us-presidential-election", "Yes"),

],

"method": "balanced"

},

{

"trade_name": ""

"REP win presidency hedged on Kamala",

"subtitle": "REP win presidency hedged on Kamala winning",

"side_a_trades": [

("which-party-will-win-the-2024-united-states-presidential-election", "Republican"),

],

"side_b_trades": [

("will-kamala-harris-win-the-2024-us-presidential-election", "Yes"),

],

"method": "balanced"

},

{

"trade_name": ""

"Trump popular vote hedged with popular vote margins",

"subtitle": "Trump wins popular vote and then buy all the margins for DEMS on the popular vote",

"side_a_trades": [

("will-donald-trump-win-the-popular-vote-in-the-2024-presidential-election", "Yes"),

],

"side_b_trades": [

("democrats-win-popular-vote-by-0-1", "Yes"),

("democrats-win-popular-vote-by-1-2", "Yes"),

("democrats-win-popular-vote-by-2-3", "Yes"),

("democrats-win-popular-vote-by-3-4", "Yes"),

("democrats-win-popular-vote-by-4-5", "Yes"),

("democrats-win-popular-vote-by-5-6", "Yes"),

("democrats-win-popular-vote-by-6-7", "Yes"),

("democrats-win-popular-vote-by-over-7", "Yes"),

],

"method": "balanced"

},

{

"trade_name": ""

"Kamala popular vote hedged with popular vote margins",

"subtitle": "Kamala wins popular vote and then buy all the margins for REP on the popular vote",

"side_a_trades": [

("will-kamala-harris-win-the-popular-vote-in-the-2024-presidential-election", "Yes"),

],

"side_b_trades": [

("gop-wins-popular-vote-by-0-1", "Yes"),

("gop-wins-popular-vote-by-1-2", "Yes"),

("gop-wins-popular-vote-by-2-3", "Yes"),

("gop-wins-popular-vote-by-3-4", "Yes"),

("gop-wins-popular-vote-by-4-5", "Yes"),

("gop-wins-popular-vote-by-5-6", "Yes"),

("gop-wins-popular-vote-by-6-7", "Yes"),

("gop-wins-popular-vote-by-more-than-7", "Yes"),

],

"method": "balanced"

},

{

"trade_name": "DEM popular vote all no",

"subtitle": "bet no on all DEM popular vote positions",

"positions": [

("democrats-win-popular-vote-by-over-7", "No"),

("democrats-win-popular-vote-by-6-7", "No"),

("democrats-win-popular-vote-by-5-6", "No"),

("democrats-win-popular-vote-by-4-5", "No"),

("democrats-win-popular-vote-by-3-4", "No"),

("democrats-win-popular-vote-by-2-3", "No"),

("democrats-win-popular-vote-by-1-2", "No"),

("democrats-win-popular-vote-by-0-1", "No"),

],

"method": "all_no"

},

{

"trade_name": "GOP popular vote all no",

"subtitle": "bet no on all GOP popular vote positions",

"positions": [

("gop-wins-popular-vote-by-more-than-7", "No"),

("gop-wins-popular-vote-by-6-7", "No"),

("gop-wins-popular-vote-by-5-6", "No"),

("gop-wins-popular-vote-by-4-5", "No"),

("gop-wins-popular-vote-by-3-4", "No"),

("gop-wins-popular-vote-by-2-3", "No"),

("gop-wins-popular-vote-by-1-2", "No"),

("gop-wins-popular-vote-by-0-1", "No"),

],

"method": "all_no"

},

{

"trade_name": "Trump for president and all DEM electoral college margins",

"subtitle" : "This trade assumes Trump winning is the opposite of the DEM winning every category "

"in the electoral college. The risk is Trump could be replaced or die causing one "

"side of this trade to not work.",

"side_a_trades": [

("2024-presidential-election-democrats-win-by-0-4", "Yes"),

("2024-presidential-election-democrats-win-by-5-14", "Yes"),

("2024-presidential-election-democrats-win-by-15-34", "Yes"),

("2024-presidential-election-democrats-win-by-35-64", "Yes"),

("2024-presidential-election-democrats-win-by-65-104", "Yes"),

("2024-presidential-election-democrats-win-by-105-154", "Yes"),

("2024-presidential-election-democrats-win-by-155-214", "Yes"),

("2024-presidential-election-democrats-win-by-215", "Yes"),

],

"side_b_trades": [

("will-donald-trump-win-the-2024-us-presidential-election", "Yes"),

],

"method": "balanced"

},

{

"trade_name": "Electoral College All GOP ALL DEM YES",

"subtitle": "This is a truely hedged trade. Bet all REP electoral college slots and bet all"

"DEM electoral college slots",

"side_a_trades": [

("2024-presidential-election-gop-wins-by-1-4", "Yes"),

("2024-presidential-election-gop-wins-by-5-14", "Yes"),

("2024-presidential-election-gop-wins-by-15-34", "Yes"),

("2024-presidential-election-gop-wins-by-35-64", "Yes"),

("2024-presidential-election-gop-wins-by-65-104", "Yes"),

("2024-presidential-election-gop-wins-by-105-154", "Yes"),

("2024-presidential-election-gop-wins-by-155-214", "Yes"),

("2024-presidential-election-gop-wins-by-215", "Yes"),

],

"side_b_trades": [

("2024-presidential-election-democrats-win-by-0-4", "Yes"),

("2024-presidential-election-democrats-win-by-5-14", "Yes"),

("2024-presidential-election-democrats-win-by-15-34", "Yes"),

("2024-presidential-election-democrats-win-by-35-64", "Yes"),

("2024-presidential-election-democrats-win-by-65-104", "Yes"),

("2024-presidential-election-democrats-win-by-105-154", "Yes"),

("2024-presidential-election-democrats-win-by-155-214", "Yes"),

("2024-presidential-election-democrats-win-by-215", "Yes"),

],

"method": "balanced"

},

{

"trade_name": "DEM electoral college all no",

"subtitle": "bet no on all DEM electoral college positions",

"positions": [

("2024-presidential-election-democrats-win-by-0-4", "No"),

("2024-presidential-election-democrats-win-by-5-14", "No"),

("2024-presidential-election-democrats-win-by-15-34", "No"),

("2024-presidential-election-democrats-win-by-35-64", "No"),

("2024-presidential-election-democrats-win-by-65-104", "No"),

("2024-presidential-election-democrats-win-by-105-154", "No"),

("2024-presidential-election-democrats-win-by-155-214", "No"),

("2024-presidential-election-democrats-win-by-215", "No"),

],

"method": "all_no"

},

{

"trade_name": "REP electoral college all no",

"subtitle": "bet no on all REP electoral college positions",

"positions": [

("2024-presidential-election-gop-wins-by-1-4", "No"),

("2024-presidential-election-gop-wins-by-5-14", "No"),

("2024-presidential-election-gop-wins-by-15-34", "No"),

("2024-presidential-election-gop-wins-by-35-64", "No"),

("2024-presidential-election-gop-wins-by-65-104", "No"),

("2024-presidential-election-gop-wins-by-105-154", "No"),

("2024-presidential-election-gop-wins-by-155-214", "No"),

("2024-presidential-election-gop-wins-by-215", "No"),

],

"method": "all_no"

},

{

"trade_name": "FED Rates in Sept all no",

"subtitle": "bet no on all FED possibilities in Sept",

"positions": [

("fed-decreases-interest-rates-by-50-bps-after-september-2024-meeting", "No"),

("fed-decreases-interest-rates-by-25-bps-after-september-2024-meeting", "No"),

("no-change-in-fed-interest-rates-after-2024-september-meeting", "No"),

],

"method": "all_no"

},

{

"trade_name": "Balance of power all no",

"subtitle": "bet no on some of the balance of power outcomes",

"positions": [

("2024-balance-of-power-r-prez-r-senate-r-house", "No"),

("2024-election-democratic-presidency-and-house-republican-senate", "No"),

("democratic-sweep-in-2024-election", "No"),

("2024-balance-of-power-republican-presidency-and-senate-democratic-house", "No"),

],

"method": "all_no"

},

{

"trade_name": "Presidential party D President Trump",