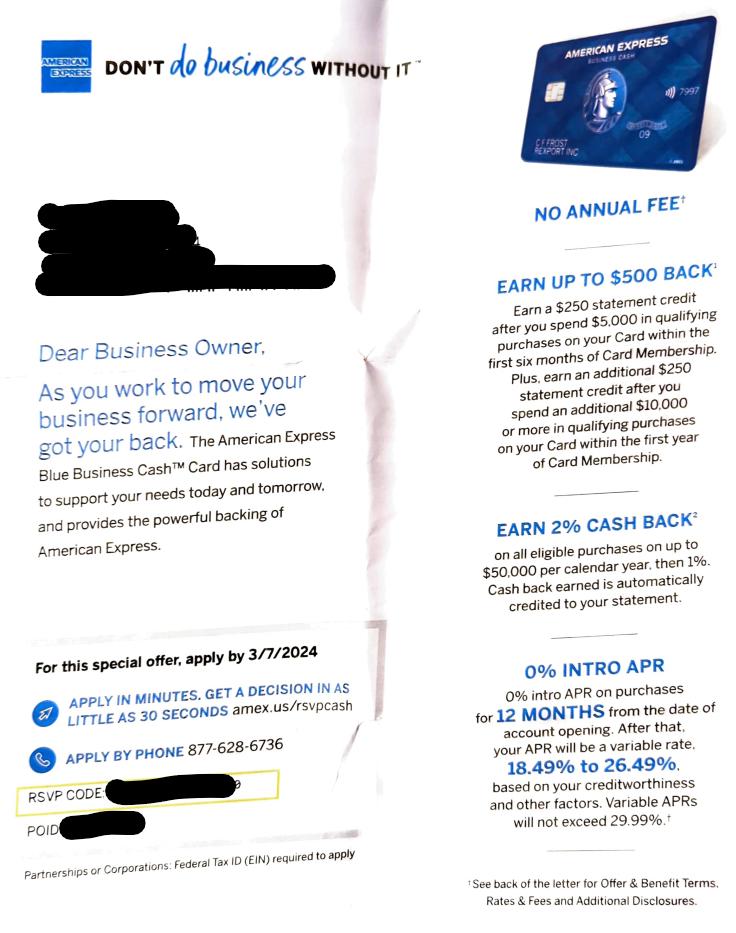

The Offer

American Express extended a 0% APR credit card offer to me, valid for 12 months. This card isn’t just about the interest-free period; it also offers approximately 5% cash back on purchases. To his the first bonus you have to spend $5,000 which earns you a $250 bonus. With a credit limit of $30,000 and no interest for a year, this presents me with an opportunity.

Strategy

In a previous post, I discussed how to earn a risk-free 5.5% in a high-yield savings account (HYSA). You can find that discussion here: Maximizing Cash Returns in a Rising Rate Environment. But in this scenario, since we have a whole year before we need to pay off the balance, we can look at even more lucrative options, like a 6-month CD yielding 5.66%. So the strategy is simple. You take the money you otherwise would have spent and paid off and instead use this card. You extend the balance to its maximum of $30,000. Now with the saved cash you simply put this into a HYSA or CD. Before the credit card starts to accrue interest, month 12, you simply pay it off.

My Scenario

Let’s break down the numbers in my situation. If I max out the card to its $30,000 limit, here’s what happens:

- Cashback Bonus: On the first $5,000 spent, I trigger a $250 bonus due to the card’s cashback offer.

- Interest Earnings: By investing this $30,000 I would have spent in a 6-month CD at 5.66%, I would earn approximately $1,698 in interest over a year (assuming I reinvest the initial interest after 6 months).

Result

Combining the cashback bonus with the interest from the CD, we’re looking at a total gain of around $1,948 over the year. This is essentially “free money,” earned by smartly utilizing the credit card’s features and pairing them with high-yield investment options.

Risks

While this strategy sounds promising, it’s essential to consider the risks and responsibilities:

- Credit Score Impact: Utilizing a large portion of your credit limit can impact your credit utilization ratio, a key factor in credit scoring.

- Payment Discipline: You must make at least the minimum payments on time every month to avoid interest and fees.

- Investment Risk: While CDs are generally safe, there’s still a risk in any investment, including the potential for early withdrawal penalties.

Conclusion

Credit card arbitrage, like the scenario I’ve outlined, can be a clever way to make your credit card work for you. However, it requires discipline, a good understanding of credit and investments, and a willingness to manage the risks involved. If done correctly, it can be a rewarding strategy for boosting your savings.

This exploration into credit card arbitrage is a prime example of how understanding and leveraging financial tools can lead to significant gains. It’s a strategy that fits well with my approach to finding and exploiting opportunities in the financial world. As always, I recommend readers do their due diligence and consider their financial situation before diving into such strategies.