The question of when the Federal Reserve will cut interest rates is at the forefront of many investors’ and minds. Given the current economic indicators and futures market trends, there seems to be little chance the FED cuts rates anytime soon. By analyzing the FOMC rate probabilities and market expectations, it’s evident that optimism for a rate cut may be premature.

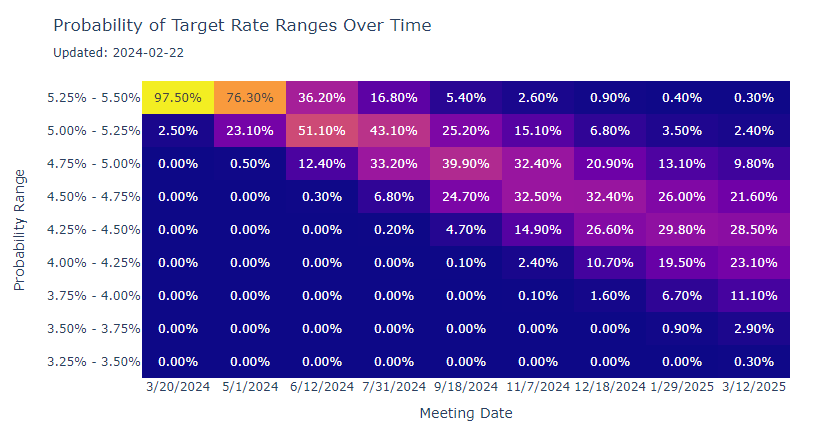

Futures traders exhibit a strong belief that the Federal Reserve will not lower rates in their next meeting on March 20th, with a 97.5% probability against a rate cut. This sentiment extends to the subsequent meeting on May 1st, 2024, where there’s a 76.3% likelihood of rates remaining unchanged. Looking even further ahead to the June 12th, 2024 meeting, the probability of the Fed maintaining the current rates stands at 36.2%, with a slight majority of 51.1% betting on a modest quarter-point reduction. Given the economic uncertainty around the globe, my guess is these numbers largely reflect the fact that the future is too hard to predict and something bad happening in the next 3-4 months is “likely”.

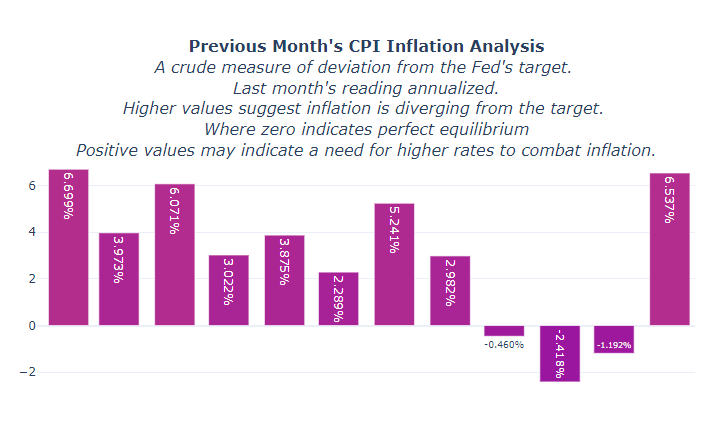

The Federal Reserve’s decision-making process is heavily influenced by its dual mandate to ensure price stability and maximum employment. Current inflation trends, a key determinant in this process, show an alarming annualized rate of 6.537% based on last month’s annualized—a figure significantly above the Fed’s 2% target.

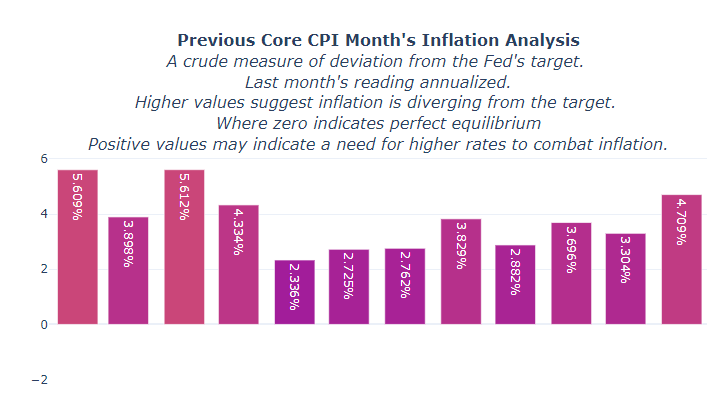

This uptick in inflation, rather than showing signs of abatement, has unexpectedly surged, underscoring the unpredictability of economic conditions. Core inflation, which excludes the volatile food and energy sectors, also presents a high annualized figure of 4.709%, further indicating that the Fed may not be inclined to lower interest rates in the foreseeable future.

Given that unemployment rates have remained relatively stable, there’s little pressure from the job market to prompt a rate cut. However, the specter of inflation, now more than ever, looms large over the Federal Reserve’s policy decisions. The fear of inflation spiraling out of control is likely a significant factor restraining the Fed from reducing rates.

Despite the current data and market sentiments suggesting that a rate cut is not on the horizon, it’s crucial to approach the future with caution. Economic conditions can shift rapidly, and recessions, when they occur, often strike with little warning. The data points to a cautious approach from the Fed, prioritizing the containment of inflation over stimulating economic growth through rate reductions. Yet, the unpredictable nature of economic transitions means that vigilance and adaptability are essential, both for policymakers and market participants alike.

Interactive data on this article is available on my FED dashboard.