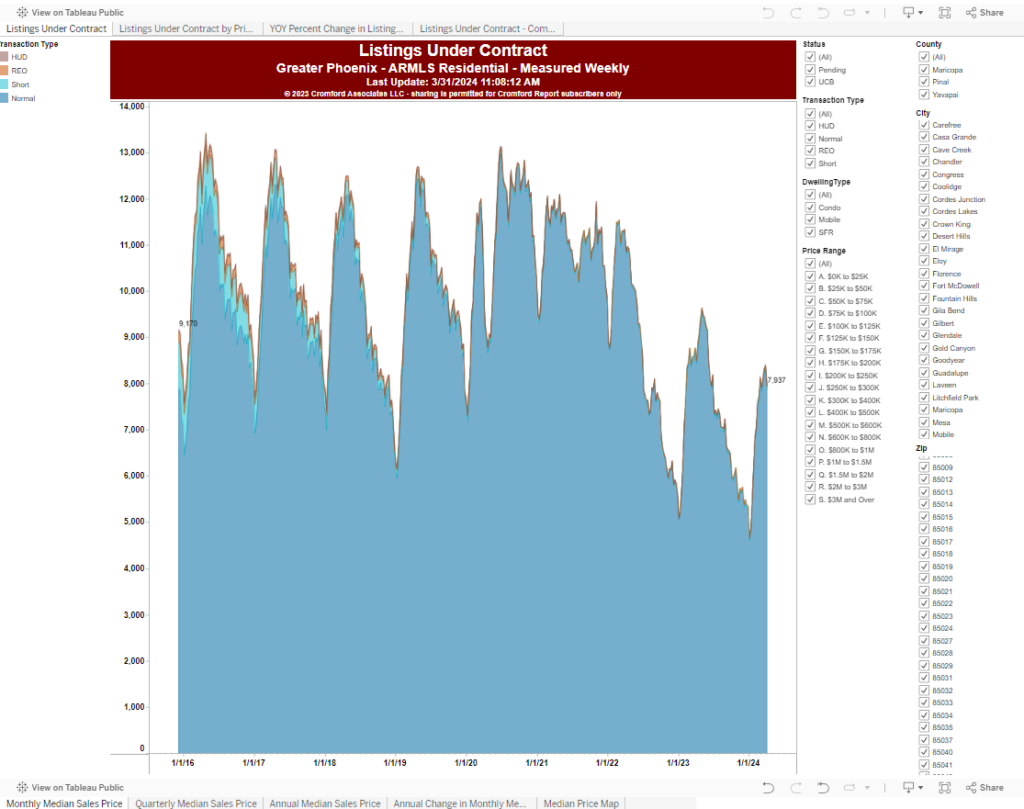

Today, I dove into housing data and decided to filter houses based on price to determine how it impacted sales numbers. The graph below illustrates Listings Under Contract up until March.

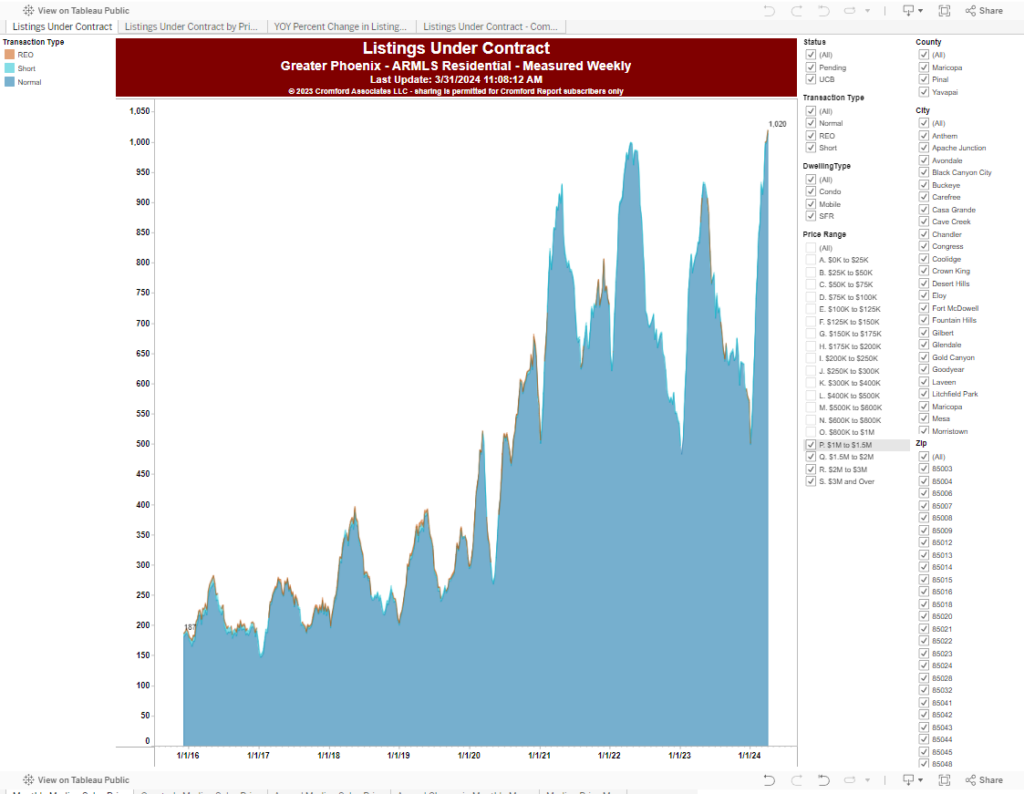

The overall findings are not particularly surprising. Last month, 8,401 listings were under contract, which represents a significant decrease compared to the last 10 years. Given the current interest rates, this is not unexpected. However, in the chart below when we focus on houses priced over $1M, an intriguing trend emerges. In March, 1,020 houses sold for more than $1M, its highest level ever. This indicates that affluent buyers are still actively purchasing expensive properties, at their fastest pace ever.

Inventory

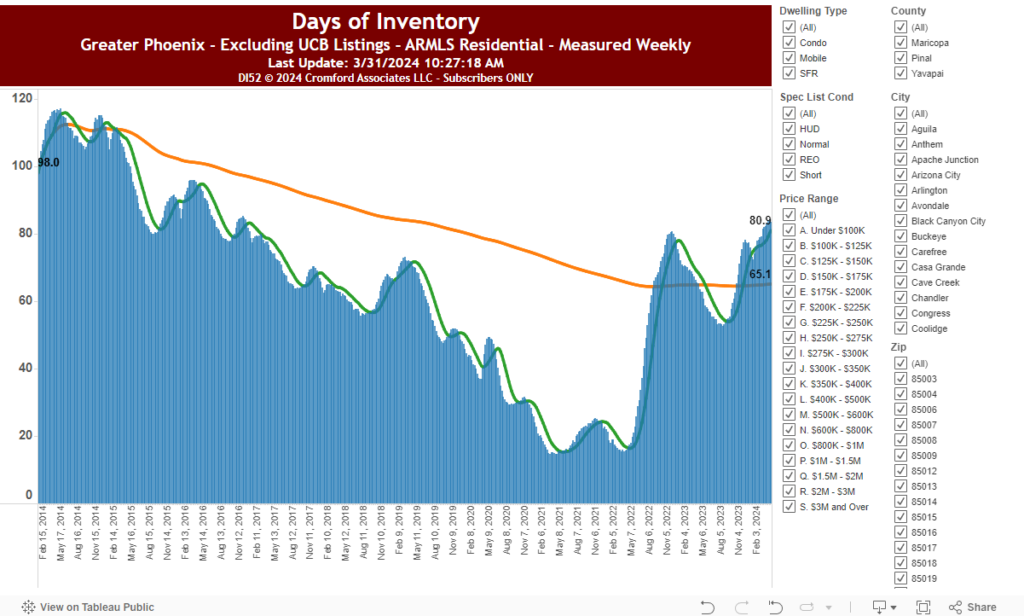

To gain a more comprehensive understanding of the market, let’s look at the days of inventory. For houses priced over $1M, the current days of inventory stand at 170 days, a notable increase from the low of 43 days. However, this figure is roughly equivalent to the levels observed in October 2020. While the trend is undoubtedly increasing, it’s crucial to consider the broader context.

When analyzing the days of inventory across all price points, we find that there are approximately 81 days of inventory, chart below. To find comparable levels, we must go back to December 2016. This suggests that the overall housing market is experiencing a severe slowdown, with inventory levels reaching heights not seen in almost a decade.

The divergence between the luxury segment and the overall market raises important questions about the factors driving demand and supply in different price ranges. While affluent buyers seem to be less affected by the current economic conditions, the broader market appears to be more sensitive to interest rates and other macroeconomic factors. So if you’re in the market for $1M+ house you might not see any good deals anytime soon. Or perhaps the demand for $1M+ houses is just latent to the overall market.