If you’re like me and live east of the US60 there is a good chance you were driving home one random day in November only to be hit with a barrage of rocks and other asphalt materials. The cause of this was neglect by ADOT when they ripped off the asphalt layer of the freeway and didn’t clean it up properly. If you drove through this you can get the repairs paid for by the state of Arizona. Below is how I filed my claim.

Here are the steps:

- Fill out this form – NOTICE OF CLAIM AGAINST THE STATE OF ARIZONA

- Get quotes to fix your vehicle and include them

- Take a picture of the damage print it out and send it with the form

- Take a picture of your registration and send it with the form

- Take a picture of your license plate and send it with the form

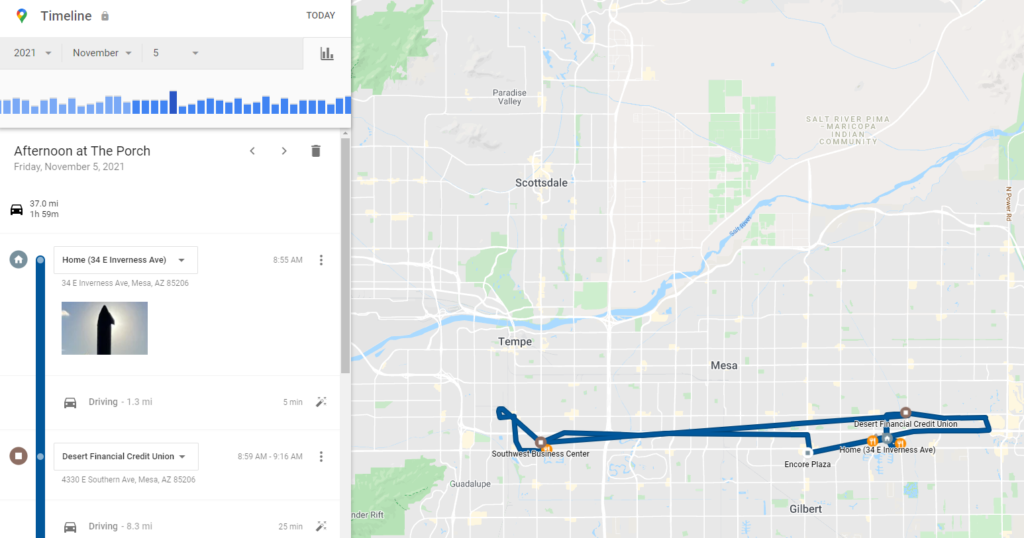

- Google tracks everywhere you go if this feature is turned on using something called Google Maps Timeline. I would include this as well showing travel through the area on that specific day. I don’t know if this is necessary but it makes it a lot harder to refudiate your claim. Here is my sample that I included.

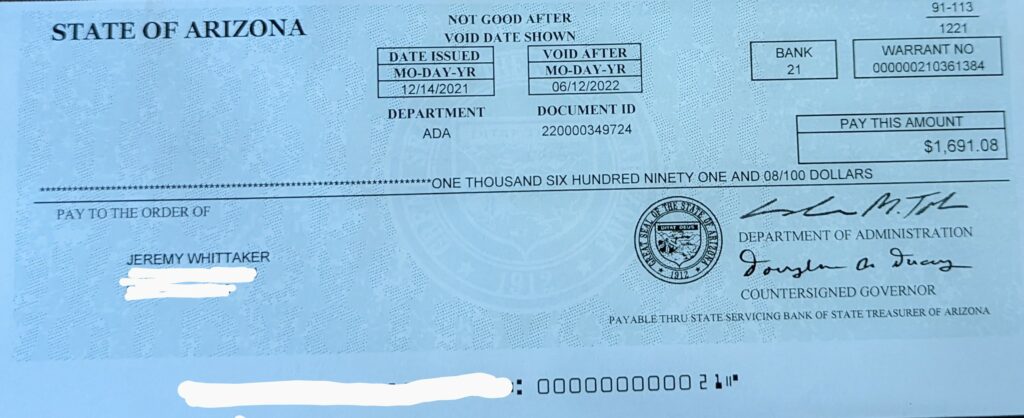

- Mail all of this to the Attorney General and if he’s not busy playing with nunchucks that day the state will send out an insurance adjuster they will then ask you to sign a form called “RELEASE OF ALL CLAIMS” and if everything checks out you will receive a check in the mail for your repairs.

And last step, cash check.