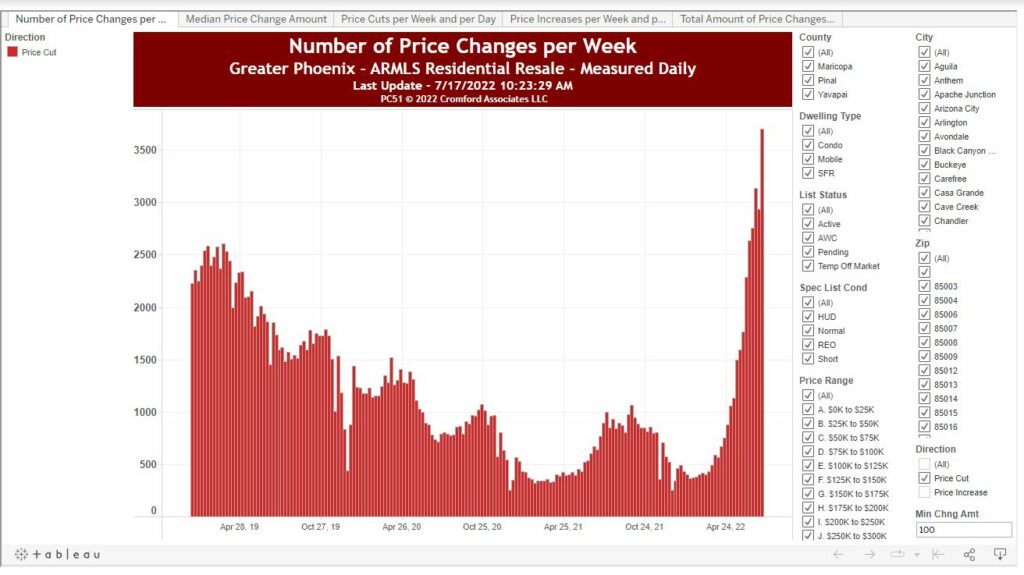

Price cuts continue to accelerate. Sellers are panicking. Typical at the top of a bull run. This is not good for housing prices.

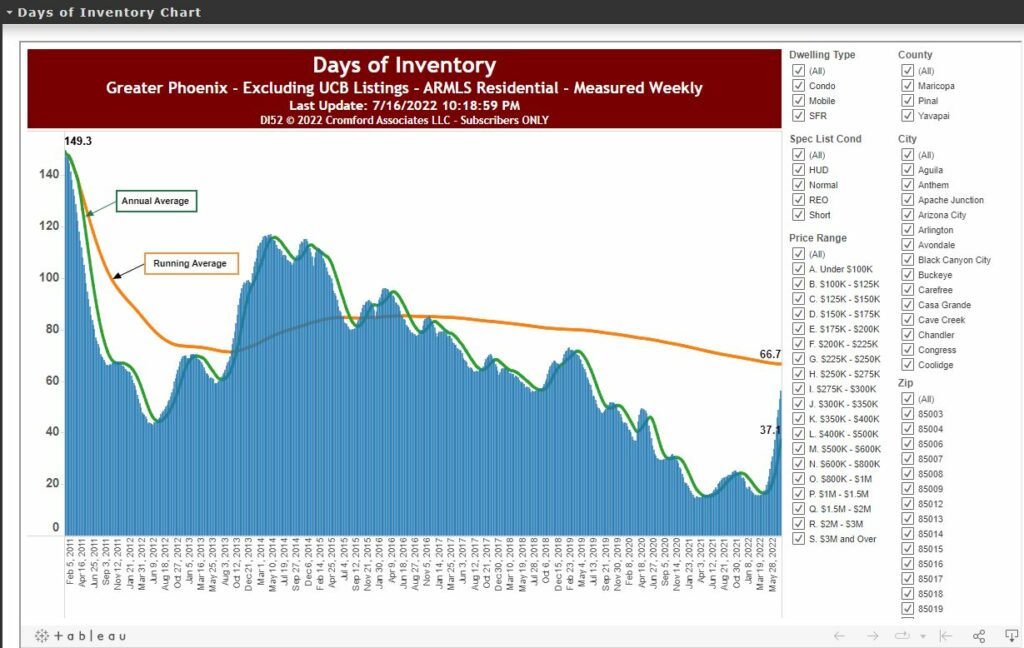

Inventory and months of supply are back to Jun 2019 levels.

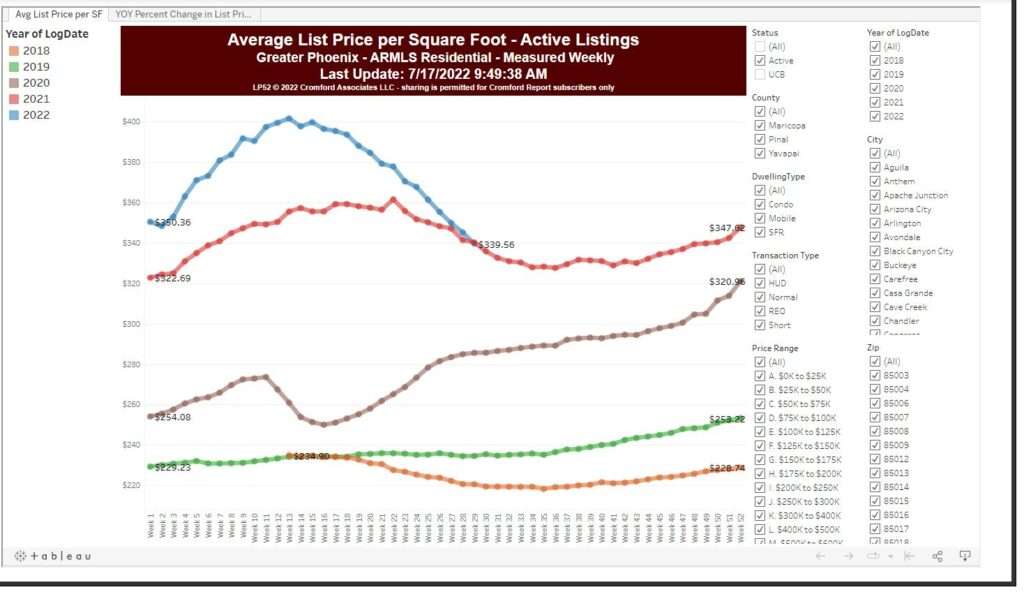

Albeit minimal the price per square foot is now lower than where it was a year ago meaning the one year ROI on a house is negative for the first time since… Um, well, I don’t know. None of the data shows house prices to have ever declined in the last 4 years. This is major sign the market has turned.

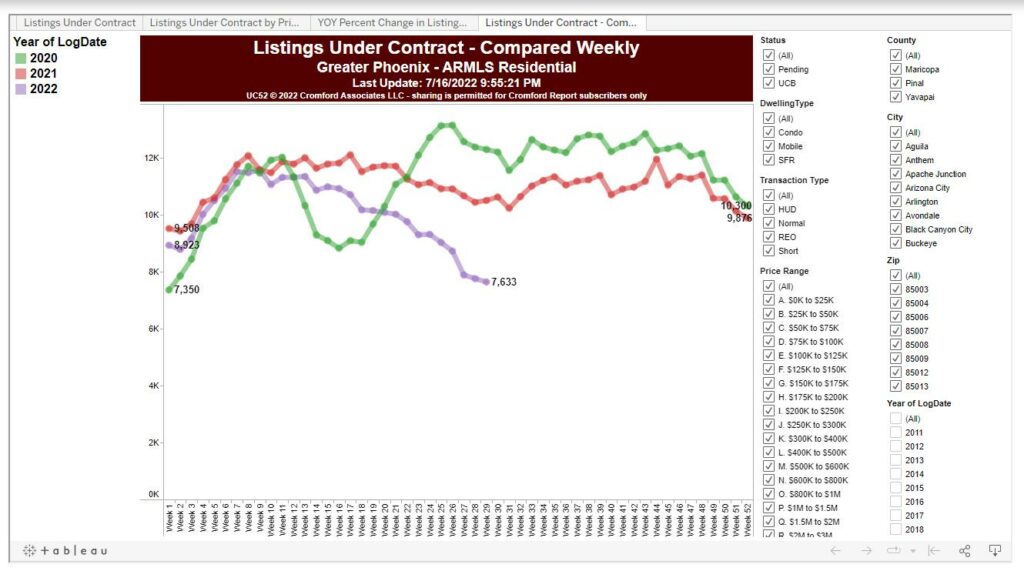

Despite the ‘low prices’ the listings under contract are the lowest they’ve been in 3 years. Also, a sign that buyers are telling sellers to keep their houses.

Don’t buy yet. But have your gunpowder ready. There will be deals soon. Don’t try to catch a falling knife.