A popular strategy that I have followed in my investments is crowdsourcing hedge fund manager investments. Many people don’t know this but any hedge fund that manages over $100 million dollars must report their stock holdings on a form called a 13f. This is filed with the SEC. There is a website that conveniently maps all of these filings so you can scan through your favorite investment manager and see what stocks they are buying and selling.

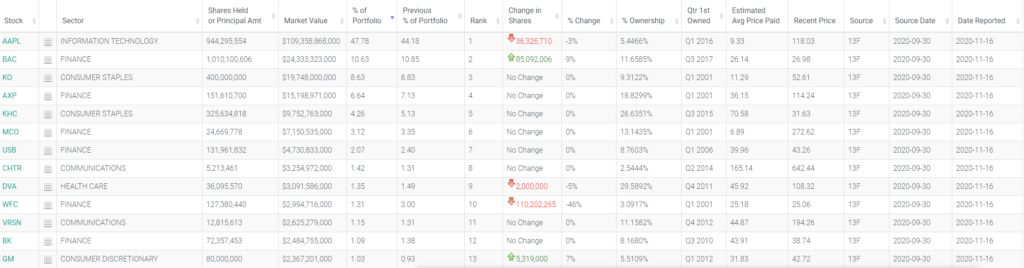

For instance, if you’re a fan of Warren Buffett and Charlie Munger you can take a look at Berkshire Hathaway’s holdings – https://whalewisdom.com/filer/berkshire-hathaway-inc Here is a list of their holdings which are over 1% of their portfolio

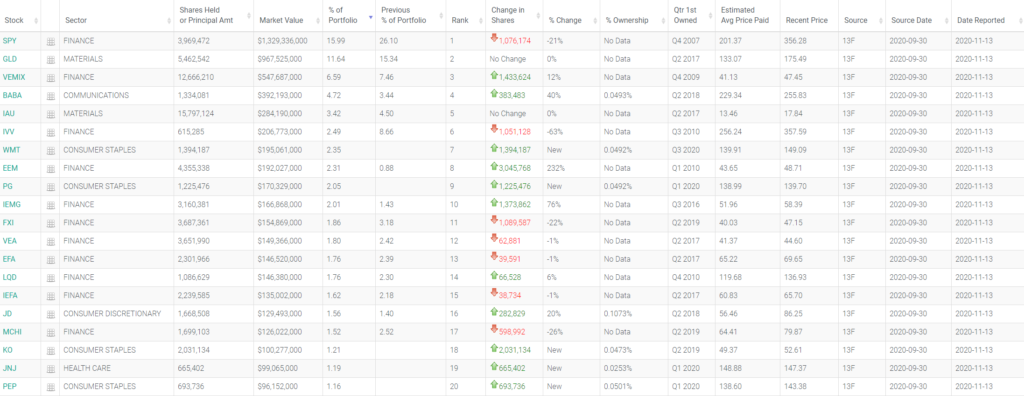

Or may be you’re a fan of Ray Dalio and you want to see what Bridgewater is holding? Here is a list of all their holdings that represent more than 1% of their portfolio.

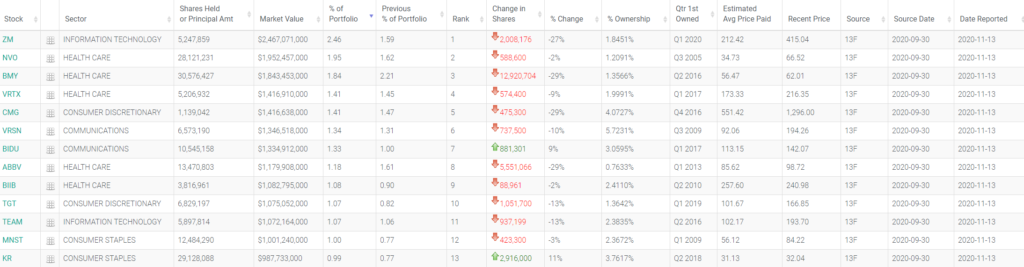

Let’s take a look at Jim Simon’s fund Renaissance Technologies.

You get the point. You are able to get some pretty good insight as to what massive hedge funds are buying.

WhaleIndex

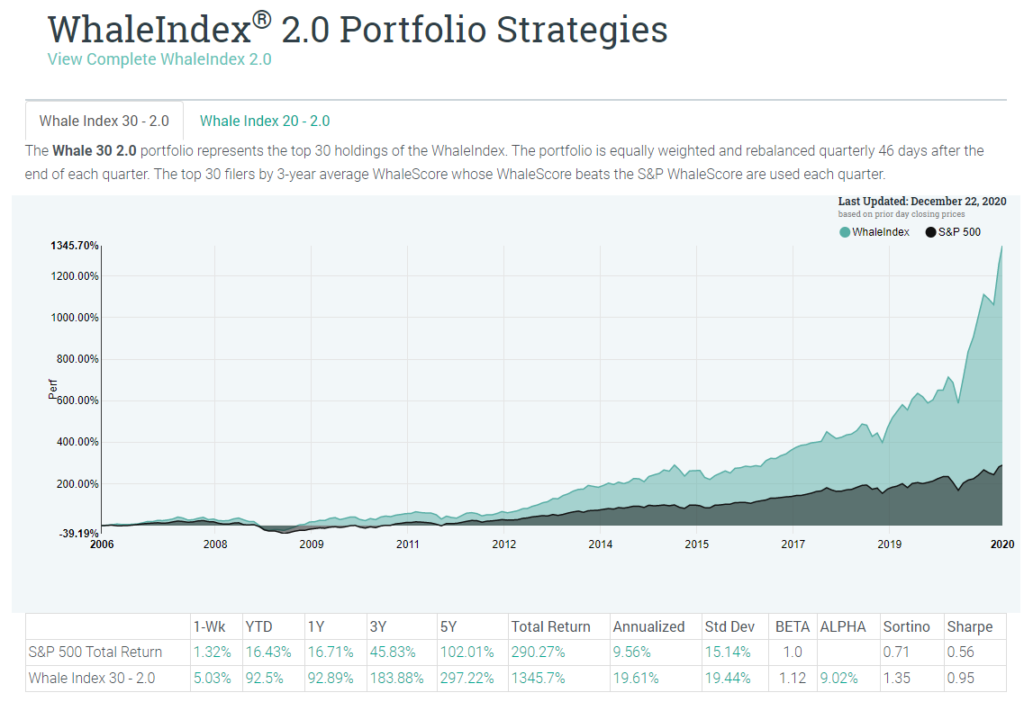

What I like about Whale Wisdom is they categorize the most successful hedge fund managers using what they refer to as a WhaleIndex.They then put together a list of 30 stocks based on successful fund managers. Some of their requirements are as follows.

- Between 5 and 750 holdings in their 13F filing

- At least 3 consecutive years of quarterly 13F filings

- Hold no fewer than five stocks in its portfolio

- Manage more than $100 million in marketable securities

- Hold at least 20% of its portfolio in its top 20 stocks

- Managers considered to be a bank, trust, pension, or insurance company are excluded

The top 40 managers who have maintained an average WhaleScore over the past 5-years higher than the five-year average WhaleScore of the S&P 500 is used in the WhaleIndex. Based on the holdings disclosed on their SEC filings, WhaleWisdom identifies the 100 stocks most commonly held among the respective managers’ 13F holdings.

The Whale Fund 2.0 is the one I follow. Since 2006 this strategy has yielded 1,345% – https://whalewisdom.com/whaleindex/portfolio_2_0

A few words of caution

13f filings come out 45 days after the quarter ends. This means the data is somewhat stale. It should also be noted that the fund could have purchased that stock at any time during the quarter. Meaning the data could be as old as 135 days. Secondly, funds are not required to report short positions or hedged positions. So you should not assume you know exactly what their portfolio consists of.

Broker

You’ll want to find a broker that allows for fractional investing if you don’t have enough money to buy full shares. Here are a couple for reference.

Firstrade – 4 free stocks with $100 deposit

Robinhood – Sign up link your bank account and get a free stock.

In Conclusion

Despite its downfalls, Whale Wisdom’s returns are still solid. While I wouldn’t recommend this strategy for your entire portfolio this is a good strategy to deploy a fixed percentage of your portfolio. There is also a book that written about this concept which you can find here – https://www.amazon.com/Invest-With-The-House-Hacking-ebook/dp/B01A3L1VEO and also an ETF that was created named VIP ETF