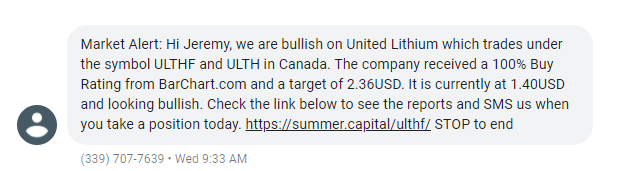

I woke up to this text message yesterday.

It was completely unsolicited and I have no idea what the source of it is. Could it be a potential pump and dump given the current market circumstances? Maybe… so I decided to dig a little into this company. It looks like it spiked a few years back and has been basically worthless for the last 3 years.

What’s interesting is it looks like it is being pumped again recently. Here is the last 2 years.

Zooming in closer it looks like there has been a massive amount of volume increase in the last 3 days. Hence my text message perhaps?

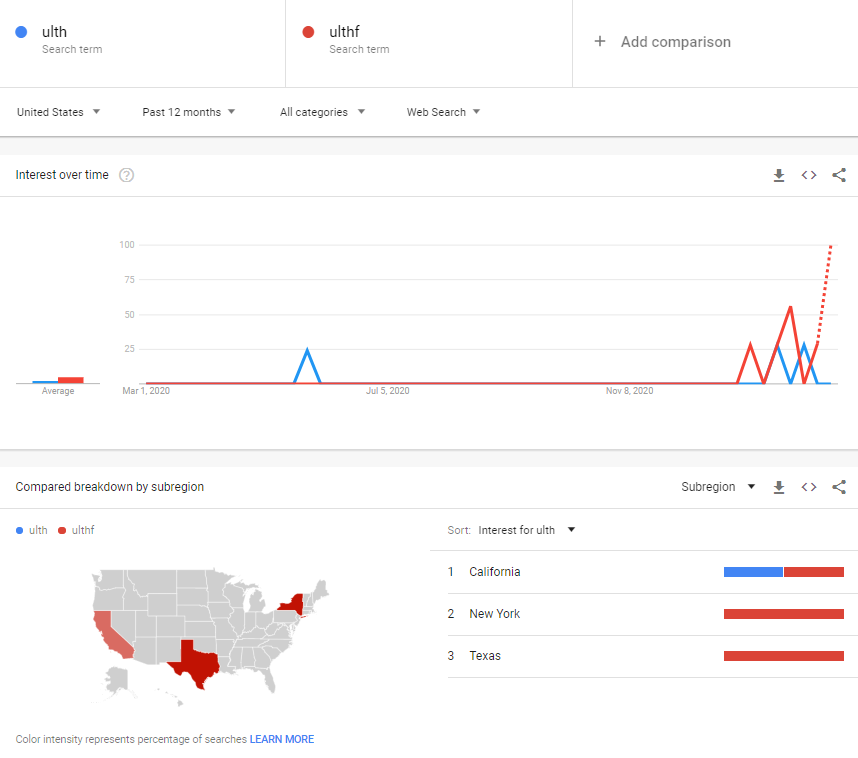

What about Google Trends did people recently just start searching for ULTH or ULTHF?

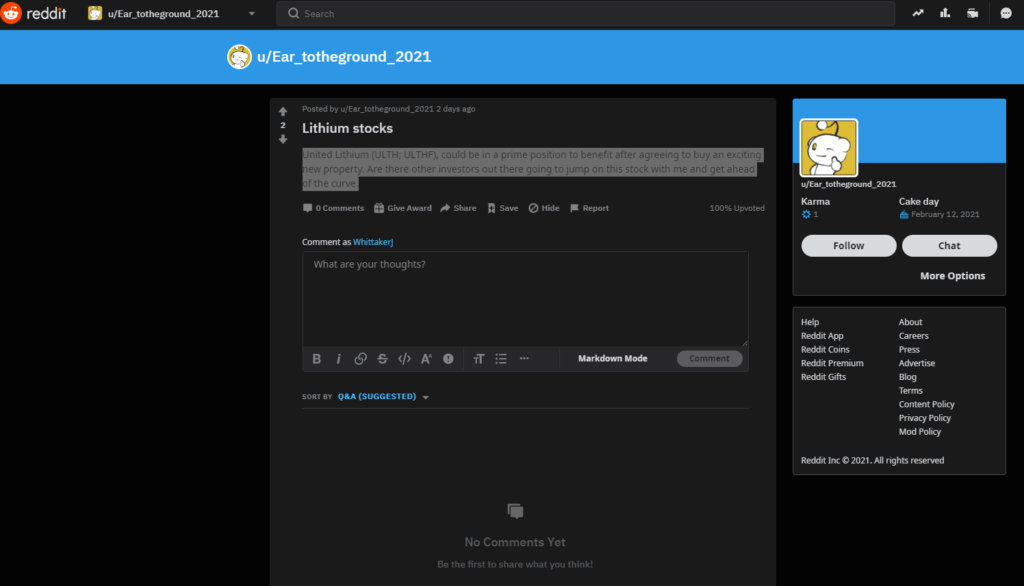

I wonder what reddit has to say.

Financials

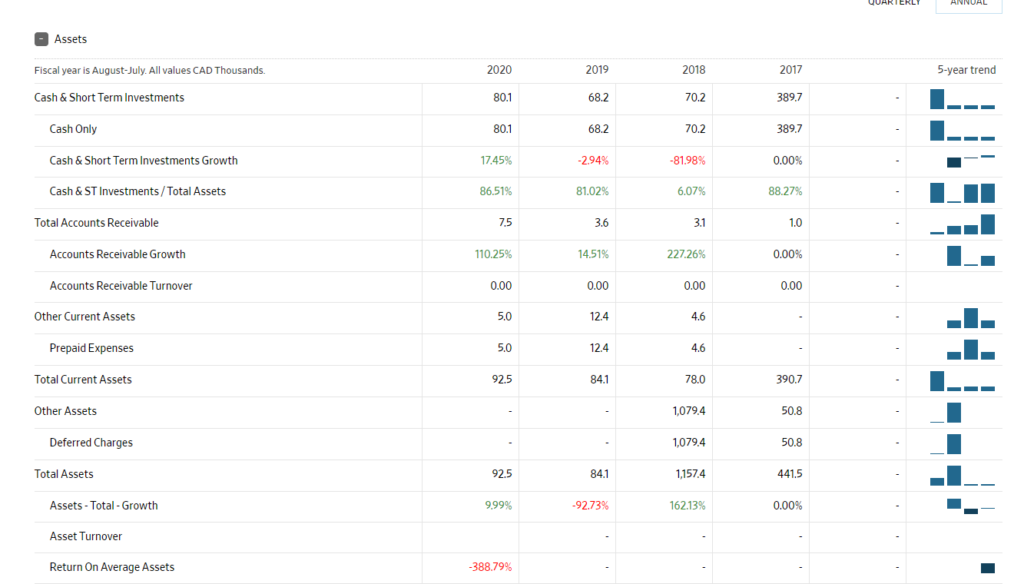

Finally, I wonder what their financials look like? Would I be comfortable holding this short position?

Let’s keep in mind this company has a market cap of $42m

But..

Only $80k in cash.

$7,500 in accounts receivable

$92k in assets

$323k in liabilities

-$5,032,200 in retaind earnings

But Lithium is rare and the price is about to explode!

So let’s take a look at LIT which is an ETF that holds a bunch of Lithium related stocks. https://www.globalxetfs.com/funds/lit/

As you can see from their holdings ULTHF is not listed. This adds further evidence this stock should be shorted. In fact, if you wanted to take a more market neutral approach to this trade you could go long an equal-weighted amount of LIT.

Time to get short

Seems like more pump and dump hype. I’m definitely going short.

I tried to get short on 2/24 @ 1.40 but my broker didn’t have any shares available.

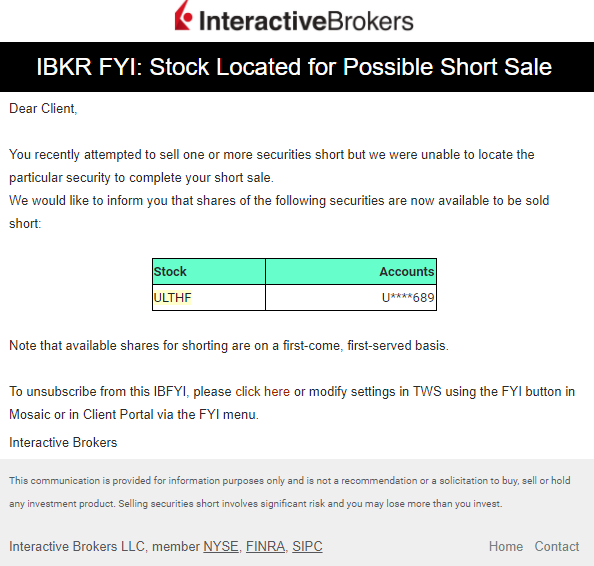

So I got an email this morning…

I was able to open a position this morning short @ 1.15. It has fallen already so I’m opening another short position @ 1.01. This trade would already be up 40% if it wasn’t rejected yesterday.