Last year during Covid I decided to purchase some silver options.

| 4/20/2020 | 25925191587 | Bought SLV Jan 21 2022 15.0 Call @ 3.25 |

| 4/20/2020 | 25925192864 | Bought SLV Jan 21 2022 15.0 Call @ 3.25 |

| 4/21/2020 | 25951958123 | Bought SLV Jan 21 2022 20.0 Call @ 2.03 |

| 5/15/2020 | 26407463083 | Bought SLV Jan 21 2022 30.0 Call @ 1.15 |

| 5/28/2020 | 26590777533 | Bought SLV Jan 21 2022 19.0 Call @ 2.59 |

Reasons for the trade

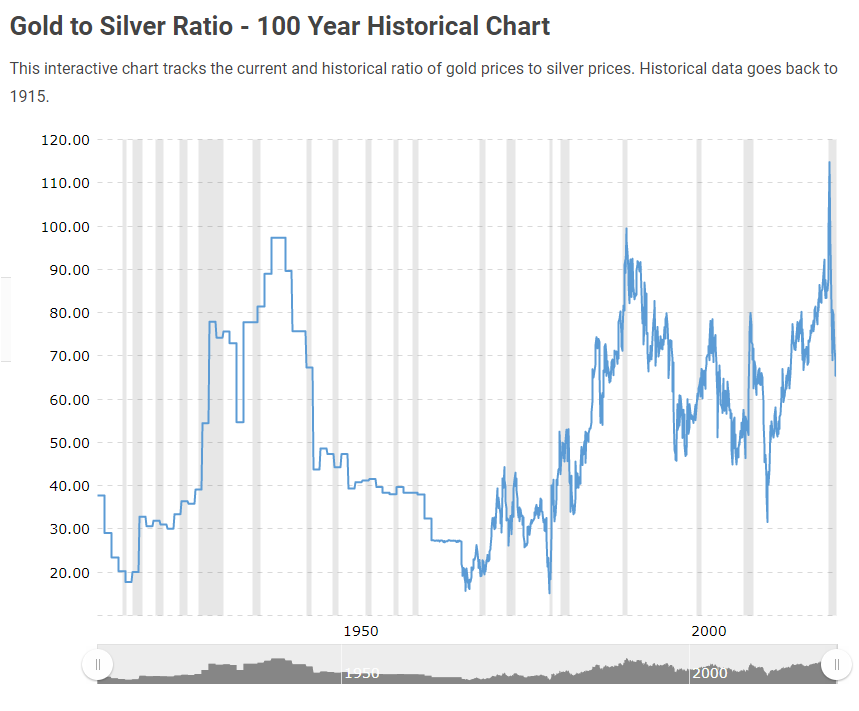

- Gold/Silver ratio was the highest it’s been in years.

- Covid was sure to send the government into a massive printing spree.

- Silver is the “poor man’s gold” most people could afford to buy it.

- APMEX.com where I buy my precious metals had a huge spread on silver over spot price.

Exiting the Trade

I’ve now closed this trade with 121% in profit. What is funny is the profit came the same week I initially made the purchase. I just held it for a long time because I thought the government’s printing press would push it a lot further. However, I’m starting to lose confidence in precious metals as a hedge to government printing, for the short term anyway. I more so think we’ll see inflation and as that loses control a shift to precious metals as a hedge to wealth preservation. I’m keeping my VDC(Vanguard Consumer Staples ETF) position open for now.

| 3/10/2021 | 33321473374 | Sold SLV Jan 21 2022 30.0 Call @ 1.94 |

| 3/10/2021 | 33321512258 | Sold SLV Jan 21 2022 19.0 Call @ 6.25 |

| 3/10/2021 | 33321508484 | Sold SLV Jan 21 2022 15.0 Call @ 9.5 |

| 3/10/2021 | 33321479857 | Sold SLV Jan 21 2022 20.0 Call @ 5.59 |

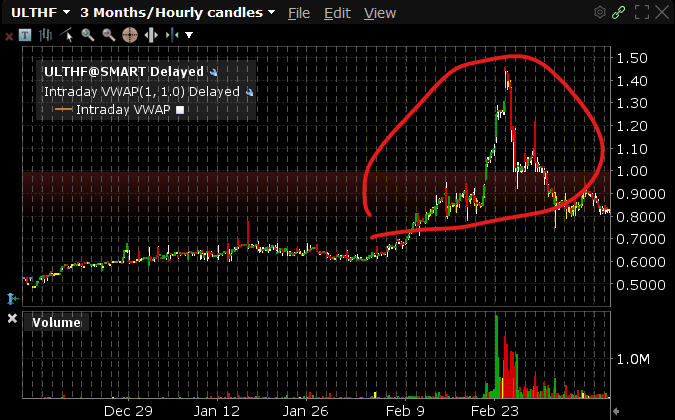

Keeping the trade open

I think there is plenty of reason for someone to keep a trade open based on some of the supply volatility we’ve seen over the last couple of months. However, my precious metals positions are getting hit pretty hard lately and I’m not sure I want to maintain this trade.

I should also note I still maintain 1-2% of my net worth in physical silver. The target is 1% but the fluctuation comes from price increases.