If you’re like me you probably have money sitting in your checking, savings, or money-market account. Paying practically zero interest and getting eaten alive by inflation. Here’s what you can do to earn 7.12% on that money and get inflation-adjusted returns on your excess cash.

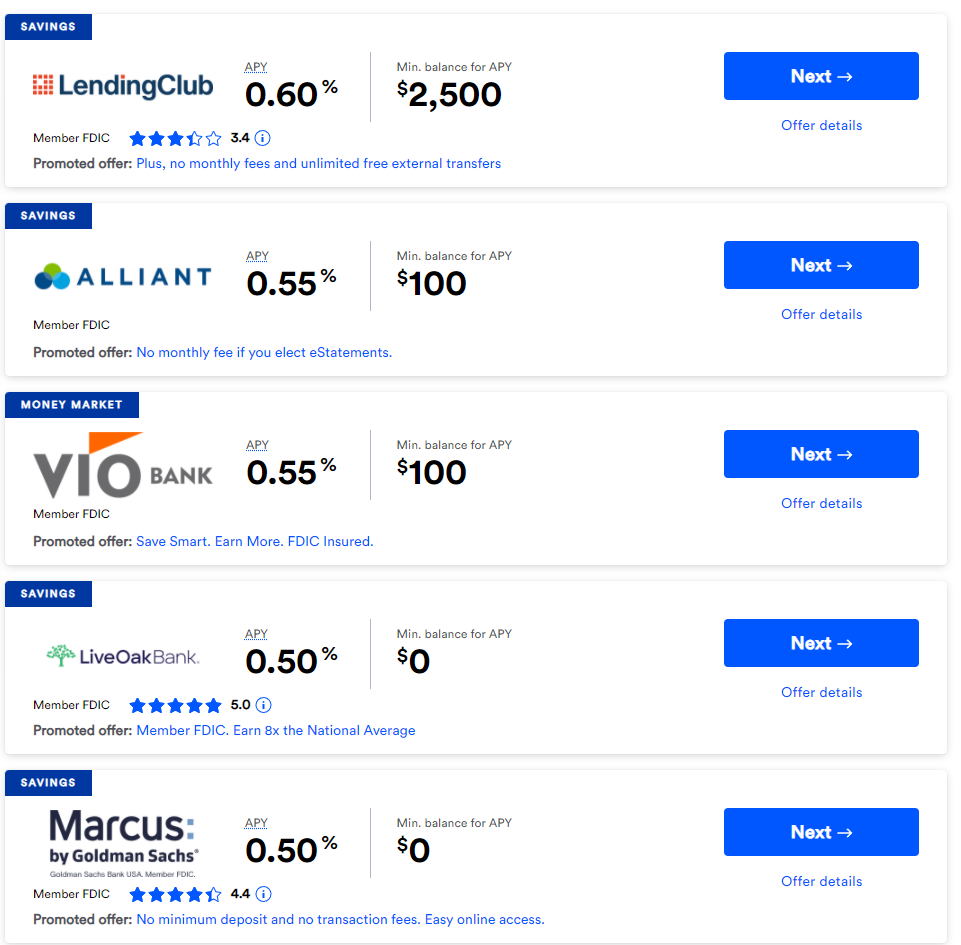

Yield on savings and checking accounts are horrible

If you’re like me you’re probably trying to move your liquid funds around into these high-yield savings accounts which aren’t exactly keeping up with inflation. In fact, to date, the highest I can find is LendingClub at 0.60%

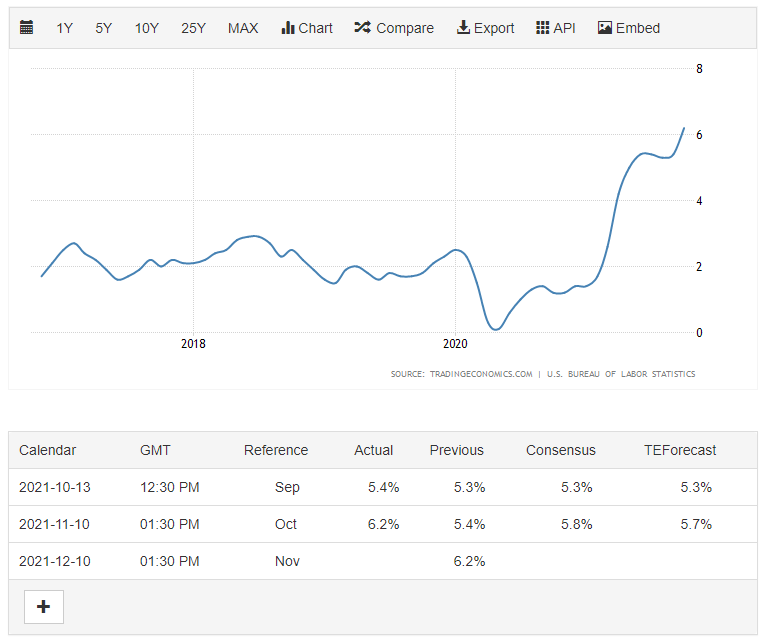

Inflation is a regressive tax on the poor and middle class

The annual inflation rate in the US has surged to 6.2% in October to 2021 according to the US Bureau of Labor and Statistics. This means your buying power is dropping significantly if you are holding on to cash. You of course know this if you have bought anything recently.

Use I bonds for risk-free inflation-adjusted return on your cash

To get the 7.12% yield you can buy I bonds which are backed by the United States government. They are inflation-adjusted. Meaning, you’re not technically building any wealth but you’re also not allowing the government to steal it through inflation. You can read more about how the rate is calculated here.

- I bonds are an excellent investment rather than holding cash

- They are exempt from state and local taxes

- Subject to federal taxes.

- Tax-deferred until you redeem them.

- Mature in 30-years or until you redeem them

- Redeemable after the first year of purchase

- Early redemption is penalized with 3-months worth of interest

- Interest is compounded every 6-months

- Your money is locked up for a duration of 1-year

Historical I bond rates

| Period when you bought your I bond | Composite rate for your six-month earning period starting during November 2021 – April 2022 (See “When does my bond change rates?”) | |

|---|---|---|

| From | Through | |

| Nov. 2021 | Apr. 2022 | 7.12% |

| May 2021 | Oct. 2021 | 7.12% |

| Nov. 2020 | Apr. 2021 | 7.12% |

| May 2020 | Oct. 2020 | 7.12% |

| Nov. 2019 | Apr. 2020 | 7.33% |

| May 2019 | Oct. 2019 | 7.64% |

| Nov. 2018 | Apr. 2019 | 7.64% |

| May 2018 | Oct. 2018 | 7.43% |

| Nov. 2017 | Apr. 2018 | 7.22% |

| May 2017 | Oct. 2017 | 7.12% |

| Nov. 2016 | Apr. 2017 | 7.12% |

| May 2016 | Oct. 2016 | 7.22% |

| Nov. 2015 | Apr. 2016 | 7.22% |

| May 2015 | Oct. 2015 | 7.12% |

| Nov. 2014 | Apr. 2015 | 7.12% |

| May 2014 | Oct. 2014 | 7.22% |

| Nov. 2013 | Apr. 2014 | 7.33% |

| May 2013 | Oct. 2013 | 7.12% |

| Nov. 2012 | Apr. 2013 | 7.12% |

| May 2012 | Oct. 2012 | 7.12% |

| Nov. 2011 | Apr. 2012 | 7.12% |

| May 2011 | Oct. 2011 | 7.12% |

| Nov. 2010 | Apr. 2011 | 7.12% |

| May 2010 | Oct. 2010 | 7.33% |

| Nov. 2009 | Apr. 2010 | 7.43% |

| May 2009 | Oct. 2009 | 7.22% |

| Nov. 2008 | Apr. 2009 | 7.84% |

| May 2008 | Oct. 2008 | 7.12% |

| Nov. 2007 | Apr. 2008 | 8.36% |

| May 2007 | Oct. 2007 | 8.47% |

| Nov. 2006 | Apr. 2007 | 8.57% |

| May 2006 | Oct. 2006 | 8.57% |

| Nov. 2005 | Apr. 2006 | 8.16% |

| May 2005 | Oct. 2005 | 8.36% |

| Nov. 2004 | Apr. 2005 | 8.16% |

| May 2004 | Oct. 2004 | 8.16% |

| Nov. 2003 | Apr. 2004 | 8.26% |

| May 2003 | Oct. 2003 | 8.26% |

| Nov. 2002 | Apr. 2003 | 8.78% |

| May 2002 | Oct. 2002 | 9.19% |

| Nov. 2001 | Apr. 2002 | 9.19% |

| May 2001 | Oct. 2001 | 10.23% |

| Nov. 2000 | Apr. 2001 | 10.64% |

| May 2000 | Oct. 2000 | 10.85% |

| Nov. 1999 | Apr. 2000 | 10.64% |

| May 1999 | Oct. 1999 | 10.54% |

| Nov. 1998 | Apr. 1999 | 10.54% |

| Sept. 1998 | Oct. 1998 | 10.64% |

Here’s how you can buy I bonds

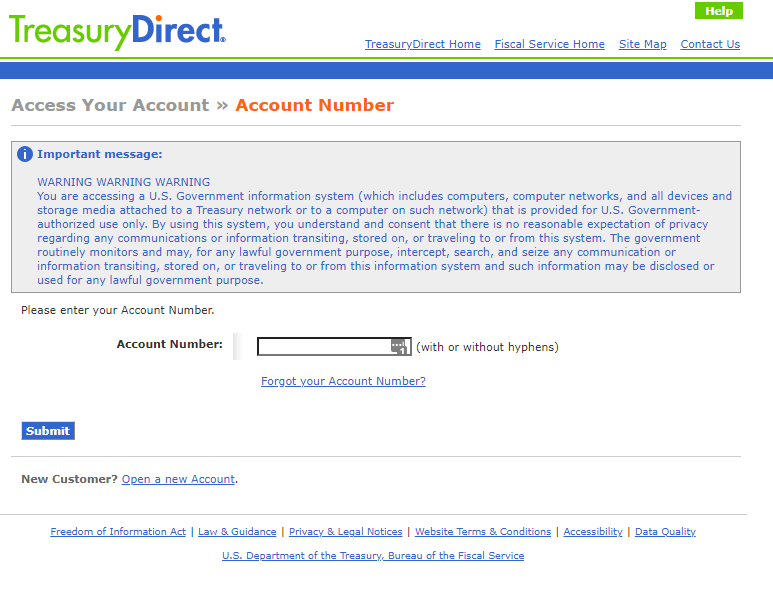

The first step is to sign up for a TreasuryDirect account which can be done here.

Once your account is set up you can log in here. You should have received your account number via email confirmation.

Once logged in you’ll see this screen.

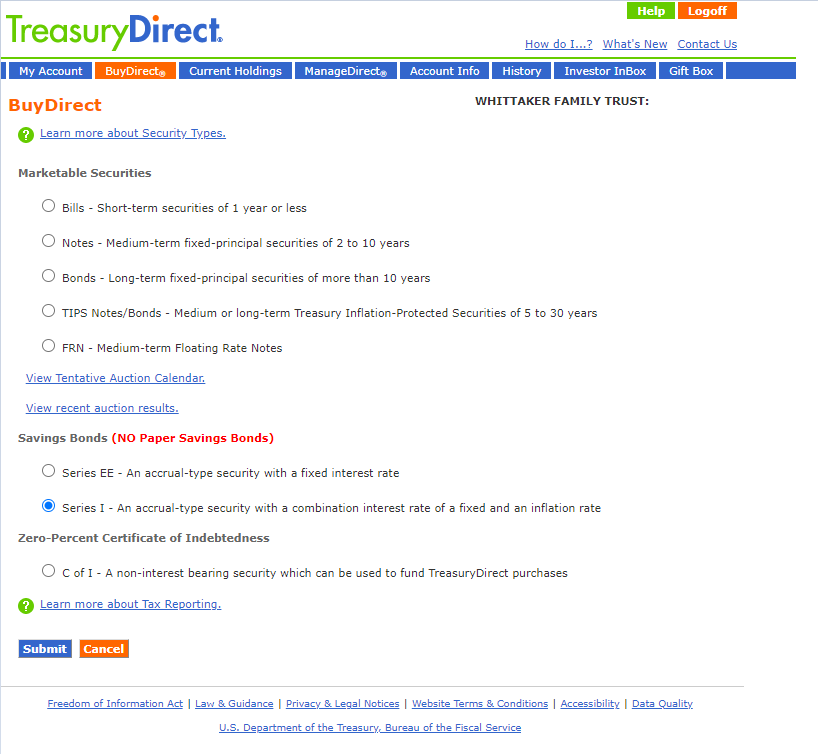

Click on the BuyDirect option at the top. You’ll want to select series I bonds.

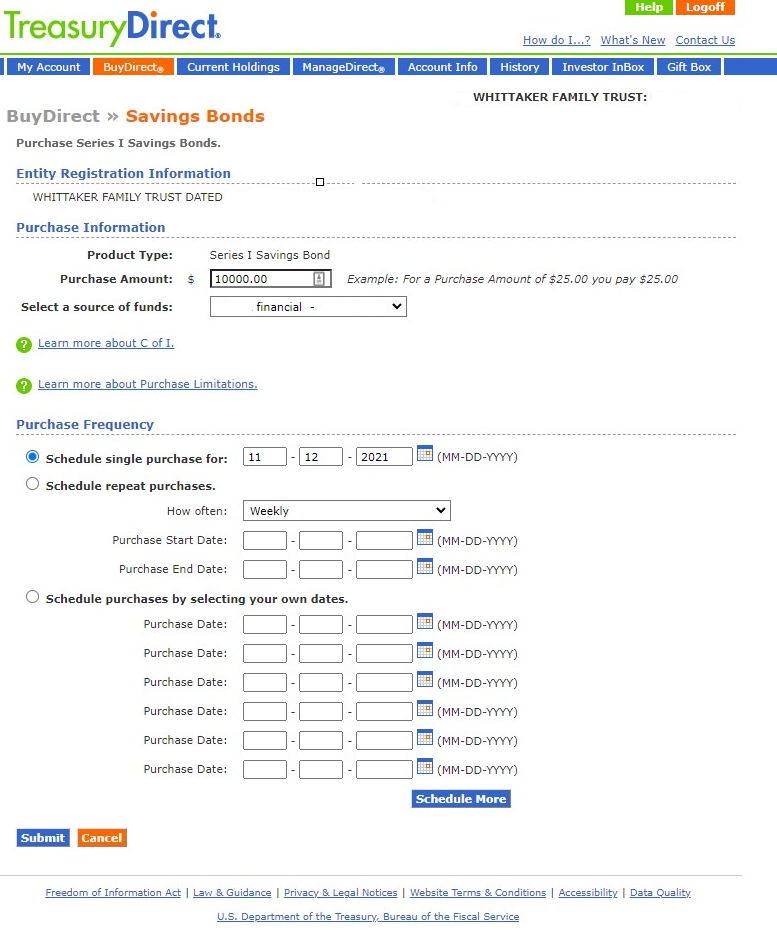

The most you can buy per social security number is $10,000/year

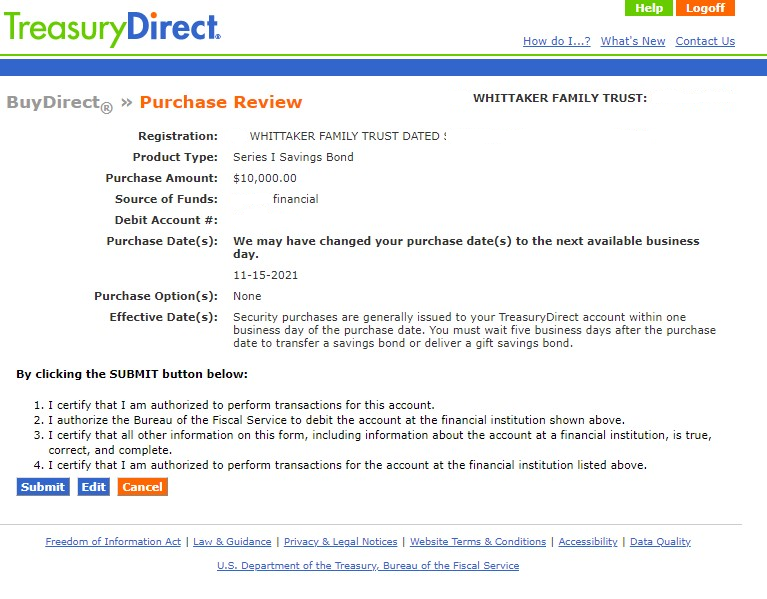

That’s it. Click submit.

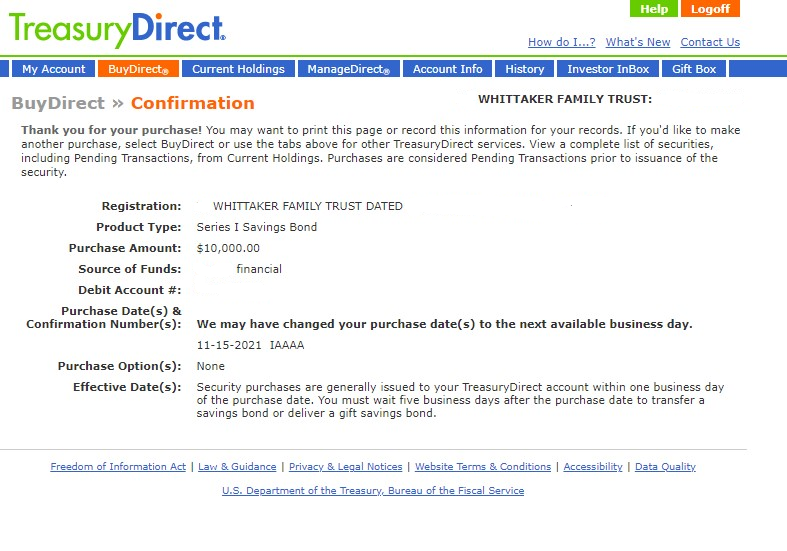

And finally your confirmation page. Pretty simple and straightforward process.

Have kids?

If you have kids you can gift $10,000/year to them as well in I bonds. Read more on gifting I bonds here.

Want to purchase $5,000 more in I bonds every year?

You are also allowed to buy an additional $5,000 worth of I bonds every year with your tax return. That is of course if you have a tax return. You can do this by overpaying your taxes intentionally to the IRS via their website, here. I wouldn’t overpay by exactly $5,000 but probably an amount over. You can read more of the details on that process here. They are going to send you paper I bonds so you will want to convert them and attach them to your online account for ease of management. You buy I bonds with your tax return by submitting tax form 8888 with your taxes

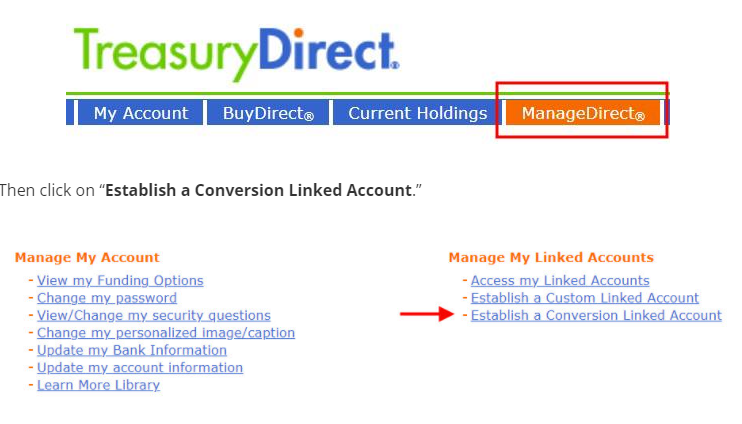

Converting your I bonds to treasury direct electronic format

Directions on this process can be found on the treasury direct website, here.

You will need to create a conversion account one time.

You then need to create a registration list that matches the paper bond ownership that is printed on the paper bonds.