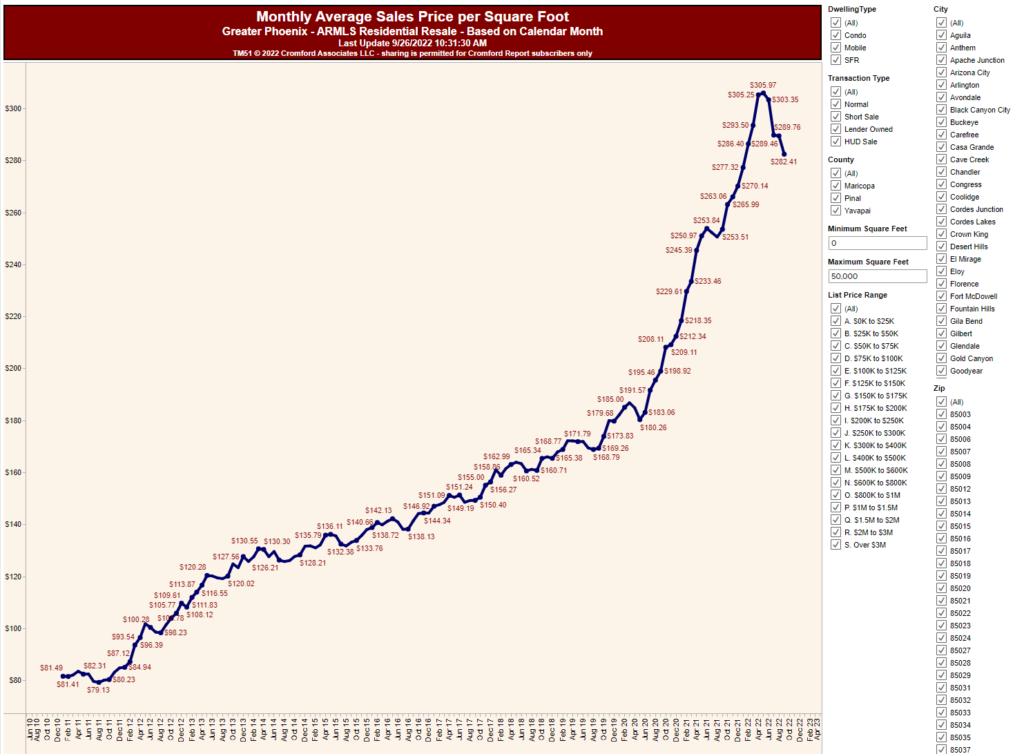

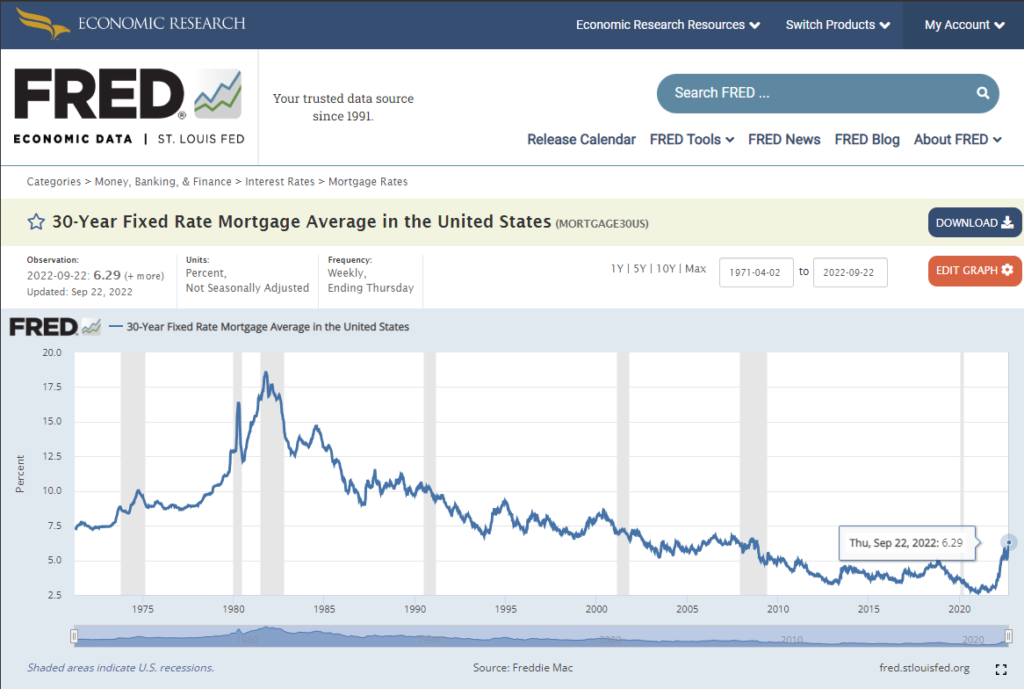

The real estate market continues to get wrecked by the FED rate increases. From a valuation perspective. But most people I would argue don’t care about the price of a house as much as they do about the monthly payment. This is a combination of price and interest rate. So I wanted to create a dataset that shows the average house price with the median sales price. This will tell you what the average person’s monthly mortgage payment is.

So here goes. The current average 30-year mortgage rate is 6.29% as of September 22, 2022.

We can take that and use Google Sheet’s formula to determine the monthly payment. It looks like this.

=-PMT(INT RATE/12,30*12,SALES PRICE)

I’m assuming zero down payment simply to hold this variable constant. What you can see here is the monthly payment currently is $2,728. This actually tops June’s monthly payment of $2,714. This means monthly mortgage payments adjusted for increased interest rates have not actually fallen at all. They are at their highest level ever.

This data is for Arizona specifically.

So while house prices are actually down 20% from their $480,000 median peak. Mortgages are actually higher.

The entire dataset, worksheet, and formulas can be found here.

So where do I think prices go from here?

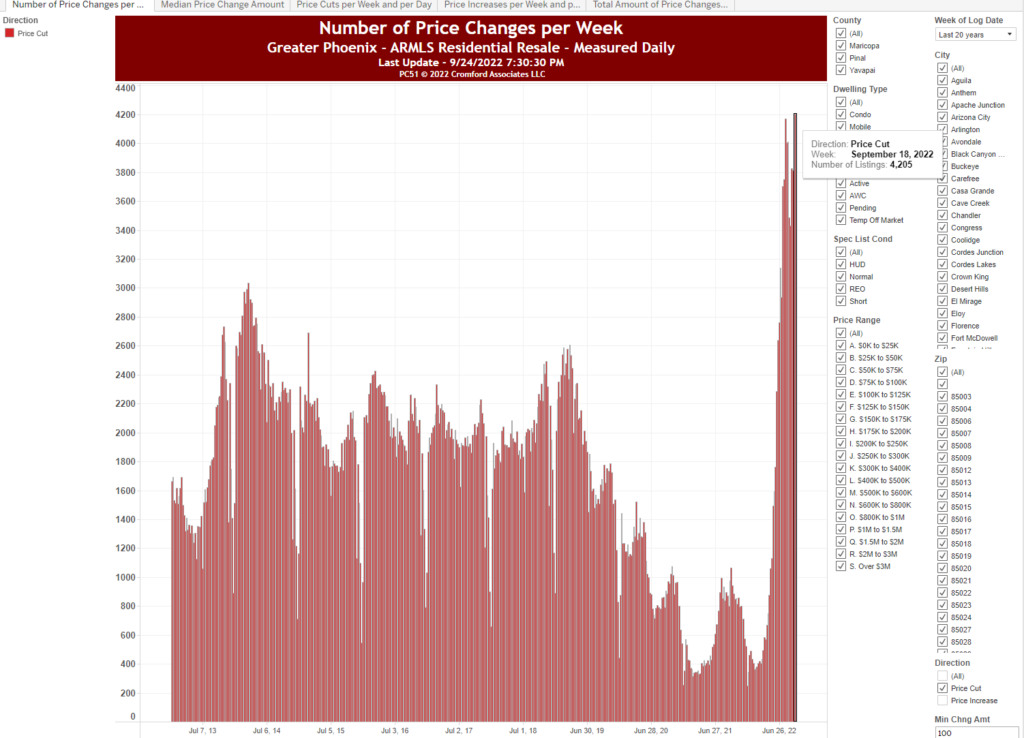

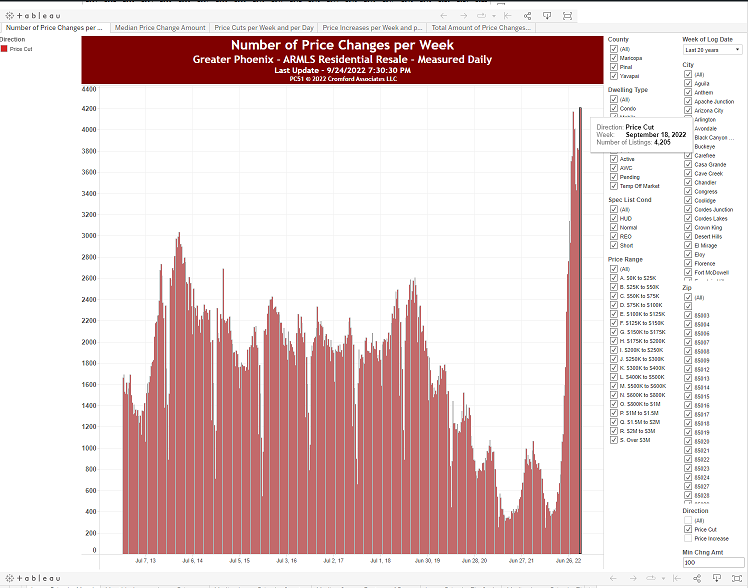

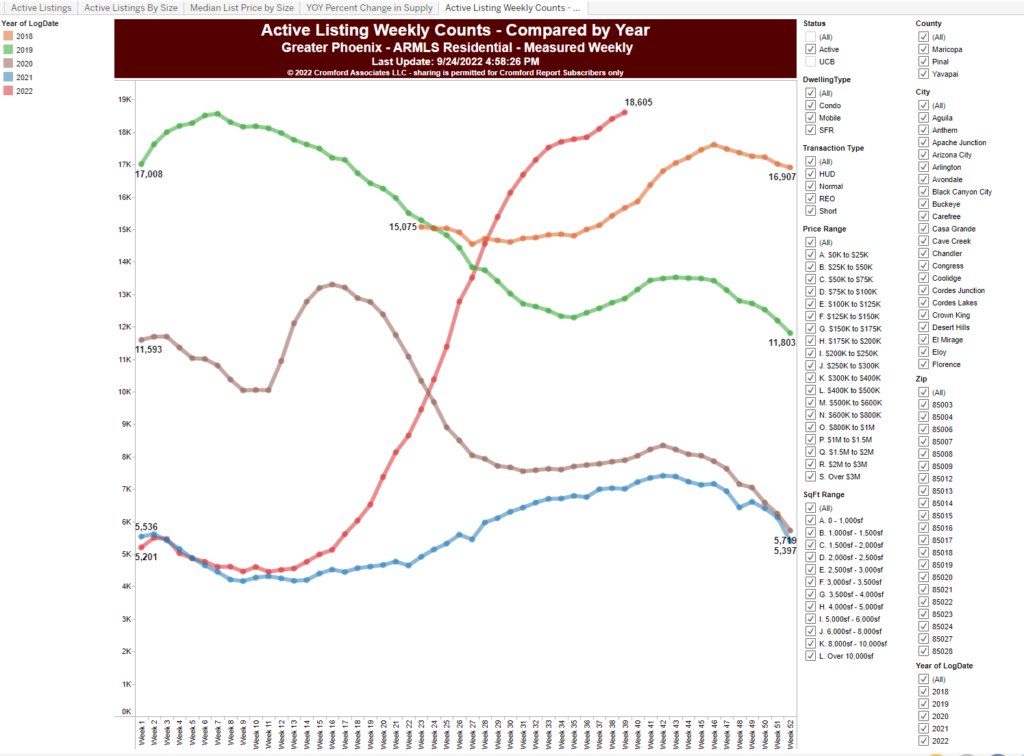

If you look at the current 1-year average in mortgage payments the amount is $2,353. If we reverse the equation we used above with current rates then houses would need to be $381,00 just to revert back to the 1-year mean. This would mean we would need a 13.6% drop from this month’s current median sales price of $441,125 or a 20% drop from the peak price of $480,000 in May. Remember this is simply to get back to the 1-year average mortgage payment price. Market’s oversell and overshoot to the downside. The psychology of sellers with over 4,000 price cuts a week could mean things will get brutal.