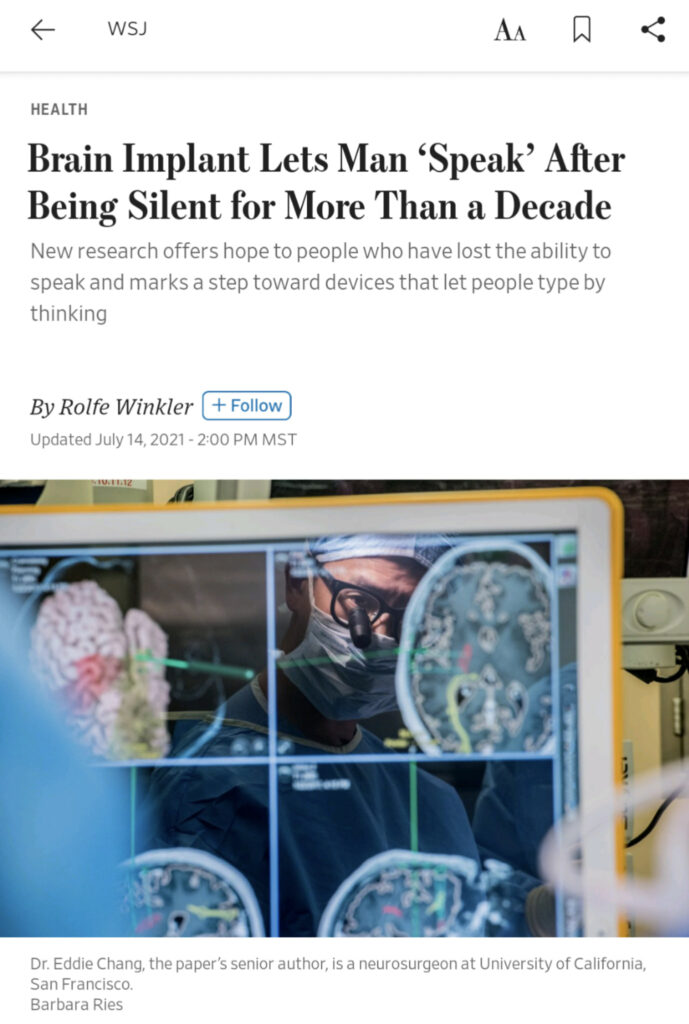

I was reading this article today from the Wall Street Journal – Brain Implant Lets Man ‘Speak’ After Being Silent for More Than a Decade(Original article from the New England Journal of Medecine). It begs the question, are we living in a simulation?

It may be a good time to watch the movie, The Matrix. Perhaps it wasn’t so far-fetched after all.

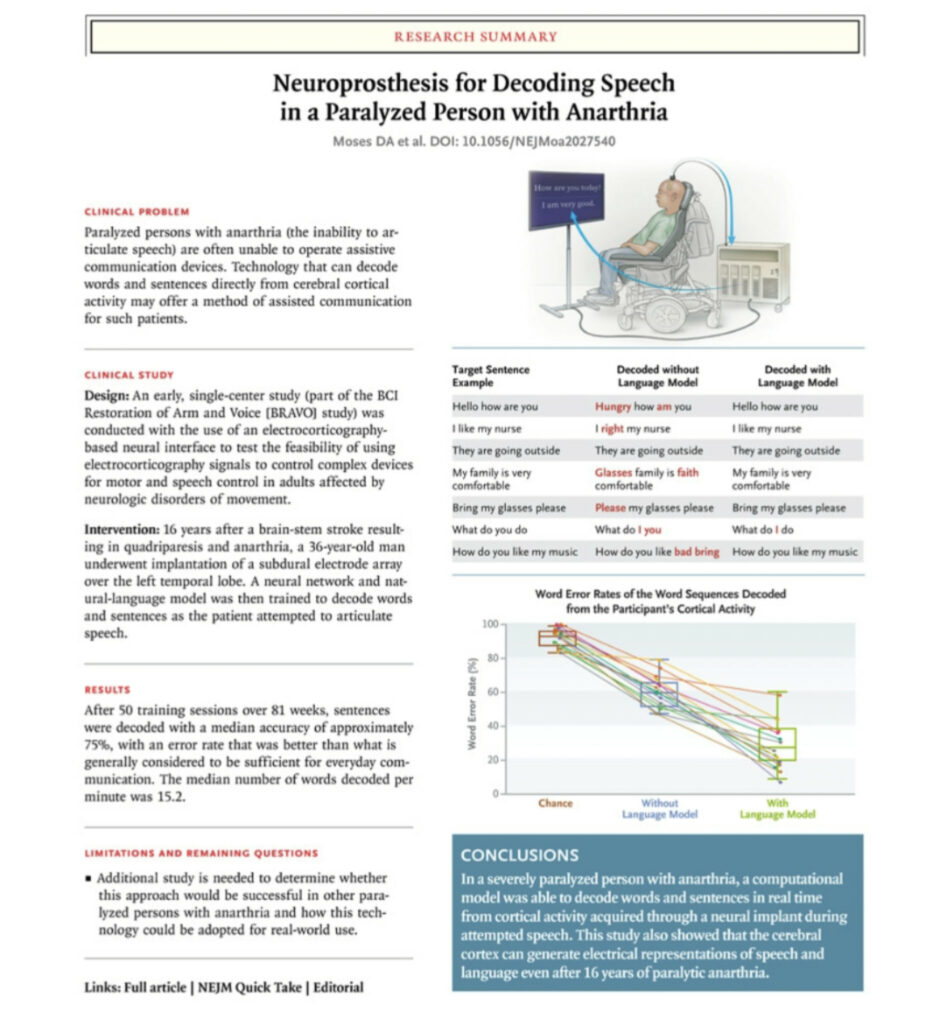

Here is a brief overview of the concept of the technology.

This means we’ll be able to communicate with each other without ever speaking or hearing. The concept is amazing if you take a second to think about it. Computers are interpreting our senses. They are reading the signals from this man’s brain, pushing those through a deep neural network, and decoding those signals into sentences.

- Imagine tasting without ever putting anything in your mouth.

- Imagine smelling without ever sniffing.

- Imagine seeing without ever opening your eyes.

- Imagine talking without opening your mouth.

- Imagine hearing but there is no noise.

Once this technology emerges there is no reason why the matrix could/does not exist. In fact, it makes it difficult to argue that you may potentially be living in a simulation currently. Keep an eye on Elon Musk’s Neuralink.