A few years ago Facebook decided to open source Prophet. This is their analytics algorithm that uses an additive model to fit non-linear data with seasonality. I started to wonder, “If this algorithm were in place in March when the stock market’s crashed what would it have advised?” So I decided to give it a spin.

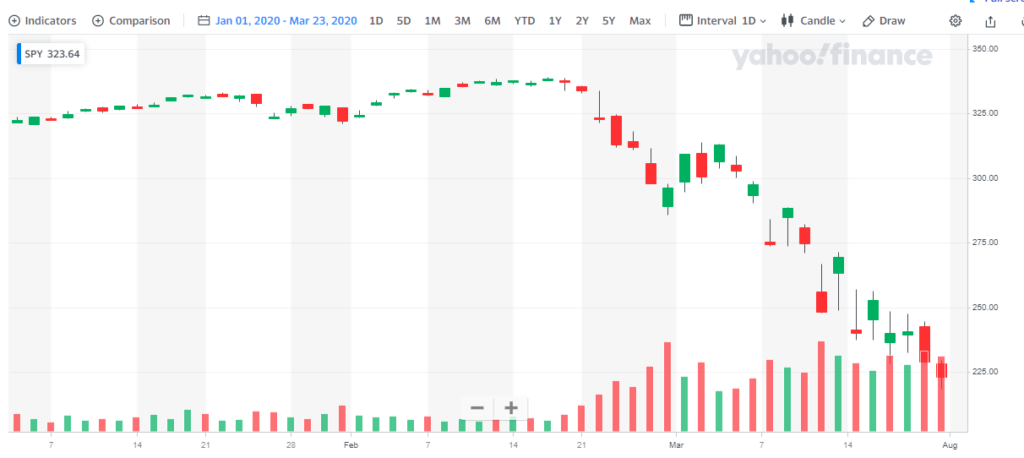

Let’s assume you had a significant amount of money invested in S&P index funds on March 23, 2020. Since the beginning of the year, you would have lost 31% of your money. At this point you might be thinking, “Oh shit, what do I do, sell, buy, hold?”. A lot of investors would panic and sell. The market thrives and two psychologies, fear and greed.

But let’s take an analytics approach to this problem. What would Facebook’s Prophet algorithm advise you do to? Here is how you can approach that problem.

The first thing I did was fire up Google Colab. The entire notebook can be found here.

The first part of this code uses a Python DataReader to pull SPY from Yahoo Finance. I created an end date of 3/23/2020. This only gives Facebook’s Prophet access to data up until this point. We are then going to have it predict where it thinks the price would be today 8/20/2020 without feeding it any future data.

# Python

import pandas as pd

from fbprophet import Prophet

from pandas_datareader import data as web

import datetime

import pandas as pd

import matplotlib.pyplot as plt

stock = 'spy'

endDate = datetime.datetime(2020, 3, 23)

#start_date = (datetime.datetime.now() - datetime.timedelta(days=2000)).strftime("%m-%d-%Y")

start_date = (endDate - datetime.timedelta(days=2000)).strftime("%m-%d-%Y")

#print(start_date)

df = web.DataReader(stock, data_source='yahoo', start=start_date,end=endDate)

#date is the index so you need to make it a column

df["Date"] = df.index

import matplotlib.pyplot as plt

plt.plot(df['Close'])

df.head()

df.tail()The next part of code renames the imported columns from “Date” to “ds” and “Close” to “y”. DS and Y are the two variables that Prophet will be looking for.

# Python

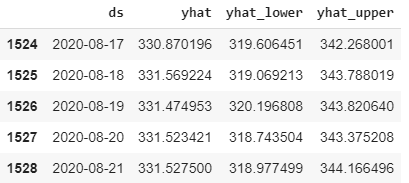

df = df.rename(columns={"Date": "ds", "Close": "y"}, errors="raise")This next part of the code starts to set up Prophet. The only variable you should be concerned with is 151. This is telling the algorithm to look out 151 days. Then it forecasts three variables yhat, yhat_lower, and yhat_upper. Yhat is the predicted price with upper and lower being the bounds in which it assumes the price will fall in.

# Python

m = Prophet()

m.fit(df)

future = m.make_future_dataframe(periods=151)

forecast = m.predict(future)

forecast[['ds', 'yhat', 'yhat_lower', 'yhat_upper']].tail()

You can see that it predicts the closing price for tomorrow will be 331.52. Remember it is only using data from March 23rd to make this calculation. Given the wild gyrations in the market, this is extremely close to being accurate. The SPY closed today at 338. Prophet predicted it would close at 331. It was off by 2%. This is using a 5-month look ahead forecasting model.

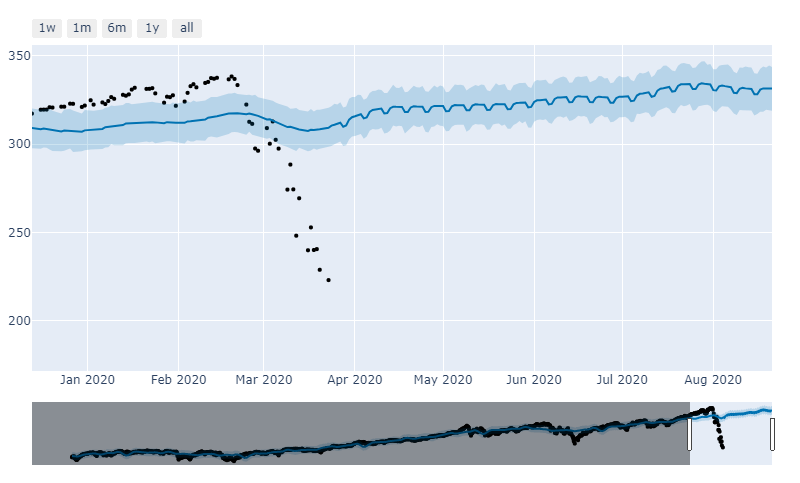

Here is the visual representation of what that looks like.

from fbprophet.plot import plot_plotly, plot_components_plotly

plot_plotly(m, forecast)

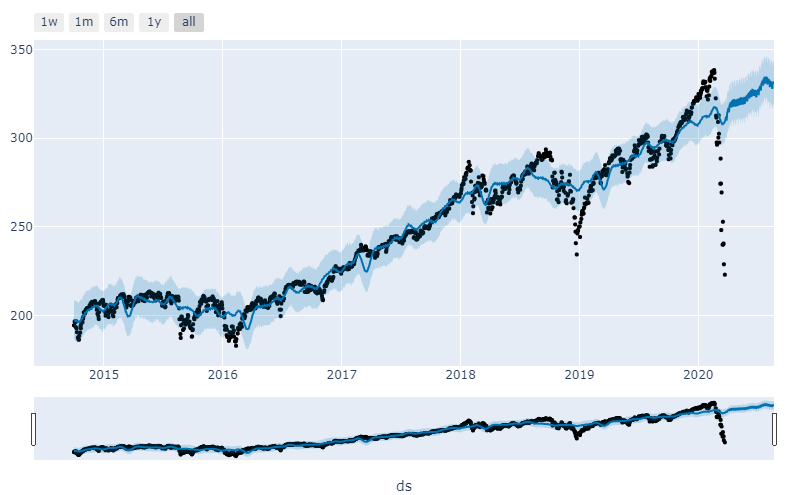

And more charts…

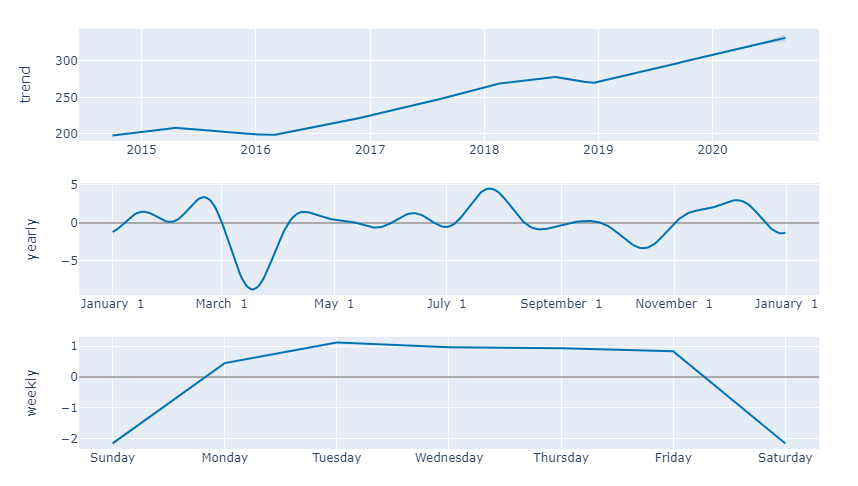

plot_components_plotly(m, forecast)

Finally here is the visualization of the predicted price vs. the actual price chart.