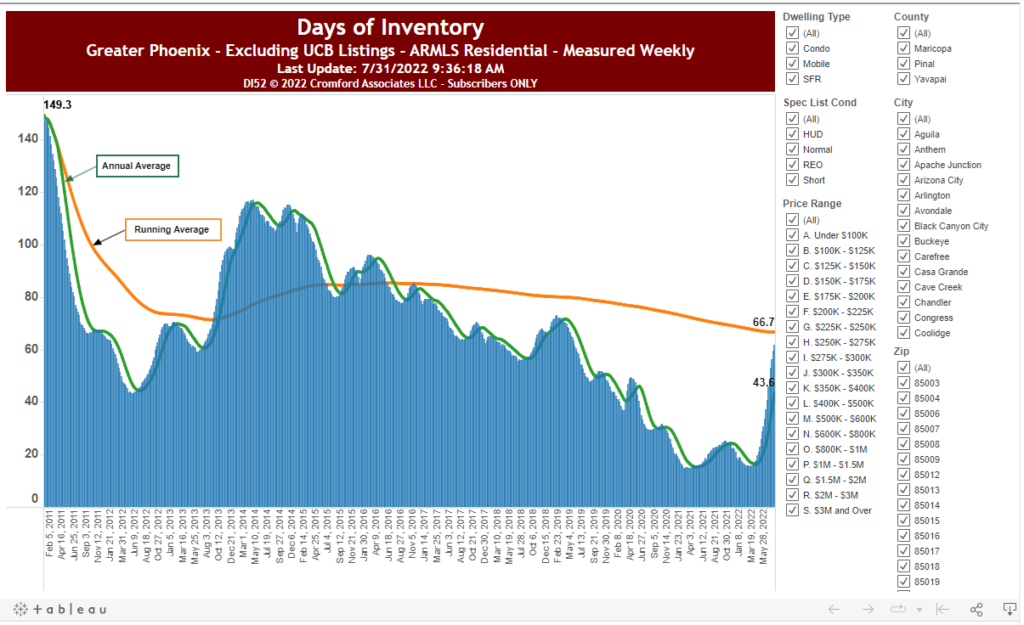

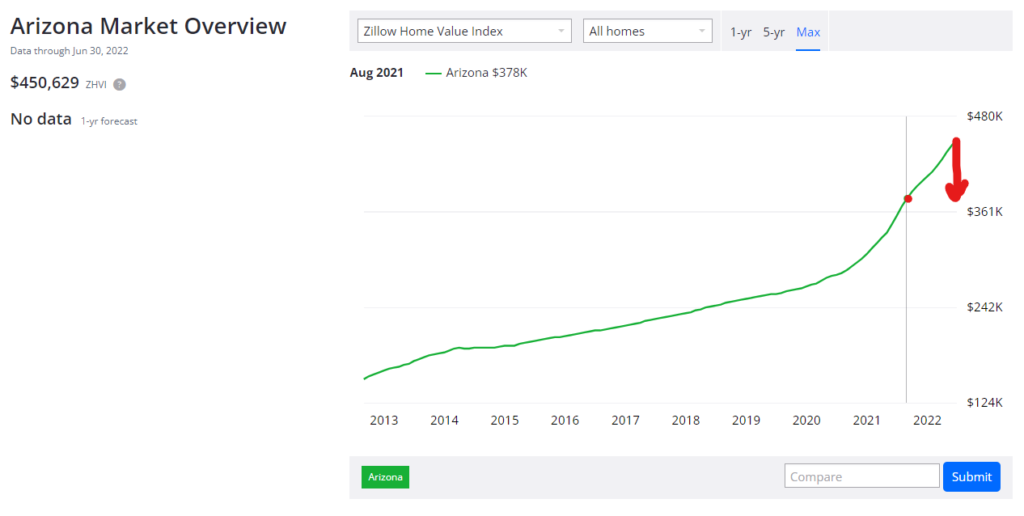

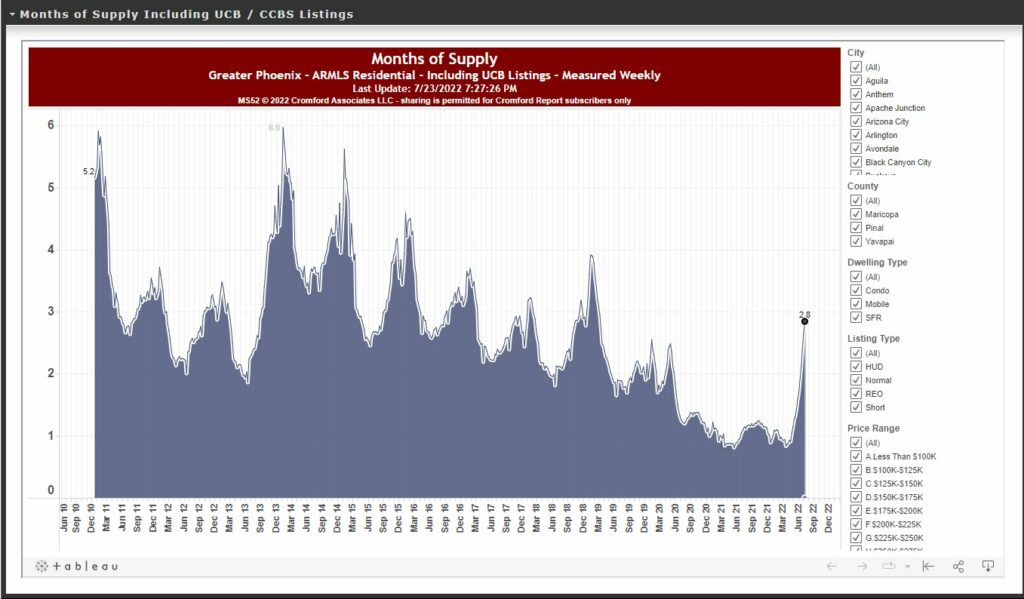

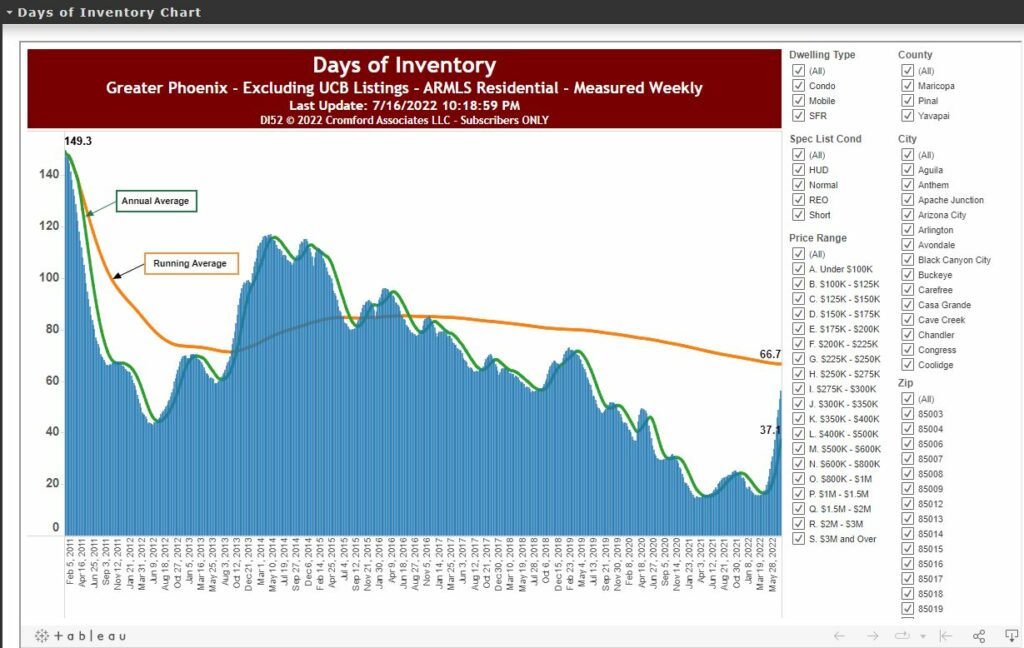

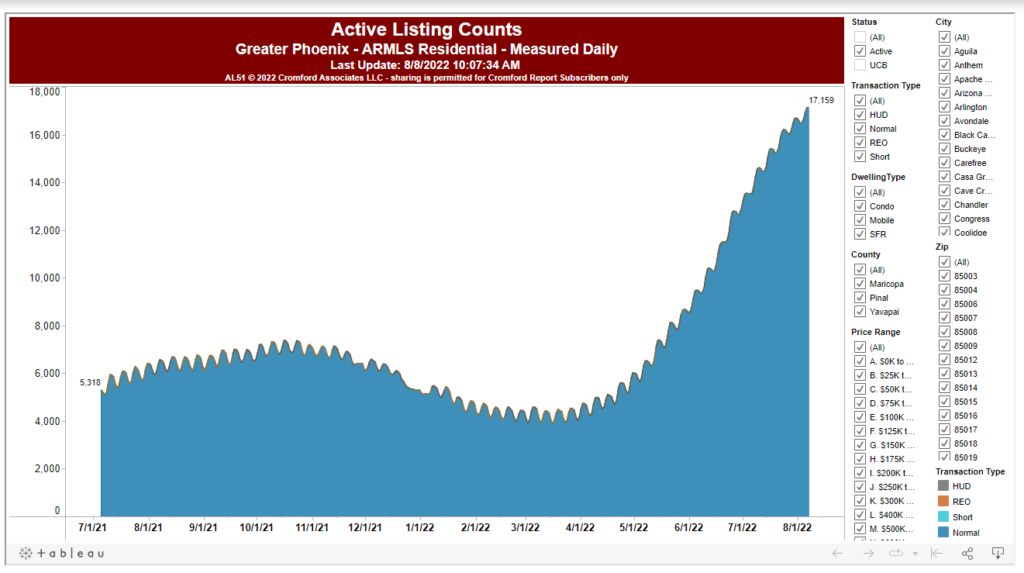

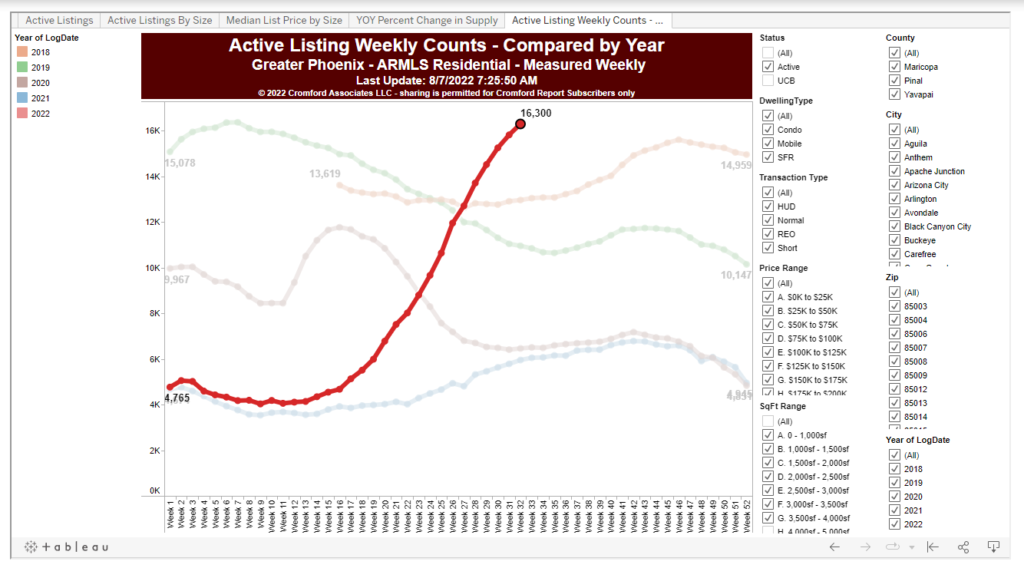

Six months ago some had the opinion, ‘this time is different. Their primary argument was that supply didn’t exist so housing prices could not fall that significantly. I always pushed back, you don’t know how many people are holding second or third houses as rentals. Or how many people bought Airbnb properties because ‘houses always go up in value? Well, now we are finally seeing people unload those houses. Where they came from for sure, who knows. But they are coming out of the woodwork. The good news is we are not yet back to the levels of inventory that we saw back ding the 2008 collapse. The peak houses for sale back then were somewhere just shy of 60k. All of the old data can be found on ARMLS. It would be nice if someone compiled it into graphs.

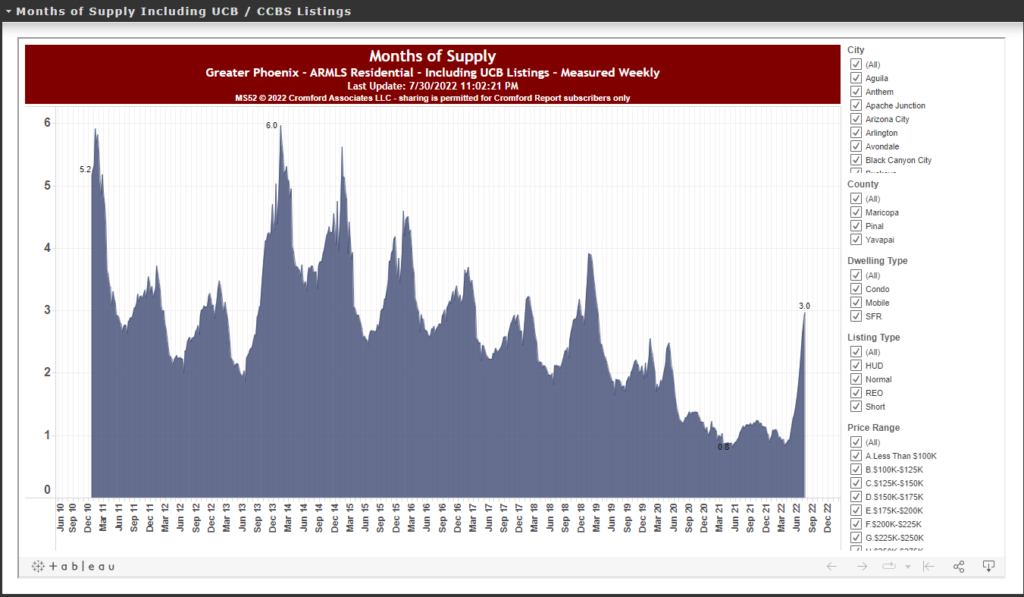

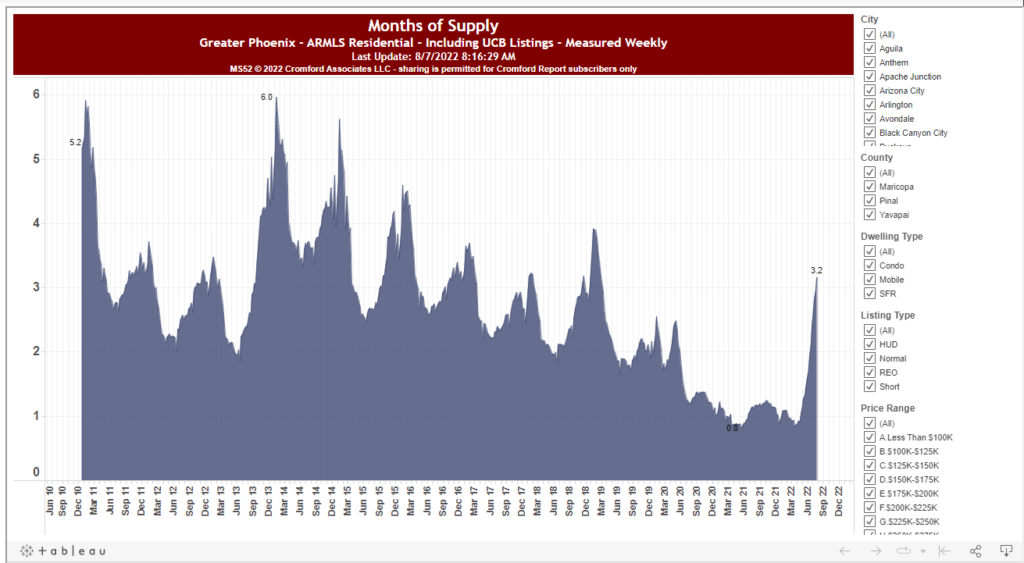

The months of supply now sit at 3.2. As I’ve indicated before supply is cyclical and we should see this peak around Jan-Feb, all else being equal.

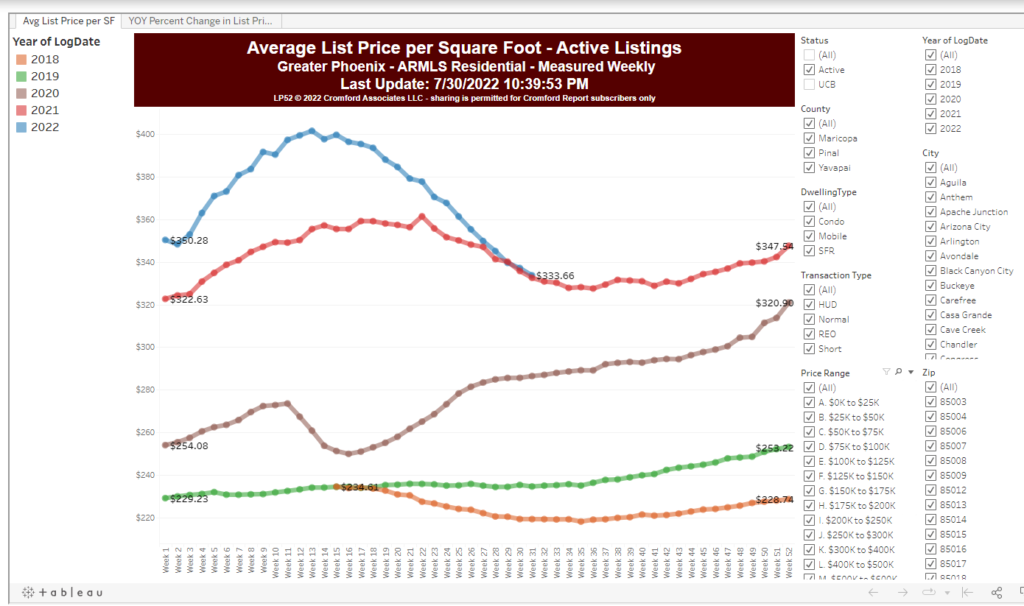

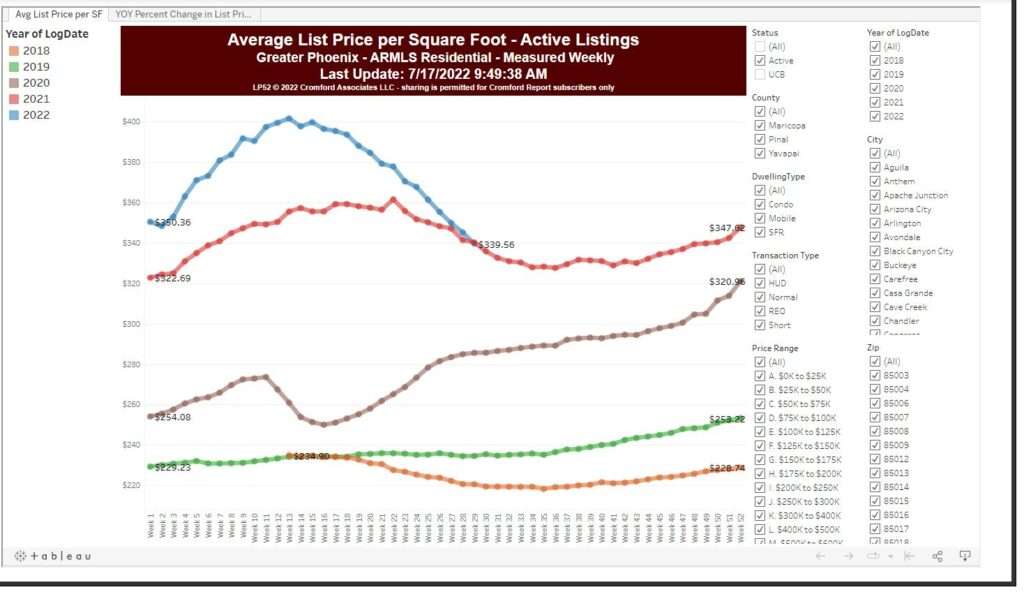

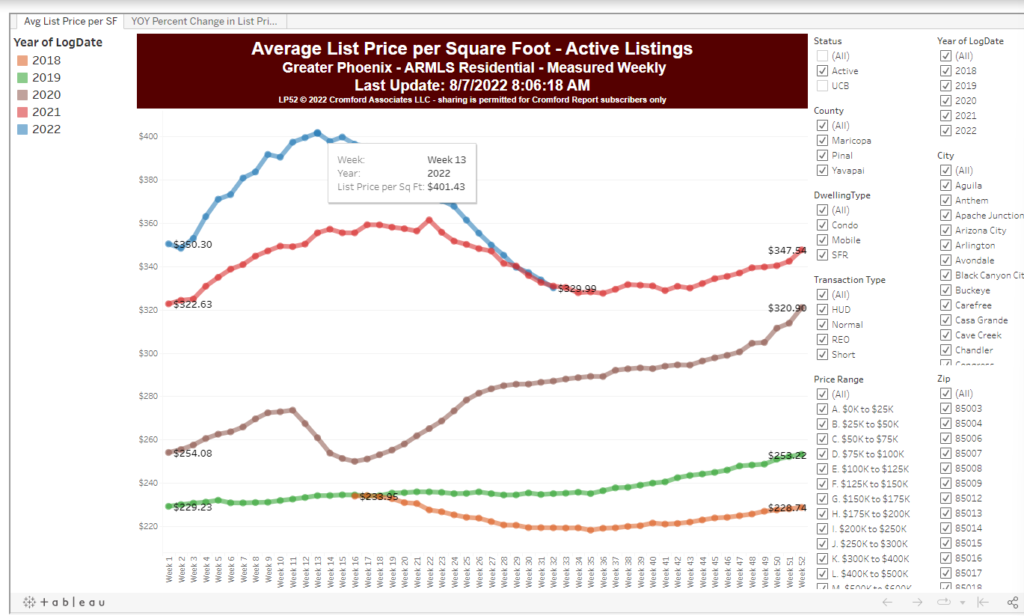

House prices peaked at $401.43/sq ft in March. Since then they have declined about 18% to $329/ sq ft.

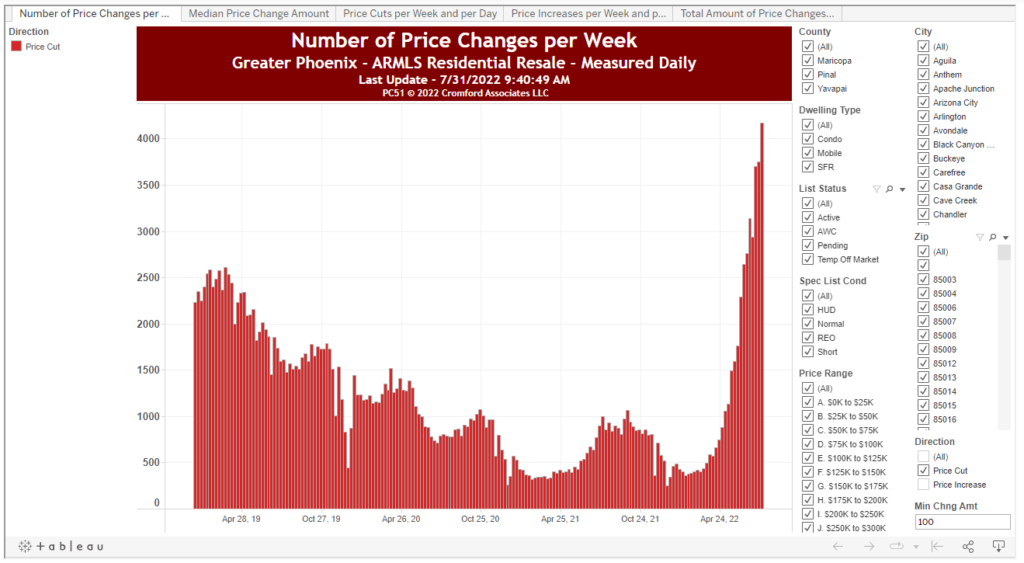

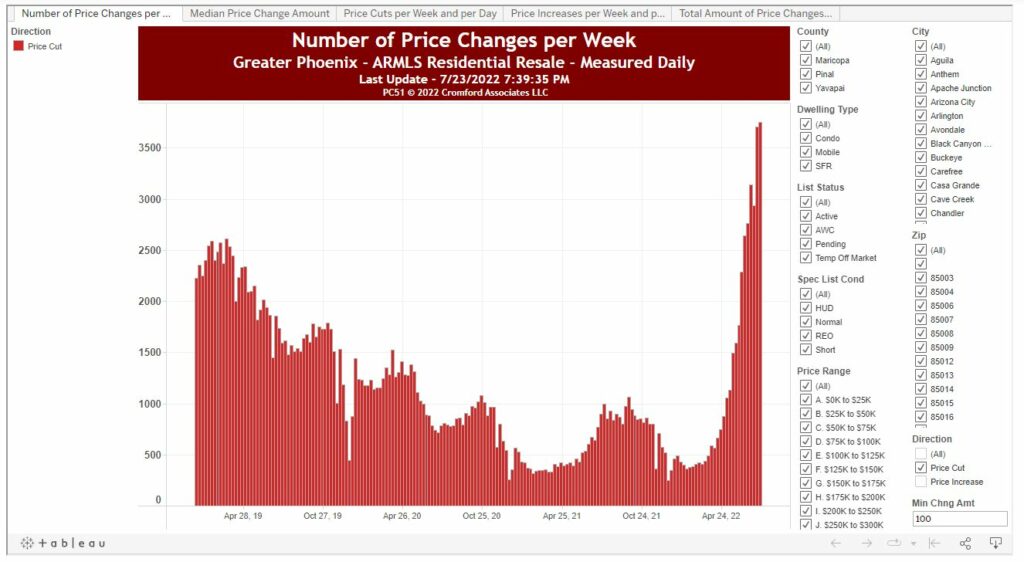

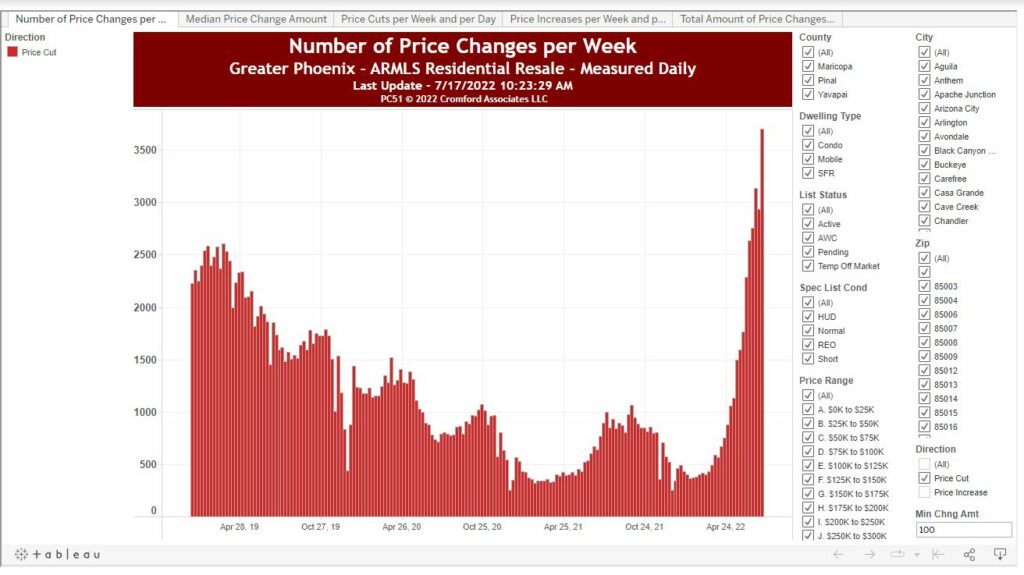

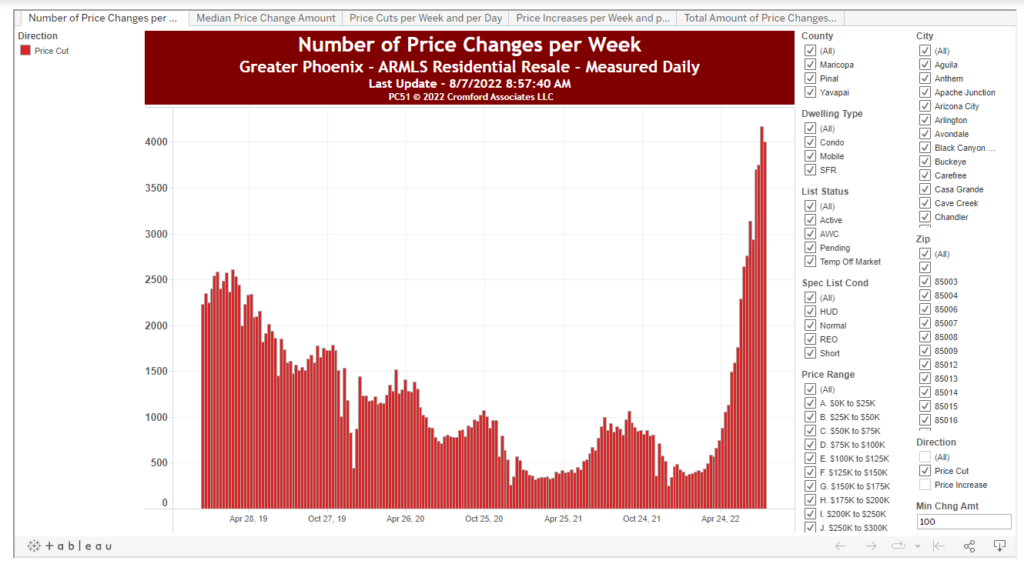

One of the key things I’m keeping an eye on is the number of price cuts per week.

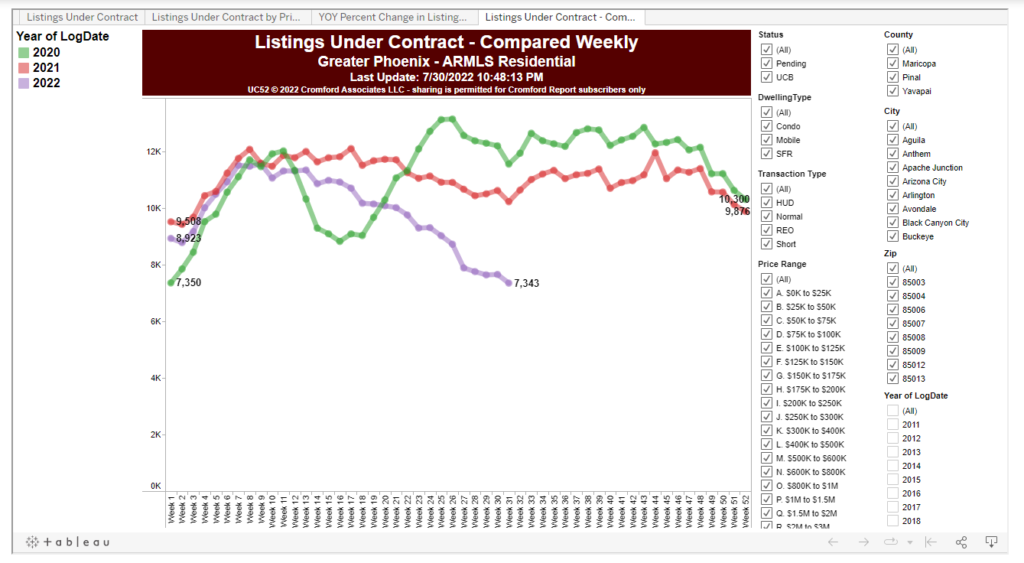

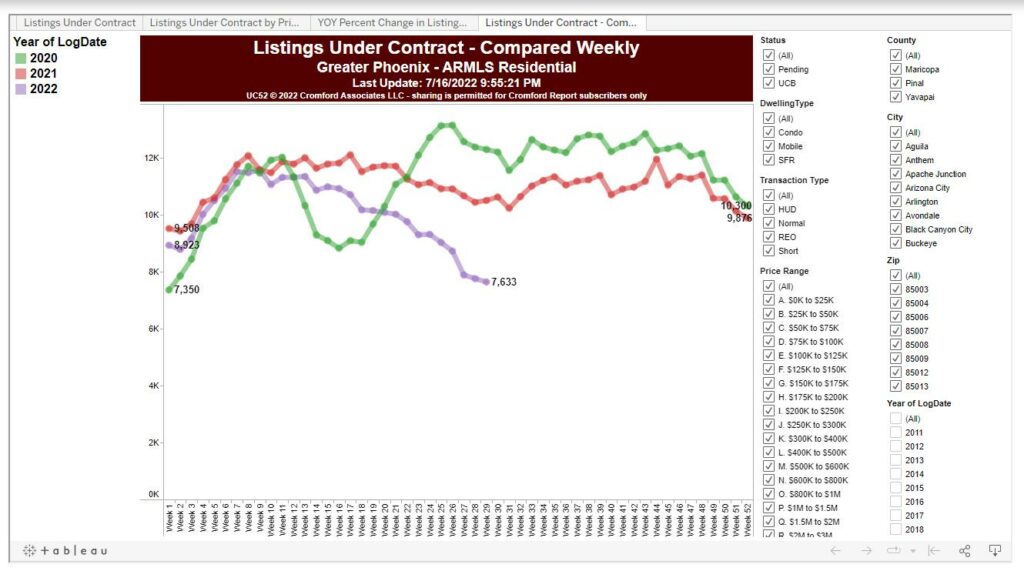

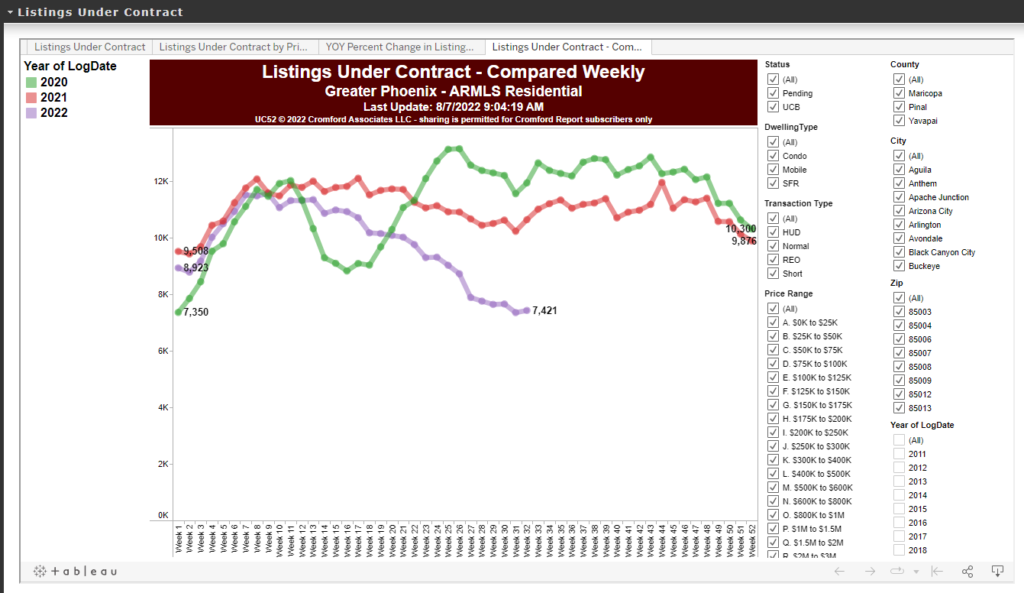

It is still elevated at 4,006. This represents 25% of the listings for sale. One in every four people who are selling houses has had to cut their price in the last week. The psychological implications of this I think are huge. People are not going to buy if they think prices will continue to decline. Listings under contract continue to decline and currently sit at 7,421.

To put this in perspective in Q4 of 2007 the lowest this level dropped to was 8,898. You could however argue that this low number is due to low inventory.

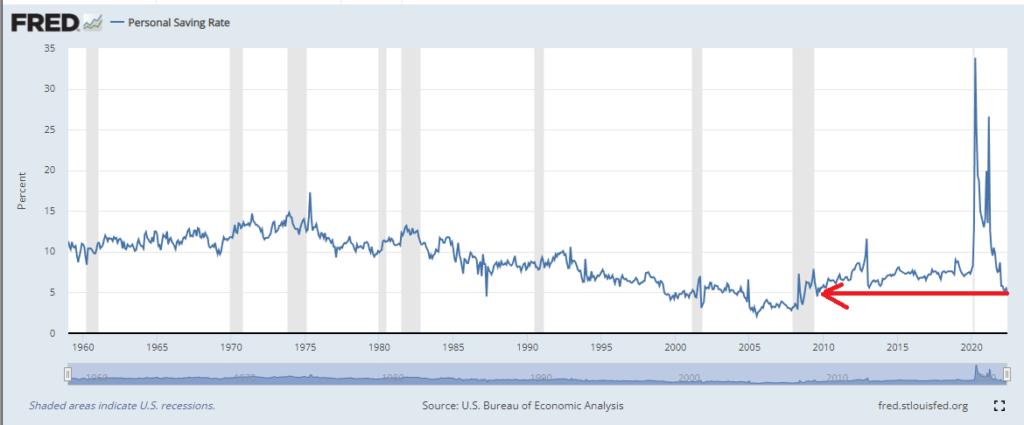

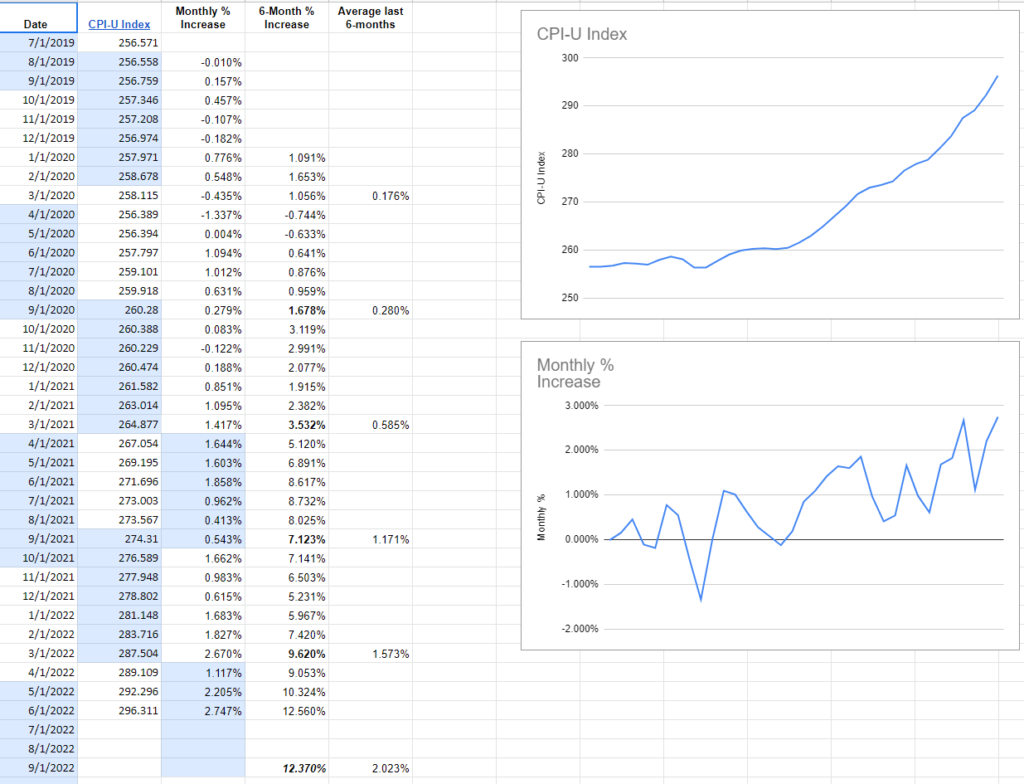

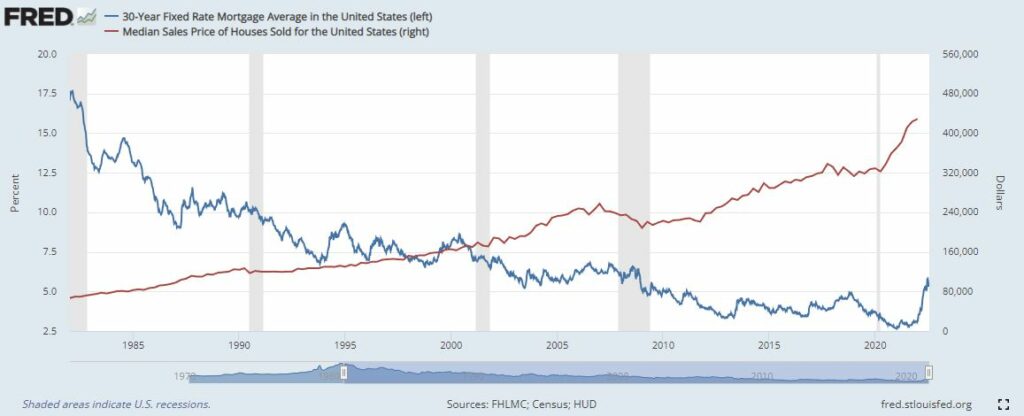

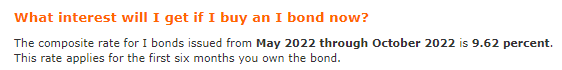

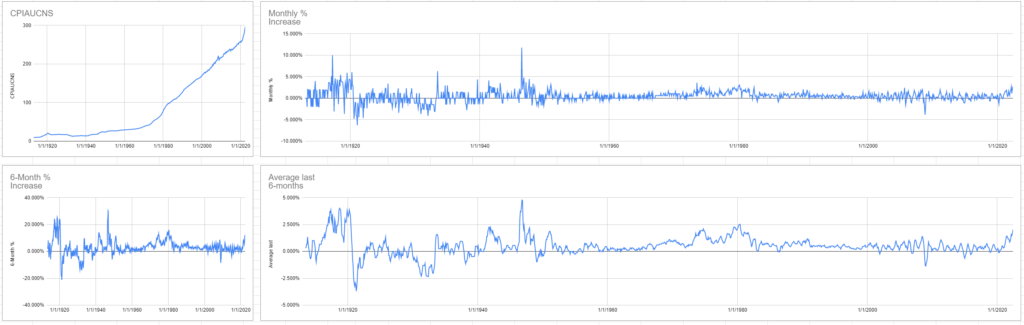

I follow CPI(inflation) pretty closely for a different investment that I’m working on.

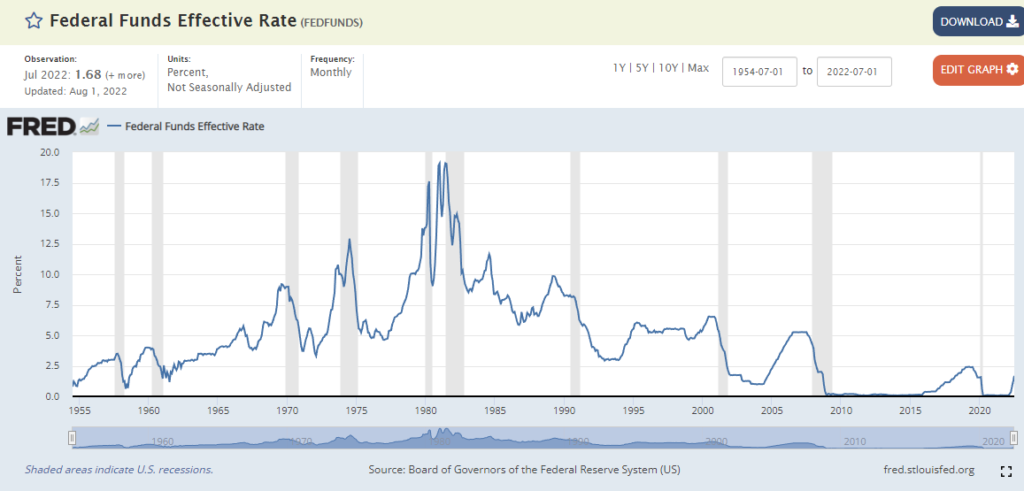

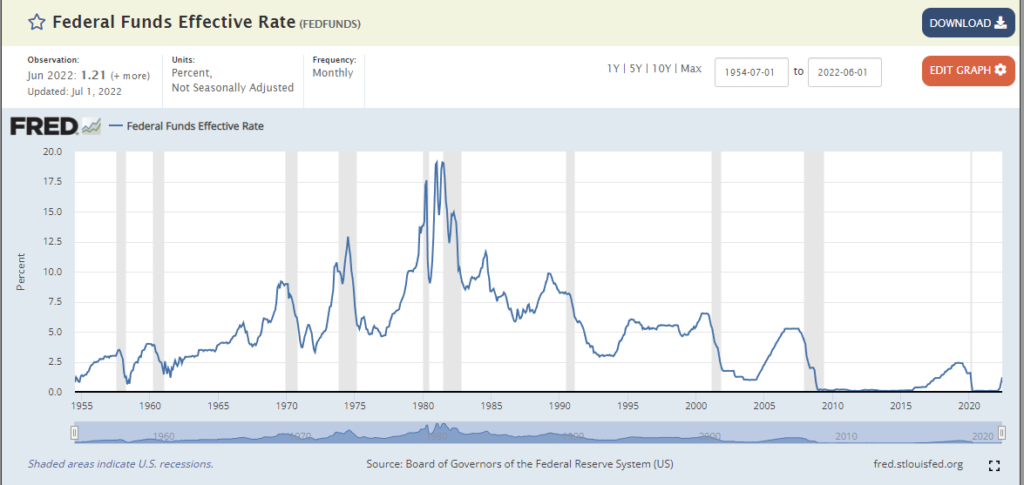

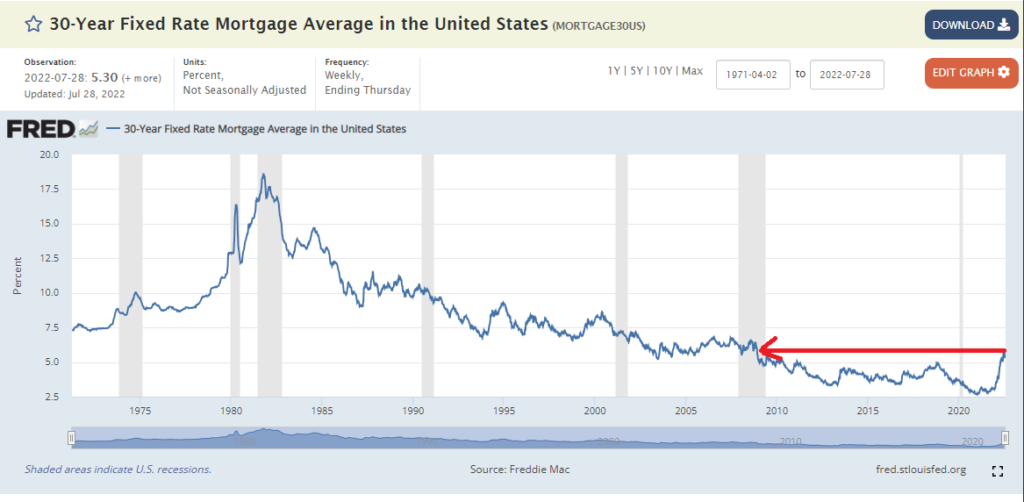

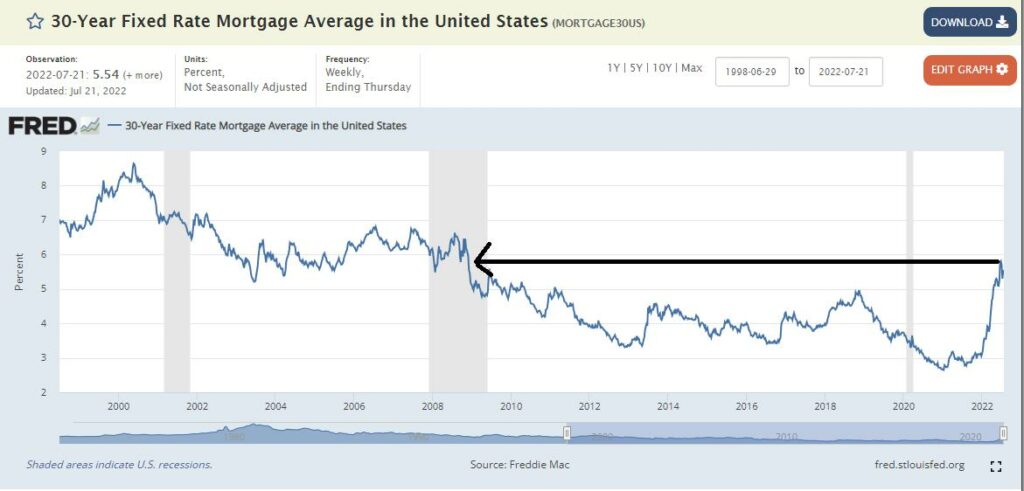

The FED is afraid of inflation. In fact, I think it’s the only thing keeping them in check. It is the main driver behind them raising rates and why they will continue to do so. I’m eagerly waiting for the July CPI report which will be released on August 10th. If CPI is continuing up the FED will respond accordingly. Until the FED stops raising rates I would be very cautious about investing in any asset class.