The new CPI report came out today. at a .43% monthly increase. This means I-bonds starting November first will only yield 6.472%

October 28th is the last day to purchase I-bonds at a 9.62% APY. Here are some things you need to know.

Yield

The 9.62% yield is only for the next 6-months. I-bonds get reassessed every 6-months. Therefore, to establish what your annual yield will be here is the simple math:

Yield until the end of October – 9.62%

Plus the yield starting in November – 6.472%

equals 8.05% for the next year.

More Complicated Yield

There are a couple of things to know about I-bonds.

If you cash out at exactly 1-year

You lose 3-months of interest if you cash out before 5 years. So your effective yield will be 8.05% minus 3.236% divided by 2 (only half the year) then divided by 2 again to get the 3-month yield equals 1.618%. Making your effective yield if you cashed out in 1-year 6.432%

More complicated formula

I-bonds actually compound semi-annually. So your first 6-month yield will be 9.62%. Let’s say you invest $10,000 (the maximum). After 6-months you will have $10,481. So the second half of the year you’re actually earning 6.472% on $10,481 not your original base of $10,000. So the second 6-moths you would net $339.17 + $10,481 ( your initial investment plus the first 6-months interest) This gives you an effective return of 8.2%, not the initially calculated 8.05% from our first formula.

Even more complicated

There is something else to keep in mind about I-bonds. They don’t actually need to be purchased until the second to last business day of the month. This means you essentially get a free month of earned interest! Even if you buy an I-bond on October 28th it is technically just an October I-bond. The date is not relevant. So it will actually mature on October 1st of the following year. Not the original date of purchase.

So the math for calculating this is just our original 8.2% divided by 12 to get our monthly yield of .68%. You can then multiply this by 12 and divide by 11 to determine the actual yield after 12 months given that you only invested for 11 months. This works out to be 8.95%

Can’t you only purchase $10,000 in I Bonds per year?

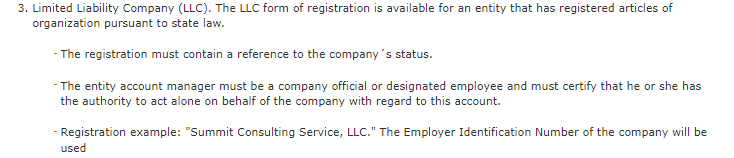

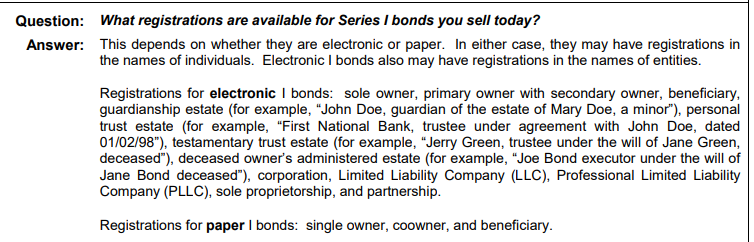

Yes, but no. Most people believe that you can only purchase $10,000 in I Bonds per year. This is in fact true. However, most people also do not realize or take advantage of the fact that LLCs can own and purchase $10,000 of I bonds per year. There are multiple references to I-Bonds being owned by LLCs on their website. In Arizona, it takes 5 minutes and $50 to set up an LLC.

Questions and Answers about Series I Savings Bonds

Treasury Direct entity accounts