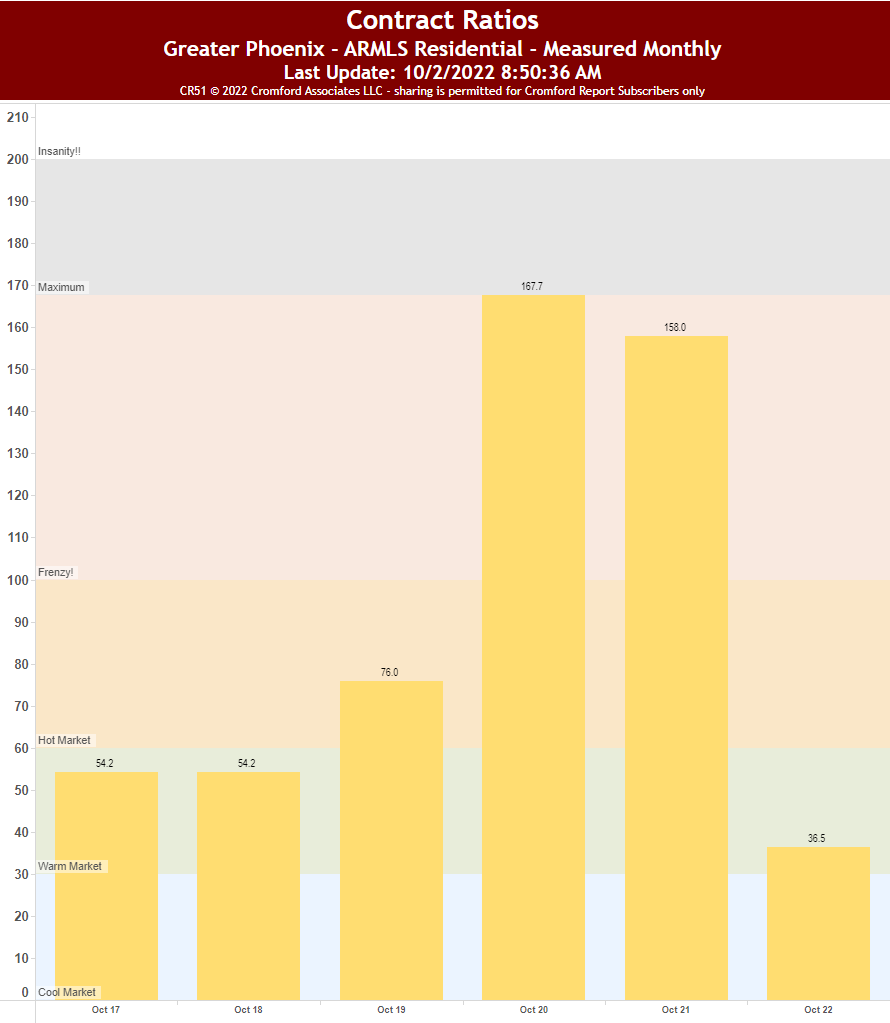

The real estate market hasn’t only cooled but it appears to be pretty frozen. What I’m looking at is the contract ratio. This essentially is the number of houses under contract divided by the number of active listings on the market. First, let’s look at October compared to previous Octobers going back to 2017. Houses under contract represent 36.5% of the entire inventory. It hasn’t been this low in at least 5 years.

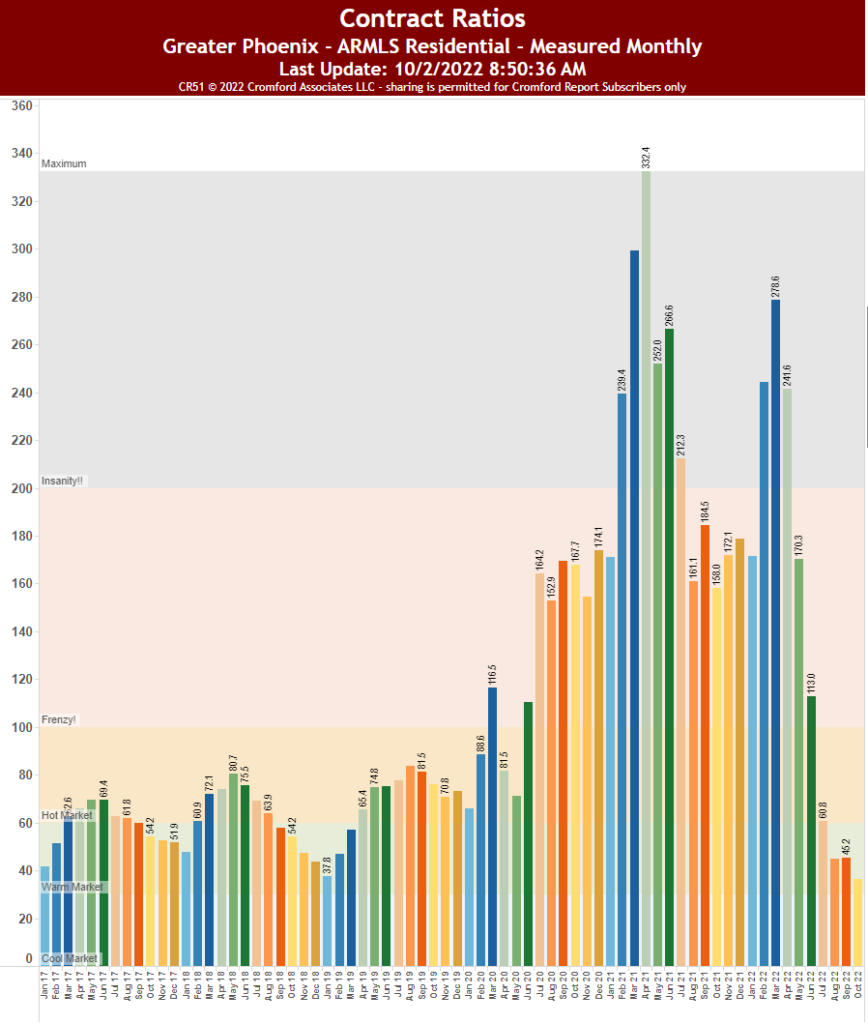

To put this in perspective, relative to the last couple of years, the peak was 332.4% of houses under contract relative to the number of active listings. Meaning, for every 3 houses under contract there was only 1 actively listed. This is a huge shift. But not only is this a huge shift it went from peak to trough at an alarmingly fast rate. This velocity is also relevant.

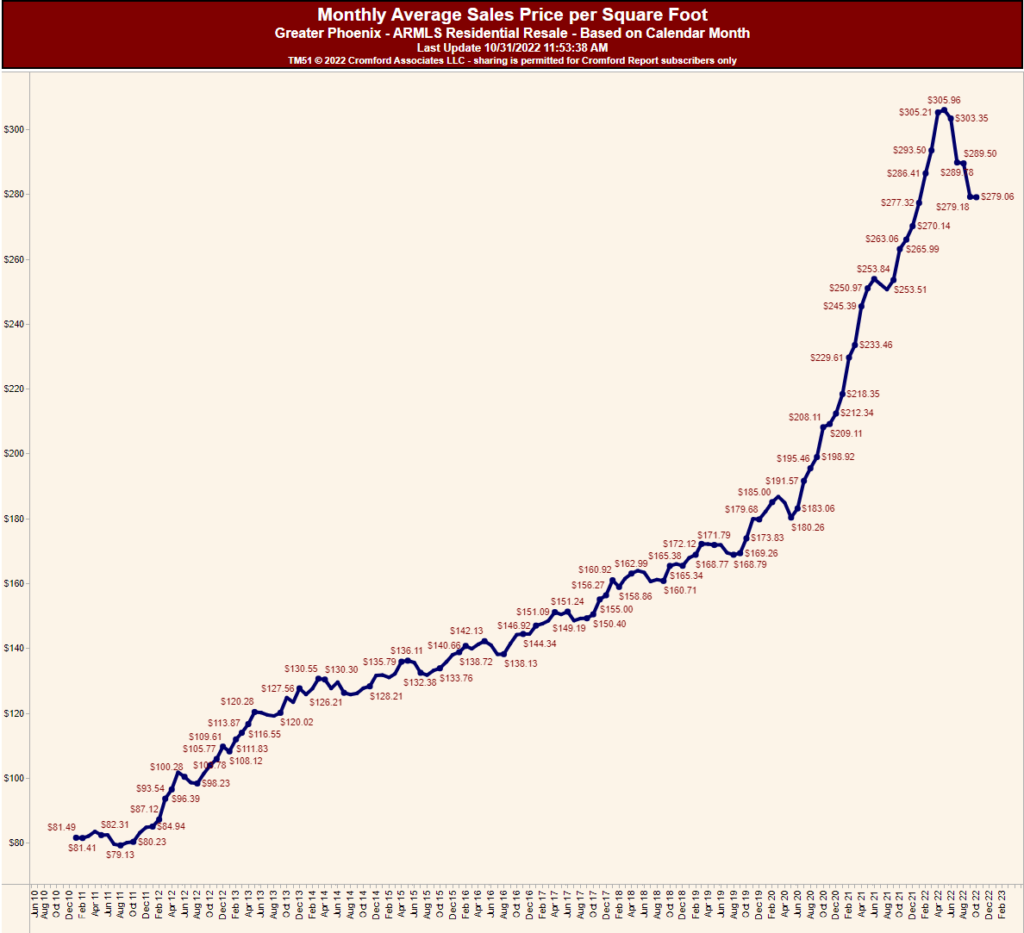

The average monthly sales price has seen a huge decline from $305.96 at its peak to $279.06 this is a 9% drop. Which doesn’t sound that bad. Except it happened in only 5 months. Again, the velocity is alarming.

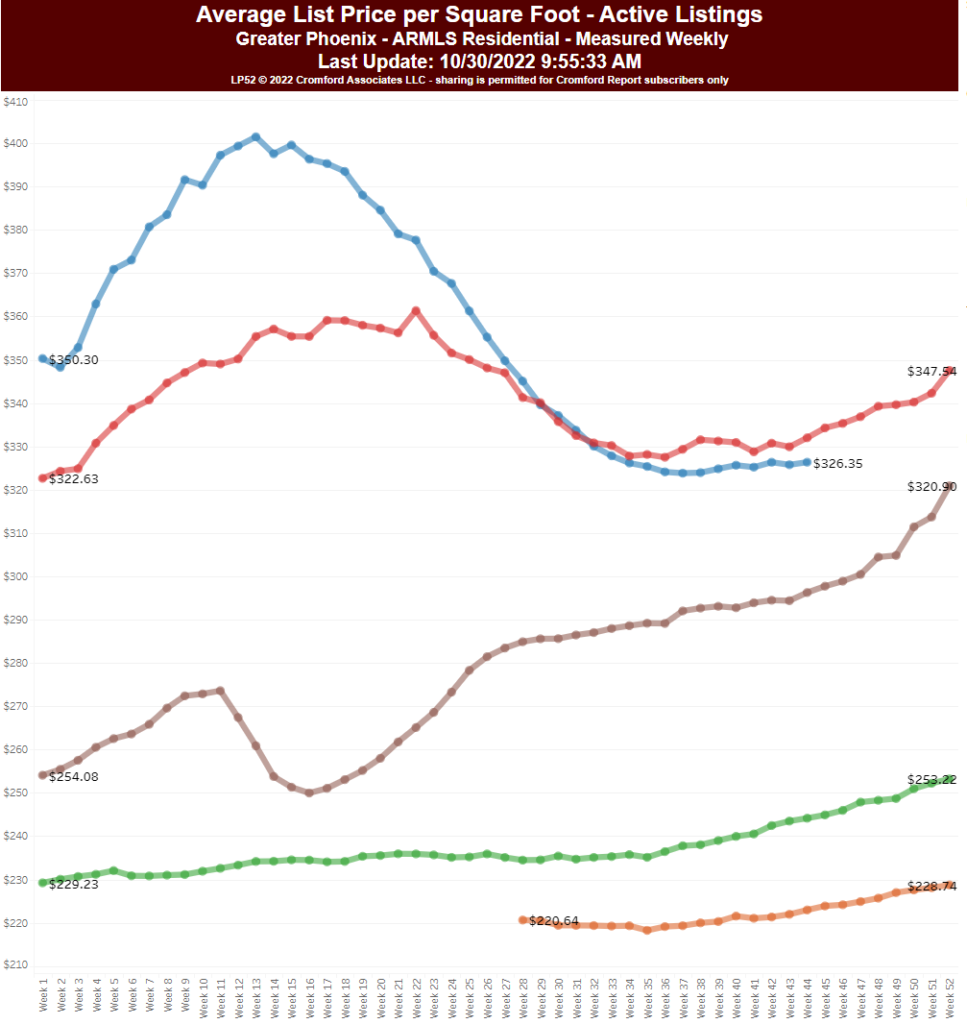

Even more interesting is the average person who is selling a house is still listing their house at $326 per square foot. This means the average person who is listing a house for sale right now is overpricing it by 14.4%. This is leading the market to stagnate. Which will eventually cause a build-up in supply and then a huge drop in prices as people who “need to sell” their houses start drastically lowering prices. This will create a massive psychological problem for anyone who is actively trying to sell their house. Not to mention the buyers will see the accumulation of price cuts and know the price isn’t as advertised. There will be room to send out lowball offers. Which some will take, causing comps to adjust and spiral downward.

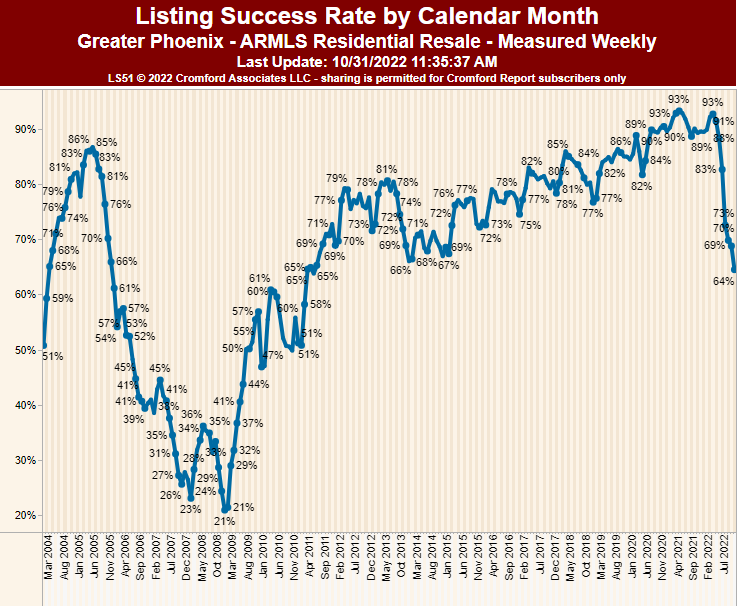

Let’s talk about the listing success rate. These are houses that actually sold rather than expired or cancel. In October of 2022, this number dropped to 64%. We haven’t seen these numbers since 2011. Grant it, there is one day left in the month…

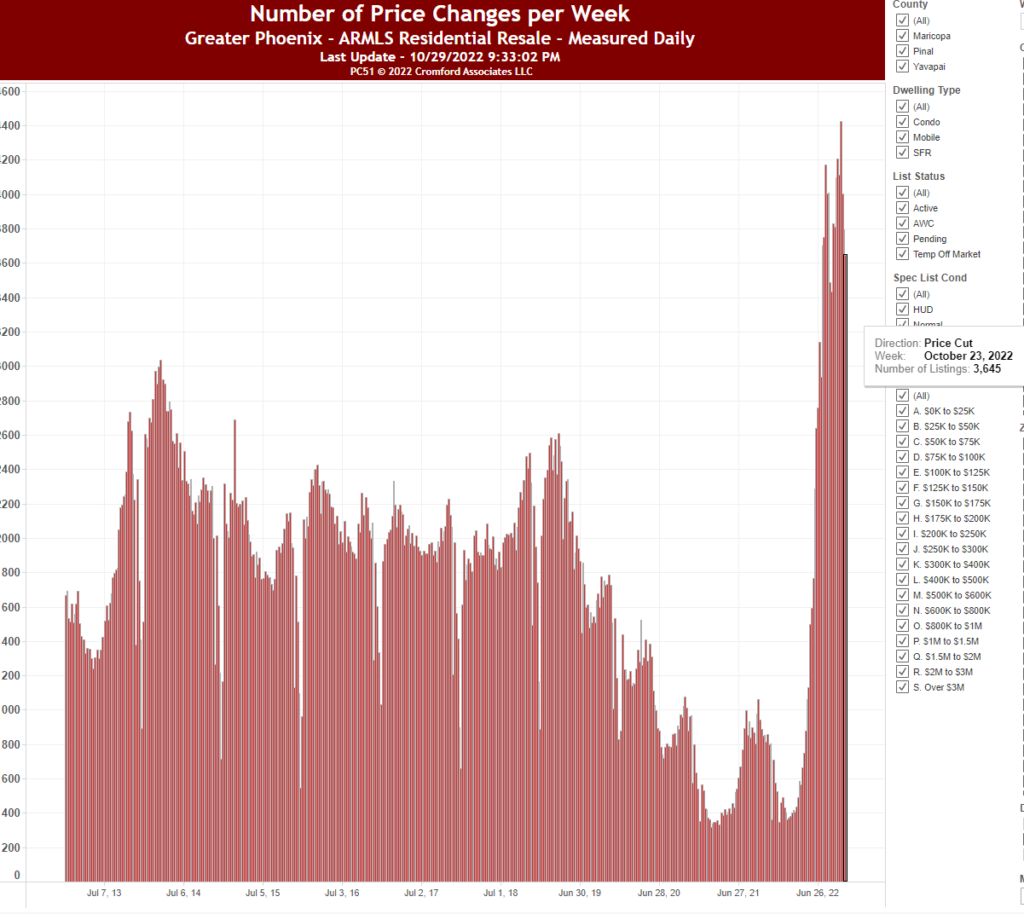

This brings me to my final chart for Arizona, price cuts per week. This chart is how you know the market in Arizona is getting annihilated. 3,645 people cut prices on their listings last week alone. There are only 19,587 active listings. This means 18.6% of all houses active in Arizona cut their prices last week and it’s not only last week. This is what it has been averaging almost every single week since the end of June. Again, it’s the psychological impact that is by far the most concerning thing here. Buyers are not going to pay “retail” prices when they see price cuts across the board. No market functions this way.

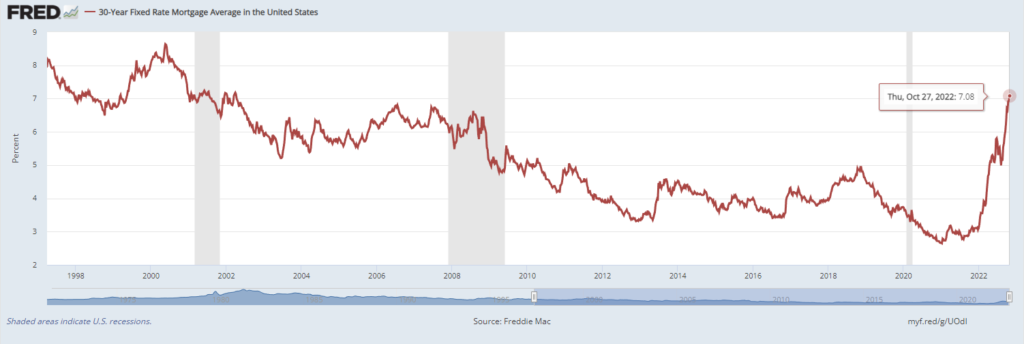

Let’s talk about the root cause of this. We all know because it’s been in the news. The Fed has had to raise rates to combat inflation. Which is 100% legitimate and far more dangerous threat to our economy. But I digress, mortgage rates haven’t been this high since 2001/2002. And let’s be clear the average buyer doesn’t care what they pay for a house. They care about their monthly payment.

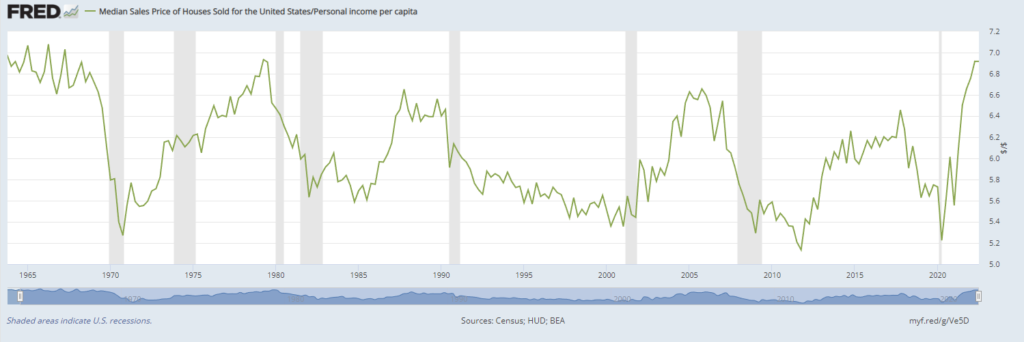

So, let’s take a look at the median sales price of a house vs. income per capita. This oscillator in my opinion is by far the best predictor of if houses are too high or too low. This is the chart to watch if you’re investing in real estate.